Key Highlights:

- Automating invoice data capture, validation, categorization, and routing is Automated Invoice Processing.

- It boosts efficiency by reducing manual intervention and ensures accuracy by eliminating errors.

- AI-enhanced OCR, machine learning (ML), and natural language processing (NLP) are the main technologies driving automated invoice processing.

- To ensure seamless automation, preparatory measures like existing workflows evaluation, goals mapping, and integration must be taken.

- Choose an automated invoice processing solution that is customizable, integrates seamlessly into existing workflows, and is cost-effective.

- Arya AI’s invoice processing AI API ensures quick integration and handles 40+ fields across multiple formats, eliminating over 80% of manual efforts.

Traditionally, organizations spend countless hours processing invoices. Here’s what the process looked like: going through a deck of invoices and manually extracting and entering data, validating and matching data accuracy, and storing the invoice copies in the right categories.

According to a survey, 56% of businesses spend over 10 hours a week processing invoices and administering supplier payments. This manual system is not only time-consuming but also increases the risks of errors and delays in approvals.

At the same time, 88% of businesses believe that improving their invoice management and payment processes can help them free their team’s efforts and focus on more strategic goals and decisions.

So, how do organizations automate invoice processing? Let’s find out.

What is Automated Invoice Processing?

Automating various steps involved in invoice processing, including data capture, validation, categorization, and routing, is Automated Invoice Processing.

It uses machine learning, optical character recognition (OCR), and robotic process automation (RPA) to automate invoice data extraction and processing.

AI-based invoice processing can process invoices irrespective of their formats, whether they are paper-based invoices or PDFs.

What are the Benefits of Automated Invoice Processing?

Here are the benefits of automated invoice processing that help solve issues that traditional processes cannot:

- Save 70% to 80% of manual time and effort: AI-based invoice processing minimizes manual data entry and matching. Accounts teams typically process around five invoices per hour manually. On the other hand, with automation, this number increases up to 30 invoices per hour, allowing banks to save 70-80% of their time spent on manual invoice processing.

- Cost savings and better cash flow management: 84% of organizations that automated their invoice processing workflows increased cost savings and cash flow. Automation cuts down the cost of processing a single invoice by 80%.

- Maximized workflow productivity and improved accuracy: According to a Gartner report, 1 of 3 financial accountants admits to making a few mistakes, like data entry errors and misfiling. Automating monotonous tasks not only allows accounts teams to focus on more attention-oriented and strategic tasks, such as budget planning and performance analysis, but also ensures high accuracy with intelligent AI models.

AI Innovations That Redefine Invoice Processing

AI innovations and trends that drive and redefine the invoice processing landscape, making it much faster, more efficient, and more accurate:

- AI-enhanced Optical character recognition (OCR): OCR struggles with accuracy when extracting data from poor-quality images or documents in multiple formats. AI-enhanced OCR understands the context of the document when extracting and processing data.

- ML for intelligent data matching: ML algorithms can intelligently match receipts, purchase orders (PO), and contracts. They can also learn from historical data and patterns to predict matching pairs and eliminate errors.

- NLP for unstructured data: Typically, invoices contain unstructured data, such as diverse layouts, text fields, logos, table variations, and handwritten signatures. While traditional systems can’t extract such diverse data, NLP understands the meaning and context of data while also interpreting notes and comments on invoices, resulting in accurate data extraction.

