Like every other industry, the insurance industry has noticed substantial advantages from implementing artificial intelligence into its ecosystem. AI offers a structured system for health insurance companies to streamline their processes, improve fraud detection, and manage risks beforehand while delivering delightful customer experiences.

A survey by Gartner revealed that leading organizations are preparing to double their AI adoption efforts and deploy AI solutions to grow their businesses. In fact, 40% of teams already leverage AI-augmented automation to ensure higher productivity. Research by McKinsey claims that 50% of claims-related activities can be replaced entirely by automation.

Automation is just one aspect of how AI in health insurance can reshape the industry. There are many more areas where AI can prove to be a boon. In this post, we will share how AI in health insurance industry crafts a more personalized and responsible approach toward healthcare.

What Is AI in Healthcare?

The use of AI in healthcare means employing artificial intelligence techniques to simplify and improve various aspects of healthcare and medical services, improving the overall healthcare industry. It involves leveraging technologies like machine learning, computer vision, natural language processing (NLP), and more to analyze complex medical data and provide diagnostic recommendations that would enhance patient care.

For example, AI algorithms can analyze medical images (X-rays, CT scans, and MRIs) to identify abnormalities, such as tumors, infections, and fractions, more quickly and accurately than traditional methods. AI can also help you predict patient outcomes by analyzing vast amounts of historical data, thereby helping you forecast the likelihood of disease outbreaks, patient readmissions, personalized treatment plans, clinical trials, and much more.

Read now- Understanding The Role of AI In Health Insurance.

What Are the Top Use Cases of AI in Health Insurance?

Health insurance providers implement AI technologies to streamline operational processes and provide better customer experiences. The possibilities are endless, from simplifying underwriting processes to claims management, organizing administrative processes, and ensuring customer satisfaction.

1. Policy Generation

AI in health insurance can analyze vast customer data, such as medical history, demographics, health trends, and more, to create personalized insurance policies. This ensures that your customers receive coverage tailored to their specific health conditions and requirements. It also helps you adjust your policy terms and premiums to offer more accurate and fair policy pricing.

Besides customizing insurance plans, AI can help you draft policy documents automatically using NLP technology. This reduces the time and effort required to generate accurate policy documents and ensures the policies are consistent with regulatory requirements and compliance standards.

2. Fraud Detection and Prevention

AI can detect fraudulent claims by identifying anomalies and patterns that indicate suspicious activities. It can analyze historical claims data by employing machine learning models to flag fraudulent activities. It monitors various insurance-related activities in real time to send out real-time alerts of potential fraud. This ensures quick investigation and prompt action against fraudulent activities. For example, AI can identify cases where the same medical procedures are repeatedly claimed for within a short period or when a patient submits a claim for services not associated with his demographic profile.

By using AI in health insurance processes, you can anticipate fraudulent activities and take measures to prevent them before they occur, thus enhancing your business's overall security.

3. Automated Claims Processing

AI in health insurance can automate your entire claims processing workflow from the claims submission to its approval. It can simplify this process by verifying the accuracy of the claims and cross-referencing them with your policy terms. It can check if relevant documentation is provided by the customers for claims approval. This automated claims processing helps you settle your claims faster and more efficiently. It also helps reduce human errors that might be overlooked during any claims process step. For instance, it can flag incorrect or incomplete claims and reduce the need for manual claims review every time a claim is submitted. This eliminates the risk of overpayments or underpayments and ensures fair claims settlements.

4. Insurance Underwriting

You can make more accurate underwriting decisions by analyzing vast amounts of insurance-related data. This process involves identifying risk factors and predicting future claims. AI in health insurance plays a crucial role in enhancing these capabilities. It can analyze valuable data like medical records, lifestyle information, and more from various data sources and conduct accurate risk assessments. Based on the findings, AI can guide you in adjusting insurance premiums based on real data and implementing a dynamic pricing strategy. Consequently, building better pricing strategies and reducing the risk of underpriced policies and financial losses for your company.

5. Risk Management

You can identify and manage risks more effectively by leveraging AI in health insurance. AI utilizes predictive analytics to identify potential risks, such as the likelihood of specific health-related events, monitor the impact of environmental factors, and forecast future trends. It also continuously monitors various risk indicators and generates real-time reports on the same. These insights can help you develop proactive risk management strategies while minimizing the overall risk exposure.

6. Business Process Automation

AI in health insurance industry introduces automation to handle routine insurance-related tasks, such as data entry, report generation, customer onboarding, compliance checks, etc. This improves operational efficiency and greatly reduces administrative costs. By taking over mundane tasks, automation helps your team focus on higher-value tasks and grow your business. For example, AI-powered optical character recognition (OCR) tools can digitize large volumes of paper-based claims accurately and categorize them into respective folders for better document management.

