Financial fraud is a huge risk that can lead to organizations and financial institutions losing their reputation and billions of dollars.

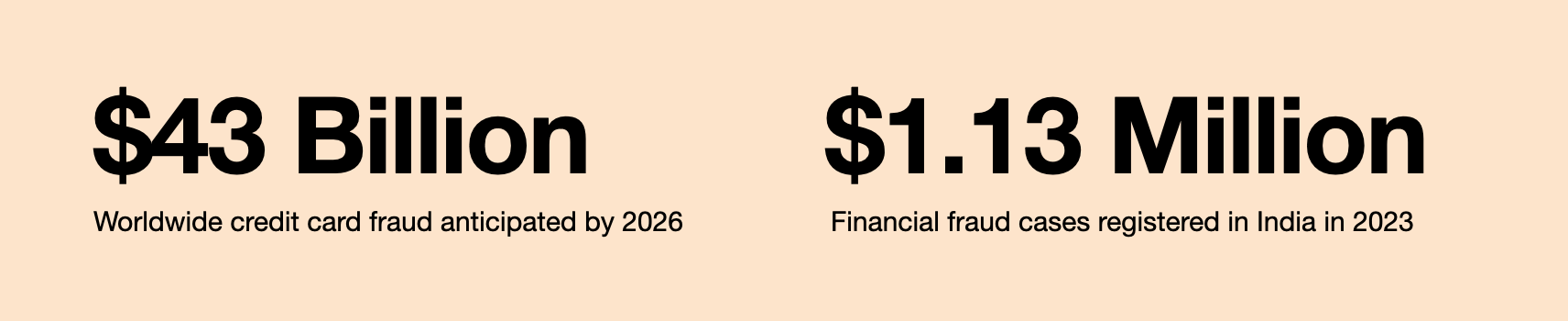

Statistics suggest that a total of 1.13 million cases of financial risks and fraud were reported in 2023. At the same time, credit card fraud alone is anticipated to reach $43 billion worldwide by 2026.

Amongst several financial security risks, fraudulent documents are emerging as major security threats for banks and financial institutions; in a Plaid survey with over 400 lenders, 61% of lenders experienced document fraud—making it a significant type of fraud. New customers, in particular, are expected to submit critical documents to prove their identity, residence, and income details to the financial service providers.

Whether applying for a mortgage or processing loan applications, fraudulent documents can expose loan lenders to increasing cybersecurity risks and potential losses.

The legacy and manual process of verifying documents is no longer applicable and reliable; hence, businesses and financial institutions are replacing these processes with automated fraud detection solutions to ensure faster, more reliable, secure, and automated fraud detection.

In this article, we’ll explore the increasing concern of fraud for lenders and how AI can help streamline fraud detection and reduce fraud risks.

What is financial fraud detection?

Financial fraud refers to manipulating financial transactions for corporate or personal gains. Fraudsters often target businesses and financial institutions to gain monetary benefits and hamper the company’s reputation.

Credit card fraud, identity theft, insider trading, and Ponzi schemes are common examples of financial fraud. With companies losing an average of 5% of their yearly earnings to fraud, fraud detection becomes imperative in minimizing fraud risks.

Fraud detection involves using predetermined protocols, tools, and resources to verify documents for fake information and prevent deceptive activities such as theft of money, data, and assets. However, while manual document checks and reviews are inefficient and time-consuming, AI fraud detection makes things easier.

AI fraud detection uses AI, ML, and data analytics to help lenders and financial service providers identify fraud, such as forged signatures on checks, fraudulent use of a different identity, and stolen credit card numbers.

Thus, by analyzing huge datasets and user patterns, AI fraud detection makes detecting anomalies and suspicious behavior quick and efficient.

