TL;DR:

- Genuine electricity bills follow a structured format, including consistent provider details, unique account information, and clear usage summaries. Spotting these features can help verify legitimacy.

- Fake bills often show errors like inconsistent formatting, unusual usage patterns, or pixelated logos, signaling possible tampering.

- Accepting fake bills can lead to financial losses, compliance risks, reputational damage, and increased operational costs for financial institutions, highlighting the need for robust fraud detection.

- AI tools like OCR and NLP can automate checks, detect anomalies, and minimize errors, enhancing fraud prevention.

- Arya AI’s Intelligent Document Processing solution uses advanced tech to detect fakes, streamline verification, and support compliance.

Document fraud is an escalating threat, with fake utility bills emerging as a common tool for deception. Fraudsters increasingly use forged documents to manipulate loan applications, bypass KYC protocols, and enable unauthorized transactions, impacting everyone, including banks, insurers, and lenders.

These counterfeit bills create significant risks—financial losses, regulatory non-compliance, and reputational harm. Detecting fraudulent documents early on is crucial for maintaining integrity, ensuring compliance, and protecting customer trust.

What Makes an Electricity Bill “Real”?

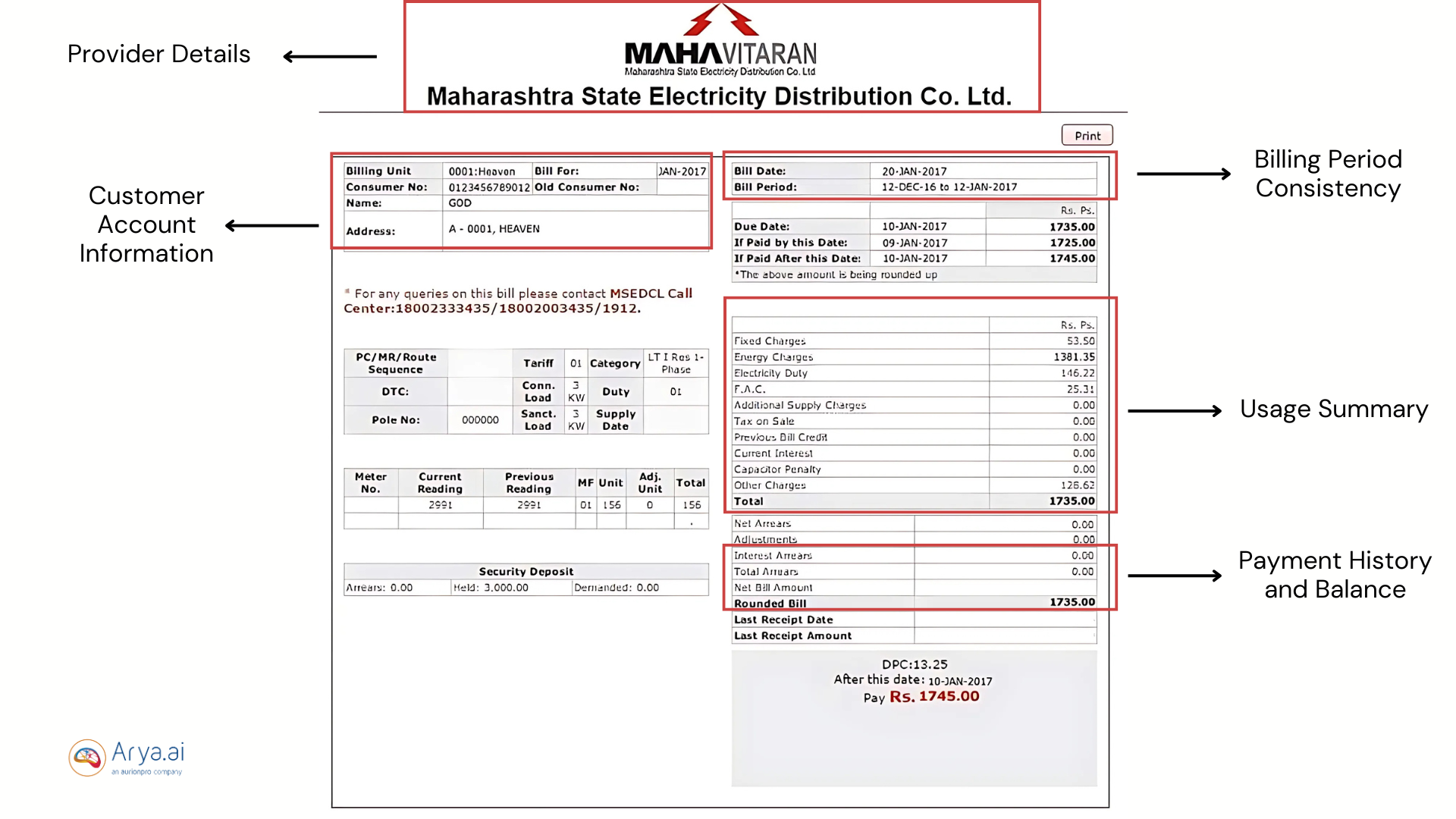

A genuine electricity bill is a structured document with specific details that reflect both the provider's and the customer's identity.

Quick Checklist of Authenticity:

- Provider Details: Legitimate bills include the utility provider’s logo, address, and customer service information. These elements are consistent and standardized across genuine documents.

- Customer Account Information: Each authentic bill contains unique account numbers, meter readings, and service addresses associated with the customer. Fraudulent bills often display mismatched or generic details.