7. Customer Retention

AI helps you boost customer retention by offering personalized engagement, improving customer service, and streamlining every step of insurance management and claims processing. It analyzes customer's health and policy data to send personalized insurance renewal messages about upcoming renewals. It can also suggest customized renewal plans that align with their current health status and future needs. This simplifies the entire insurance renewal process for customers, reducing their likelihood of switching to another provider.

Further, AI-powered chatbots provide 24/7 customer support by handling inquiries, processing claims, and assisting customers with policy information. This enables you to respond promptly and accurately to customer queries and offer increasingly personalized and relevant support.

What Are the Benefits of AI in Healthcare?

AI offers numerous benefits to the healthcare industry. It collates and analyzes large volumes of data generated and provides valuable insights to healthcare professionals. Let us explore some of the benefits of leveraging AI for healthcare.

1. Reduction of Human Error

Human errors can cause significantly serious consequences and medical mistakes which could cost someone their life. Implementing AI in healthcare reduces the chances of human errors and ensures higher reliability and safety in patient care. Besides, it can automate repetitive administrative tasks, such as patient data entry, updating electronic health records, billing, scheduling appointments, and more, thereby reducing the risk of documentation errors and eliminating the burden of healthcare staff.

2. Reducing Costs

AI optimizes various aspects of healthcare operations, such as patient flow management, resource allocation, supply chain logistics, and more. It can help forecast patient admissions and resource requirements to ensure the healthcare facility is well-staffed, thereby cutting down on wastage. It can also help reduce the number of unnecessary medical tests and procedures by offering accurate primary diagnosis. This significantly lowers operational costs and performs essential tasks cost-effectively.

3. Improved Patient Care

AI can build personalized treatment plans for individual patients by analyzing their health history and improving the effectiveness of their treatments. It can monitor patients' vital signs via wearable devices or mobile health apps, enabling timely interventions for continuous health care. This ensures patients receive the most effective treatment at all times. It can also help identify patients at high risk for developing certain conditions, such as diabetes, heart disease, and more, for intensive monitoring and preventing serious complications.

4. Enhanced Health Insurance Processes

AI in health insurance simplifies claims processing through automated review and approval stages, thereby speeding up claim processing time while reducing manual errors and leading to quicker resolutions that enhance customer satisfaction. It can detect abnormal billing patterns or unusual claims that differ significantly from the norm, which helps detect potential insurance fraud quickly. Thus, it helps health insurers save millions spent on fraudulent claims. It also helps create customized insurance plans, allowing customers to pay for the necessary coverage without unnecessary services.

How Arya.ai helps health insurers?

Arya AI can revolutionize your health insurance business with cutting-edge automation and health monitoring technologies.

Health Vitals Monitor API- Arya's Health Vital Monitoring technology analyzes various facial features and expressions to determine the physical health vitals of your customers with just a 30-second face scan. It leverages advanced AI algorithms to streamline customer health assessment processes, such as face scanning, computer vision, and more. Conducting comprehensive health checks and tracking various health metrics gives you deeper insights into your policyholders' well-being.

Besides physical health, this API monitors various emotional cues to understand customers' moods and stress levels. Thus giving you a complete overview of your customers' physical and mental well-being. By tailoring your insurance plans to align with individual health profiles, you offer a highly personalized service to your customers.