Understanding the difference between Fraud Detection and Fraud Prevention

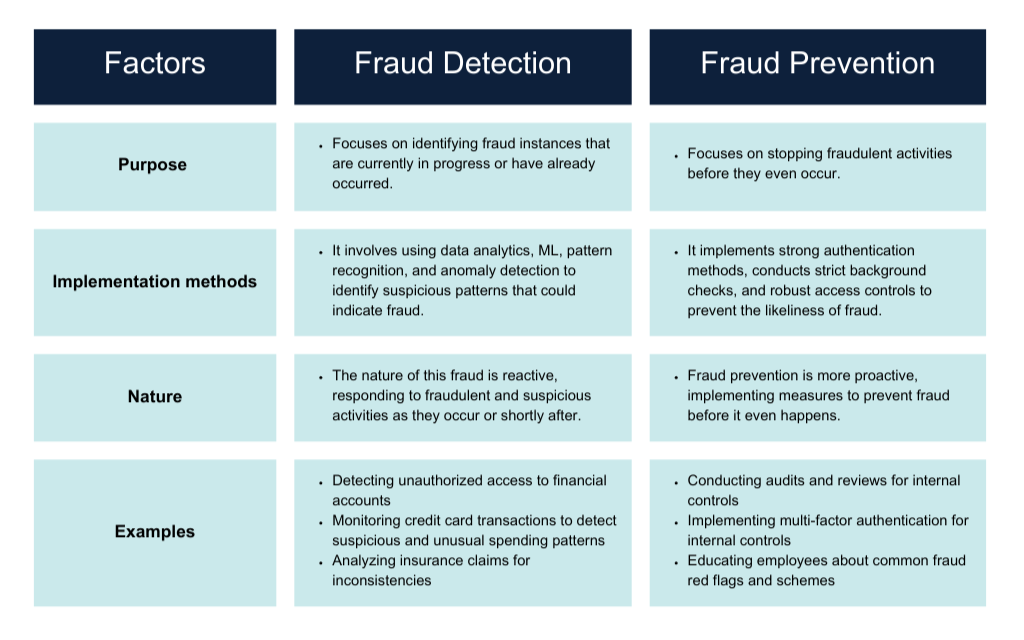

Fraud detection and fraud prevention are often confused together, but they differ in terms of the time and the way security measures are implemented to mitigate fraud.

Here’s a quick rundown to understand how fraud prevention and detection differ.

Detecting Fraud Manually: Understanding The Existing Fraud Mitigation Solutions

Frauds take many forms, including account takeover fraud, credit card fraud, fake synthetic accounts, etc. Here are some of the currently existing fraud mitigation techniques that lenders use to mitigate these frauds:

- Dual biometric verification: This technique requires the user to provide biometric verification authentication, such as fingerprint scanning, facial recognition, or iris scanning, along with their passwords to access accounts.

- Multi-Factor Authentication: Here, the user is expected to provide two or more authentication factors, such as their passwords, plus an authenticator app to gain access to their accounts.

- Statistical data analysis: This type of fraud detection solution performs multiple statistical operations, such as data collection, regression analysis, and data matching, to detect potential fraud.

- Transactional history analysis: Banks and financial institutions monitor users’ account histories to track money coming in and going out of their banking accounts and detect suspicious, questionable, unusual, and illegal behavior.

- Income verification: An income verification report is a document from one’s employers or other supporting documents representing verifiable income. Using data aggression, banks can collect these reports for verification as they directly connect with one’s banking accounts, reducing risks of fraud.

While these fraud mitigation solutions can help prevent fraud to some extent, they are highly time-consuming, expensive, and non-scalable, making it challenging for lenders to detect fraud effectively—which brings us to the next section.

What are the Challenges faced by lenders in the detection of fraud?

As fraudsters become more sophisticated, detecting fraud becomes challenging, especially for new clients and loan borrowers. New and sophisticated methods involving identity thefts, account takeover, and synthetic identity fraud often exploit vulnerabilities in traditional fraud detection systems.

This makes it integral for lenders to employ automated and comprehensive fraud detection solutions. Here are a few more challenges lenders face when detecting fraud:

- Data complexity and volume: Loan lenders deal with highly complex and vast volumes of data from several sources, making it difficult to identify fraud and irrelevant patterns among legitimate transactions. Moreover, incomplete, unstructured, and inconsistent datasets further complicate the fraud detection process.