- Usage Summary: Authentic bills provide a detailed breakdown of monthly or bi-monthly electricity usage, billing cycle, and payment due dates.

- Payment History and Balance: Genuine bills show the previous month’s balance, payments made, and any outstanding amounts. Unusual charges or unexpected zero balances can indicate tampering.

- Billing Period Consistency: Review the billing cycle dates. Missing or incorrect dates suggest possible alterations.

These core elements provide a foundation for assessing a bill's validity.

Red Flags of Fake Electricity Bills You Shouldn’t Ignore

Fraudulent bills often contain noticeable errors and irregularities. Here are the top five red flags that commonly appear on fake utility bills:

- Spelling and Grammar Errors: Fake bills often include typos in the provider’s name or address, an immediate red flag for possible tampering.

- Inconsistent Formatting: Look for inconsistencies in font styles, sizes, or alignments. Authentic bills from reputable providers maintain a standard format, while fake ones may appear sloppy or irregular.

- Suspicious Usage Patterns: Anomalies like unusually low usage levels or zero balances, especially for high-consumption months, often indicate falsification.

- Altered Account Numbers or Meter Readings: Fake bills might contain fabricated account numbers or altered meter readings to match an applicant’s fraudulent profile. Verify account numbers against official records whenever possible.

- Pixelated Logos or Images: Scanned or manipulated logos on fake documents often appear pixelated or blurry. Utility companies typically use high-resolution graphics, making any visual irregularities a point of concern.

These signs can indicate tampering and should prompt further investigation to ensure document integrity.

How Fake Electricity Bills Impact Financial Institutions

Accepting a fake utility bill is more than a minor oversight; it poses serious implications for financial institutions. With 46% of organizations affected by economic crime in the last two years, per PwC’s Global Economic Crime and Fraud Survey, the stakes are high. Fake documents can become a serious bottleneck in customer due diligence, contributing to fraud like account takeover.

Impact on Financial Institutions:

- Increased Fraud Losses: Fraudulent applications approved based on fake bills can lead to substantial losses, with recovery efforts costing institutions millions in legal fees.

- Compliance and Regulatory Risks: Accepting forged documents can lead to regulatory non-compliance, resulting in fines or, worse, loss of licensure.

- Reputational Damage: Financial institutions lose customer trust when fraud is discovered. This erosion of trust can deter potential clients and disrupt client retention.

- Operational Costs: Manual document verification requires extensive resources, yet remains fallible. Financial firms often invest significant time and money in remediation when fraud goes undetected initially.

As fraudulent document schemes become more sophisticated, financial institutions must stay proactive to mitigate risks.

Tips for Spotting Fake Electricity Bills

To aid financial institutions in flagging potentially fraudulent bills, here are some practical tips:

- Verify Against Provider Records: Whenever possible, cross-check the bill's account information directly with the utility provider.

- Check for Consistent Branding: Examine logos, brand colors, and font styles for consistency. Genuine bills from established providers have uniform branding.

- Inspect Details Carefully: Verify that the billing cycle dates, service address, and usage details align with the customer’s claims.

- Use Pattern Recognition Tools: Utilize technology to detect patterns that may indicate repeated fraud attempts using similar falsified details.

- Additional Documentation for High-Value Transactions: If a utility bill seems suspicious, ask for supplementary documents such as recent tax returns or pay stubs to validate customer information.

Using AI to Automate Fake Electricity Bill Detection

As document fraud schemes evolve, AI has emerged as a powerful tool to help financial institutions detect forgeries with higher accuracy and efficiency. AI-powered tools reliant on Intelligent Document Processing (IDP), Optical Character Recognition (OCR), and Natural Language Processing (NLP) can analyze and validate data from scanned documents. This automation minimizes manual labor, improves fraud detection, and reduces turnaround time for verification.

Benefits of AI in Fraud Detection:

- Pattern Recognition: AI algorithms can spot patterns across thousands of documents, flagging inconsistencies that a human reviewer might miss.

- Heat Map Analysis: Advanced AI solutions highlight suspicious areas in documents, such as altered numbers or modified logos, allowing rapid assessment.

- Scalability: With AI, financial institutions can handle high volumes of documents, identifying discrepancies within seconds rather than hours.

- Reduced Manual Errors: Automation minimizes human oversight, ensuring consistent, accurate verification.

How Arya AI Can Help

Arya AI’s Intelligent Document Processing (IDP) offers a solution for efficiently managing and verifying documents. Utilizing advanced technologies such as OCR and natural language processing, the platform streamlines the extraction, interpretation, and validation of data, significantly reducing manual effort and errors.

Its ability to detect document alterations, such as fake electric or utility bills, ensures higher accuracy and operational efficiency, making it an essential tool for businesses handling critical documentation.

Fraud detection is a key feature of Arya AI’s IDP, which can identify manipulated details, altered images, and fabricated data. This functionality is particularly valuable in areas such as compliance and onboarding, where document integrity is paramount.

Conclusion

Detecting fake electricity bills is critical for financial institutions to protect from fraud, compliance risks, and reputational harm. With increasing sophistication in document falsification, relying solely on manual checks is no longer sufficient. Organizations can proactively identify fraud attempts by understanding key red flags such as inconsistent formatting, suspicious usage patterns, and altered details.

However, using technology AI-powered tools is going to be the most effective approach. These automate document verification, detect anomalies with precision, and reduce operational costs, allowing institutions to stay ahead of evolving threats.

![Identifying Fake Documents [A Complete Guide]](/content/images/size/w960/2024/08/Identifying-fake-document-2.png)