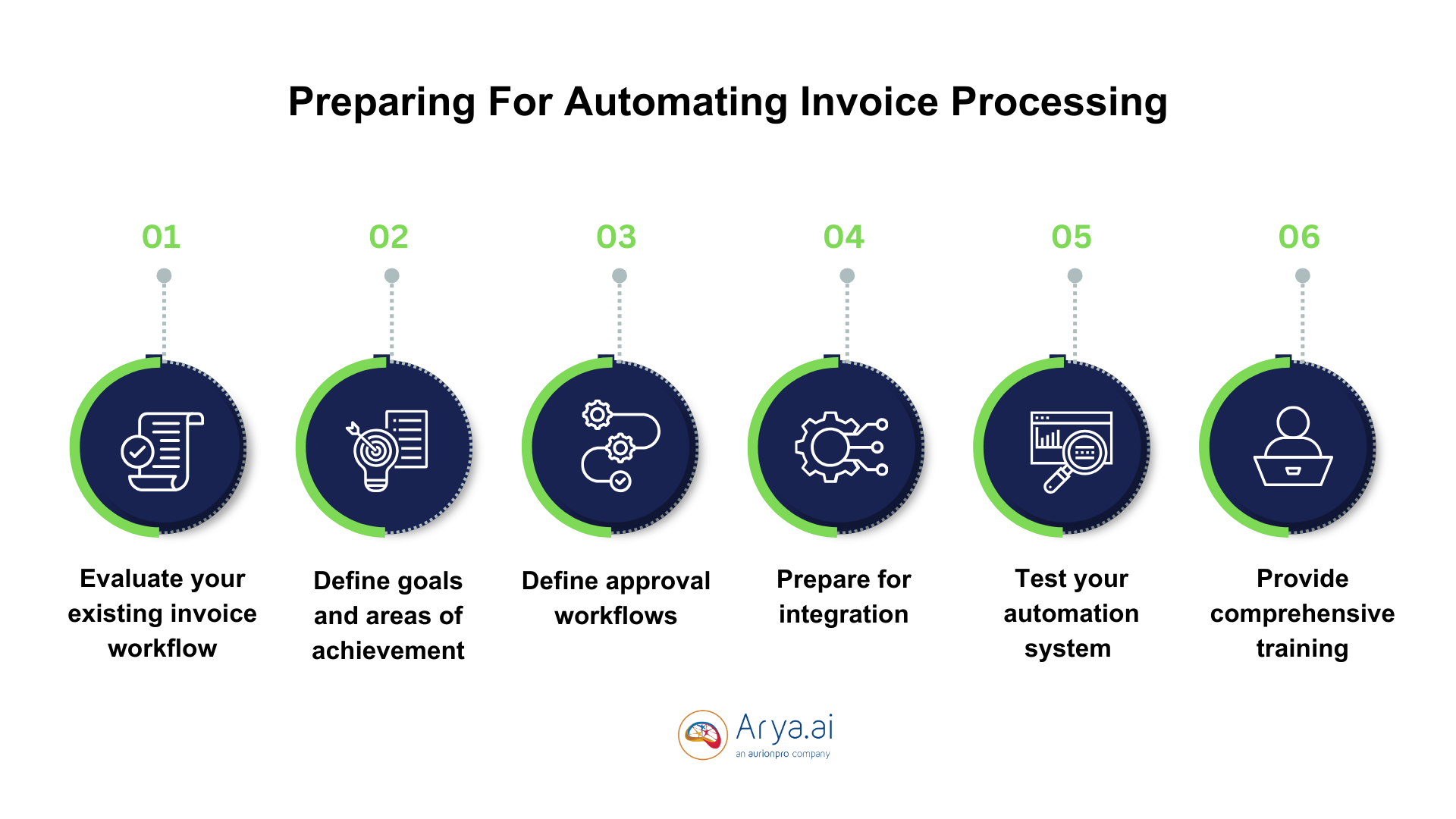

Preparing For Automating Invoice Processing

You need to prepare and take preparatory measures before integrating AI into your existing invoice processing system to avoid failure and ensure a seamless shift towards automation.

Here are a few steps you must take when preparing for automated invoice processing:

- Evaluate your existing invoice processing workflow to analyze aspects like areas of points and volume of monthly or annual invoices that need to be handled to understand the automation scope.

- Define goals and determine areas of achievement, such as minimizing manual effort, reducing errors, and ensuring payment accuracy, to focus more on that particular aspect.

- Define approval workflows, such as hierarchies, thresholds, and rules (based on vendor categories or invoice amounts), to ensure that the AI-based system aligns with your organization’s policies.

- Prepare for integration by organizing your current data (vendor details, cost centers) and ensure accurate and efficient automation. Make sure the automation system seamlessly integrates with the existing accounting/ERP software for accurate data flow.

- Test your automation system to ensure it functions as desired or address issues and feedback before the software goes live. Also, make sure that the software complies with data protection regulations.

- Provide comprehensive training and resources to your team to ensure they can comfortably and confidently work with the automated system and maximize its benefits.

How To Choose an Automated Invoice Processing Software?

You need to consider and analyze several factors to choose the right automated invoice processing software.

Firstly, it’s important to analyze the automation requirements and what parts of the process need to be automated. For instance, you may wish to automate invoice data extraction, payment processing, or approval workflow.

Once you decide upon the primary focus area, the next step is choosing a relevant solution with the following considerations:

- Choose a solution that seamlessly integrates with your existing invoice processing or ERP systems to ensure smooth data transfer and eliminate risks of data loss, error, or misplacement.

- Make sure that the automated invoice processing software is intuitive and easy-to-use to enable a hassle-free transition from manual to automated processes for employees and reduce training efforts and requirements.

- What you choose should be highly customizable, allowing you to tailor it to specific needs and demands. For instance, it should allow you to modify aspects like data extraction rules, user interface settings, and vendor classifications.

- It’s also critical to consider the cost of the solution, analyze its setup fees, license costs, and support costs, and choose a software that best fits your budget.

Besides, determining the security benefits and scalability solutions is essential to choose a secure, reliable, and robust solution that’s worth all your money.

How To Automate Invoice Processing Using Arya AI

Arya AI offers a reliable and secure invoice extraction App that helps organizations eliminate over 80% of their manual efforts and reviews. Having processed over 15M+ invoices, this App offers a 99% success rate and is easy to integrate within your core business workflows.

You can launch the App within 5 minutes, making AI integration hassle-free. Here’s how the invoice extraction can benefit your invoice processing workflow:

- Accurate data extraction: The Arya App accurately extracts key information, such as customer name, address, invoice total, vendor details, etc., with high accuracy.

- Intelligent data classification: It not only extracts data but also intelligently classifies it into relevant categories using the state-of-the-art parser. The category fields can include shipping details, billing details, vendor details, purchase order details, etc.

- Adaptive document handling: Whether you deal with invoices in PDF, .PNG, or .JPG formats, the App accurately processes invoices in varying formats.

- Extracts data from 40+ fields: With invoices consisting of distinct and diverse fields, our App captures data from dozens of fields and complex layouts, ensuring higher accuracy.

- No code required: Our App offers a hassle-free, no-code platform, perfect for organizations and developers with or without extensive coding experience.

Conclusion

The global e-invoicing market, which was valued at $13.5 billion in 2023, is projected to reach $60.9 billion in 2032, set to grow at a CAGR of 17.7%.

With organizations increasingly shifting from analog to AI-based digital invoice processing, invoice process automation is no longer a choice but a necessity to sustain growth and stay ahead of the curve.

This shift will allow organizations to capture invoice data 6.8x faster than traditional processes. So, if you want to see similar results and automate your invoice processing workflow, make sure to check our Invoice Extraction App to leverage high accuracy, security, and reliability.