- False positives: Identifying genuine frauds and minimizing false positives can be significantly challenging when trying to strike a balance between the two. While low false positive rates can lead to undetected fraud losses, high false positive rates can result in unnecessary customer experience and high operational costs.

- Cross-channel fraud: Detecting fraudulent activities becomes especially challenging when fraudsters use multiple channels and platforms, such as mobile banking, online transactions, and call centers. Without automation, integrating these platforms and analyzing data gets complex, expensive, and resource-intensive.

- Insider threats: Employees can exploit their privileges or collaborate with external third parties to perform fraudulent activities. Hence, incorporating robust monitoring systems and internal control policies is crucial to detect and prevent insider fraud.

- Compliance regulation: Complying with regulations is essential to combat fraud. However, stringent compliance regulations can impede the implementation of effective and innovative fraud detection strategies and technologies.

Addressing these challenges requires a robust and automated fraud detection approach to detect fraud in lending.

Why is fraud detection important for lenders?

Financial fraud can cause businesses and banks to lose billions of dollars along with other damages like loss of reputation and customer trust.

Fraud detection for lenders helps mitigate financial losses, comply with regulations, protect their reputation, maintain financial stability, and preserve customer trust.

The Veriff Fraud Index 2024 says that global fraud increased by a whopping 18% compared to 2021, linking digital channels to 61% of all global financial losses.

This indicates that fraud cannot be stopped, but taking preventative and mitigation measures is critical to reducing the risks and resulting losses associated with investigating, recovering, and mitigating fraud costs.

What are the types of fraud in lending?

Cybercriminals incorporate several types of fraud to manipulate and compromise financial institutions and their consumers.

Here are the most common types of financial fraud in lending:

1. Document fraud

Document fraud involves using legitimate altered documents or creating completely fake documents using downloadable templates to secure loans or complete forgeries.

Cybercriminals often use legitimate customer documents by impersonating a genuine loan borrower by altering the data within those documents. Fraud detection tools identify errors and inconsistencies with the document formatting and font usage to identify document fraud when processing loan applications.

2. Loan fraud and stacking

Loan fraud involves stealing the user’s identity, making it a form of identity theft, wherein the fraudster compromises the user’s identity to use it to apply and obtain a loan.

The fraudster uses the user’s social security number, name, bank account number, or other sensitive personal information to apply for a loan. Fraudsters use fake bank statements to fool financial organizations with wrong data to acquire loans. Moreover, fraudsters can also stack multiple loans into a genuine user’s name simultaneously, with no intension of repaying the loan back to the bank.

3. Commercial fraud

Commercial fraud is a type of insider fraud where business executives or employees perform deceptive practices or are involved in illegal activities and legal violations for financial gain.

This fraud ranges from disclosing a business’s income or business tax returns and misrepresenting a loan borrower’s facts or information to providing misleading information about a company’s performance, insider trading, and misappropriation of business funds.

4. Mortgage funds

Mortgage fraud, as the name suggests, involves using falsified or misinterpreted information to obtain a mortgage or a much larger loan amount that could have been approved based on genuine data.

Fraudsters enter false information on mortgage applications to manipulate a property’s appraised value or to acquire a house. Mortgage fraud can also result from insiders, such as attorneys or bank employees, bilking lenders, or homeowners.

5. Financial fraud

Financial fraud occurs when fraudsters use deceptive tactics to steal money or other critical assets. Cybriminals or fraudsters often use other forms of fraud, like mortgage or document fraud, identity theft, or embezzlement, to enable financial fraud.

Inconsistencies in the borrower’s data, accounting anomalies, or discrepancies in the user’s name or address and social security number can help lenders identify and prevent financial fraud.

6. Synthetic identity fraud

Fraudsters manipulate stolen credentials or use fragments of personally identifiable information to create fake identities to enable synthetic identity fraud.

For instance, on a particular loan application, a synthetic identity may include a valid social security number associated with a real address or other details, but when inspected closely, details like the applicant’s name, address, date of birth, and social security number may not match with a real person.