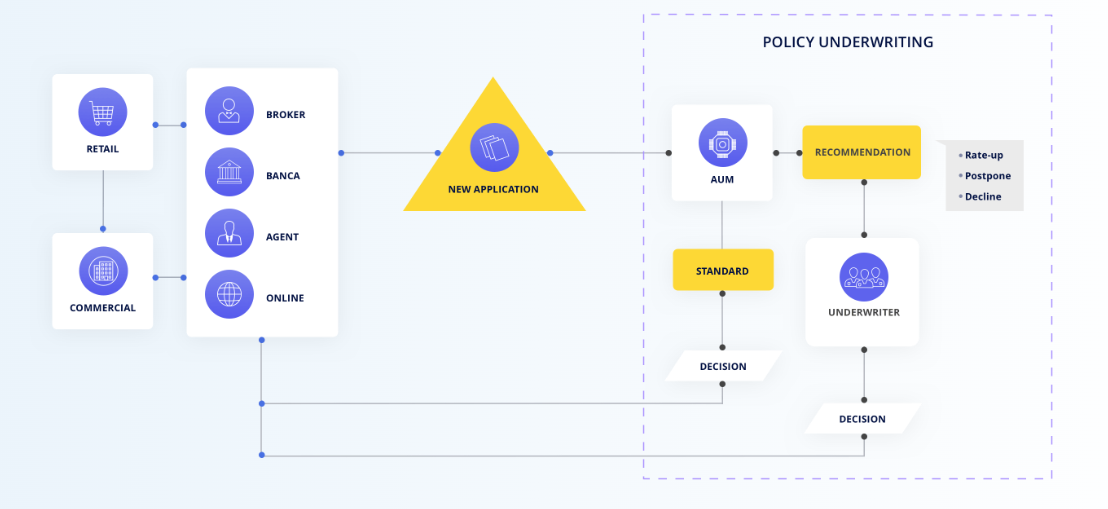

Automated Underwriting Module (AUM)- The Underwriting Management model automates and enhances the evaluation process for insurance applications by leveraging comprehensive data analysis to assess risks and determine pricing.

It include risk assessment to evaluate potential risks, predictive modeling using historical data to forecast future claims and set premiums, automated decision-making to streamline the approval process, personalized pricing tailored to individual risk profiles, and regulatory compliance to ensure adherence to industry standards. This model accelerates the underwriting process, improves customer experience, enhances accuracy in risk assessment for better pricing strategies, reduces human error, increases underwriting efficiency, and improves the insurer’s risk portfolio

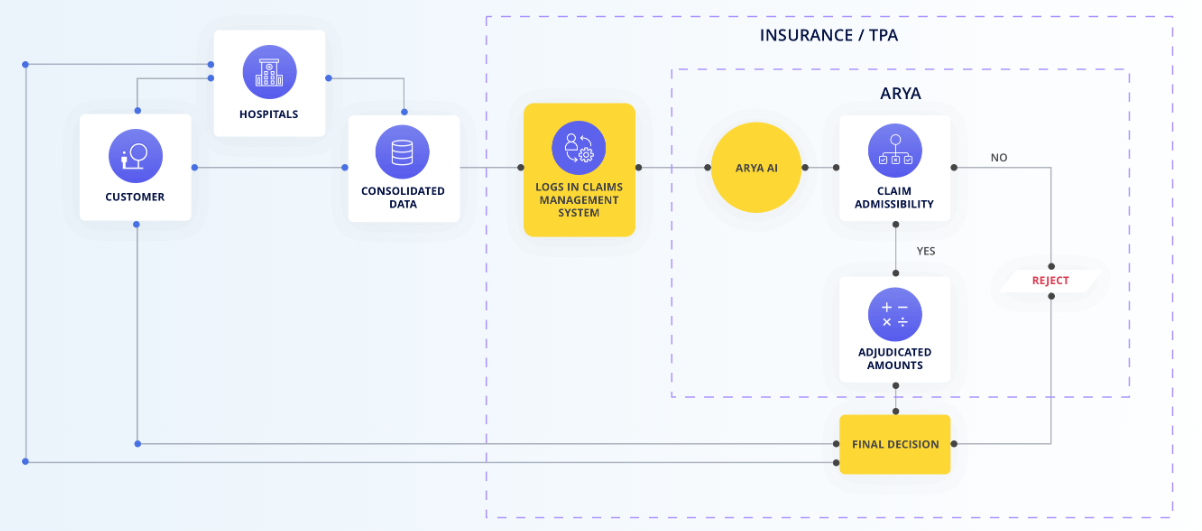

Automated Claims Processing (ACP)- The Claims Processing model streamlines insurance claim handling, from submission to settlement, ensuring timely and accurate processing.

Key features include automated claims triage for prioritizing based on severity, fraud detection to identify suspicious claims, AI-driven image and document analysis, real-time processing for swift approvals and payments, and automated customer communication for updates. This system speeds up processing, boosts customer satisfaction, cuts operational costs, enhances accuracy, and consistency in evaluations, and minimizes fraud-related

Wrapping Up

Many business sectors, including the insurance sector, are beginning to realize AI's potential in optimizing business processes, managing fraud, and providing exemplary customer service. AI has proved its mettle in transforming the insurance industry from claims processing to fraud detection, from insurance underwriting to insurance pricing.

As AI evolves, insurance companies must invest in an end-to-end AI-powered solution to manage their offerings. Arya can significantly benefit your health insurance business by incorporating Automated Claims Processing (ACP), the Automated Underwriting Module (AUM), and Health Vital Monitoring (HVM) to provide real-time health data analysis, improving risk assessment accuracy and minimizing frauds.

To explore more about how Arya AI can revolutionize your health insurance operations, contact us today!