This makes synthetic identity fraud often difficult to detect compared to other types of fraud. However, comparing the details of the loan application with third-party data can help lenders reveal inconsistencies in the data and stop fraudulent activity.

What are the benefits of fraud detection for lenders?

Here are the benefits of fraud detection and its importance for lenders and borrowers in today’s age of increasing risks:

- It helps reduce exposure to fraud by minimizing the risks of financial losses. By detecting and preventing fraudulent loan transactions and applications, lenders can reduce the overall negative financial impact of fraud.

- It helps enhance risk management, enabling lenders to better assess and mitigate risks associated with lending.

- Fraud detection improves the quality of the loan portfolio by minimizing the number of fraudulent loan applications and transactions. This helps improve loan performance and results in lower default rates.

- Effective fraud detection protects the lending institution’s trust and reputation by committing to combating fraud and ensuring the bank’s or financial institution’s integrity—allowing banks to gain a competitive advantage.

- Fraud detection also results in a better loan borrower and customer experience with higher conversion rates, ensuring high security for customers.

- It helps minimize manual entry errors and risks associated with manual reviews, detect file tampering faster, and enhance productivity and customer trust.

What are the different Fraud Detection Techniques?

Financial detection employs several techniques and frameworks to fight against and mitigate financial fraud. Here are a few fraud detection techniques:

1. Fraud detection using AI

Lenders and data analysts can use Artificial Intelligence (AI) algorithms to analyze the vast dataset beyond human capability, identifying anomalies and patterns and preventing fraud.

AI frameworks can efficiently adapt and learn from existing and new patterns and behavior to identify complex trends and relationships that traditional methods cannot.

With AI in fraud detection, finance companies and banks can match data, perform regression analysis, calculate statistical parameters, use probability distributions and models, and recognize patterns to detect suspicious patterns and behavior.

2. Fraud detection using ML

Machine Learning algorithms in fraud detection can help in continuously adapting and learning to new and suspicious patterns of fraudulent activity.

These ML algorithms help analyze historical data and transactions to identify anomalies and deviations, making it easier to detect irregularities that can indicate potential fraud and damage. With time, the ML algorithms learn from the new data, increasing the accuracy in detecting fraud over time.

3. Anomaly detection

In the context of financial fraud detection, anomaly detection involves identifying patterns and deviations that stand out from the norm.

Anomaly detection detects unusual activities and transactions, such as unexpected spikes in transaction volume, an atypical purchasing pattern, or an unusual geographic location for a specific transaction.

4. Continuous monitoring

Continuous monitoring in fraud detection ensures that fraud is detected in real-time, with the ongoing scrutiny of transactional activities.

Continuous transaction monitoring and real-time analysis enable immediate response to potential threats, which helps prevent risks of fraudulent transactions, which is imperative in today’s fast-paced world.

5. Real-time alerts

Real-time alerts are a game-changer in fraud detection. Whenever suspicious activity is detected, the system generates automated alerts, prompting immediate action from the designated personnel or authorities.

These alerts can also trigger automated responses, such as temporarily suspending an account, blocking a transactional account, or preventing further fraudulent activity.

6. Behavior analysis

Behavior analysis in fraud detection studies the behavior and patterns of individual users to establish a baseline for usual or expected behavior. Any inconsistencies or deviations from this baseline are flagged as fraudulent.

It considers and analyzes factors, such as typical or usual transaction amount, transaction frequency, and the time of when the transactions occur to flag fraudulent activities in case of deviations.

AI in Fraud Detection

Fraud detection is critical for banks and businesses of all shapes and sizes. At Arya AI, we provide holistic fraud detection solutions and APIs to combat fraud efficiently.

These APIs help your bank and company foster a culture of security, ensuring revenue growth and a quality customer experience. Here are some of the APIs we offer:

- Face verification: Our face verification and recognition module identifies and matches faces from multiple sources, such as surveillance images or footage, to ensure authorized and frictionless customer onboarding.

- Document tampering detection: The document tampering detection API helps detect authentic and genuine images from tampered digital images using deep learning and advanced algorithms to ensure reliability and integrity for various applications.

- Liveness detection: Passive face liveness detection works as an anti-spoofing technology that distinguishes between 2D and 3D printed images with the user-uploaded digital image to prevent spoofs or presentation attacks.

- Deepfake detection: The deepfake detection API distinguishes genuine content or images from manipulated digital images using advanced algorithms and deep learning technologies. This ensures secure image identification with enhanced security.

Best Fraud Detection Practices For Lenders

Robust fraud detection practices help lenders protect their businesses and customers from financial and reputational damages. Here are a few best fraud detection practices to get started:

1. Implement Know Your Customer (KYC) Procedures

Implementing thorough KYC processes is crucial to verifying the loan applicants’ identity and analyzing their risk profiles. Lenders must collect and analyze relevant user identity documents, such as passports, government-issued IDs, and passports to authenticate user identities.

2. Implement robust authentication protocols

Enforcing strict authentication protocols, such as Multi-Factor Authentication (MFA) helps prevent unauthorized access, adding an additional layer of security.

This is especially beneficial to secure sensitive transactions, making it difficult for fraudsters to get into sensitive systems and accounts.

3. Leverage data analytics and advanced technologies

Using advanced cutting-edge security technologies, such as data analytics and machine learning, makes it efficient to analyze a large volume of data in real time.

This dataset includes customer behavior patterns, historical transaction data, and external data sources. ML algorithms analyze this data to find discrepancies and anomalies in the patterns, flagging potential fraud instances quickly.

4. Ensure real-time monitoring and regular security assessments

Implementing real-time monitoring processes, such as setting up automated alerts to flag suspicious behavior, is key to quickly identifying potential fraud instances.

Moreover, conducting regular security assessments and audits, like conducting penetration testing and evaluating existing security systems, allows businesses to address security risks more effectively and stay abreast of emerging threats.

5. Promote employee assessment and training programs

Providing comprehensive training and assessment programs educates employees about the existing and emerging fraud schemes, tips to identify red flags, and fraud detection processes and best practices.

These programs can include understanding social engineering tactics, the importance of MFA, recognizing phishing attempts, and more to foster a robust security culture within companies and financial institutions.

Emerging Fraud Trends To Look For In 2024

Here are the emerging financial fraud trends companies and financial institutions must look out for this year:

- Phishing attacks via AI: AI-enhanced phishing attacks are becoming more and more advanced in 2024, where attackers exploit AI to tailor clickbaity, personalized, and convincing messages, resulting in unauthorized account access and financial losses.

- Deepfakes in identity fraud: The deepfake technology leverages AI to generate realistic but fabricated videos and images to enable identity fraud. With its reliance on digital identity verification, the financial sector is especially vulnerable to this fraud, particularly with its sophisticated and evolving nature in 2024.

- Synthetic identity fraud: This fraud involves using stolen and fake information to create a synthetic ID, known as the ‘Frankenstein ID,’ to gain unauthorized access, manipulate financial documentation, or steal money.

- KYC data breaches and manipulation: There is a growing trend of sophisticated attacks targeting KYC data manipulation, which will be a goldmine for fraudsters in 2024. These breaches question financial institutions’ credibility and threaten customer security.

- Adoption of new digital payment methods: While convenient for customers, adopting new digital payment methods can be beneficial for attackers, allowing them to leverage new avenues of attack. Juniper research suggests that losses due to online payment fraud are estimated to exceed $200 billion in 2024.

Thus, while we see an evolving landscape of financial fraud in 2024, using cutting-edge AI technologies in fraud detection and help mitigate these frauds and save financial value and reputation.

Conclusion

Given the vigilant and sophisticated nature of fraud and cybercriminal activities, incorporating a holistic and automated approach to fraud detection is crucial to minimize the challenge of false positives and manual fraud detection errors.

To prevent the risks of financial fraud, such as document, mortgage, or loan fraud, banks, lenders, and financial institutions must incorporate security measures and holistic security API modules, like the ones mentioned above by Arya AI, to help reduce the risks of fraudulent activities.

Get started with Arya AI today!