TL;DR:

- Fraudulent pay stubs pose significant risks, including financial loss, regulatory violations, and reputational damage for institutions.

- Inconsistent formatting, incorrect employer details, unusual pay amounts, and missing or distorted tax information are common indicators of fraudulent pay stubs.

- Advanced AI tools can analyze inconsistencies in font types, spacing, logos, and tax data while using metadata and reverse image search to spot manipulations.

- Machine learning algorithms, OCR technology, and natural language processing streamline the detection process, enhancing accuracy and reducing human error in financial document verification.

The impact of fake pay stubs is far-reaching, with financial institutions losing significant sums. Additionally, fake IDs —created by blending legitimate data with falsified information—are becoming more difficult to spot using traditional methods. As the volume of fraudulent transactions continues to grow, businesses need more advanced methods to detect them,

The alarming trends in financial fraud, including fake paystubs, highlight the need for advanced tools to combat digital deception. As fraud strategies evolve, so must our approach to identifying them.

Signs of Fake Pay Stubs

1. Inconsistent Formatting and Layout

- Unusual Fonts and Spacing: Legitimate pay stubs follow a standard format with consistent font sizes and spacing. A fake paystub often has odd fonts, inconsistent spacing, or unusual text alignment. For example, the company name might appear in a different font than the other details on the stub.

- Missing or Distorted Elements: Paystubs usually include specific details like the company logo, tax information, and the employee's pay period. Fake pay stubs may be missing or have distorted logos.

2. Inaccurate or Missing Company Information

- Incorrect Employer Details: A real paystub will always list accurate company information, such as the correct name, address, and contact details. Fake pay stubs might contain incorrect or generic company names or list an outdated or non-existent address.

- Non-Matching Contact Information: If you attempt to call or email the company listed on the pay stub and cannot verify the details, it's a significant red flag.

3. Inconsistent Pay Details

- Unusual or Incorrect Pay Amounts: Fake pay stubs might show pay amounts inconsistent with the employee's actual role or income. For instance, someone with an entry-level job might show an unrealistic salary or hourly rate.

- Rounded Figures: Pay Stubs from legitimate sources usually show precise figures, such as payroll taxes or hourly wages calculated down to the cent. Fake pay stubs may round amounts for simplicity or to avoid detailed scrutiny.

4. Missing or Incorrect Tax Information

- Absence of Tax Deductions: A legitimate paystub should show tax deductions, insurance contributions, and retirement savings. If the deductions seem unusually low or high compared to the income level, it's a red flag.

- Incorrect Tax Year: Pay Stubs should clearly display the correct tax year. Fake documents might have discrepancies in tax year dates or not align with the current year.

5. Digital or Scanned Documents

- Low-Quality Scans or Images: Many fake pay stubs are digital files scanned or created using editing software. These often have lower-quality images, pixelation, or inconsistent shading.

- Metadata Anomalies: Paystubs created digitally may contain hidden metadata indicating when the file was created or edited. If this metadata doesn't match the expected timeline of the document or seems out of place, it may mean that the document has been manipulated.

Why is it important for organizations to identify fake paystubs?

Fake pay stubs can promote fraudulent activities across financial applications such as loan approvals and employment verifications. Fraudsters often create fake pay stubs to manipulate their apparent income, helping them secure loans, rent properties, or obtain credit cards.

- Rise of Financial Fraud: Financial institutions are not immune to the growing threat of fake pay stubs. In 2022, nearly 70% of financial institutions experienced increased fraud-related losses, with fake documents such as pay stubs being a primary tool for fraudsters. This has resulted in millions of dollars lost across industries, from retail to banking.

- Protecting Against Regulatory Risks: Compliance with regulatory standards is paramount in the financial sector. Institutions guilty of facilitating fraud—knowingly or unknowingly—may face severe legal repercussions, including fines and sanctions.

- Legal and Reputational Damage: Financial institutions found guilty of approving loans or issuing credit based on fraudulent documents may face lawsuits, regulatory fines, and long-term reputational damage. According to the Survey conducted by Alloy, 70% of respondents have lost over $500K in the last twelve months, and 27% of respondents lost over $1M to fraud in 2022.

- Widening Use of Synthetic Identities: Synthetic identity fraud involves combining accurate and fabricated data to create a new identity, which can be used to commit various forms of fraud. It has been costing financial institutions more than $6 billion each year.

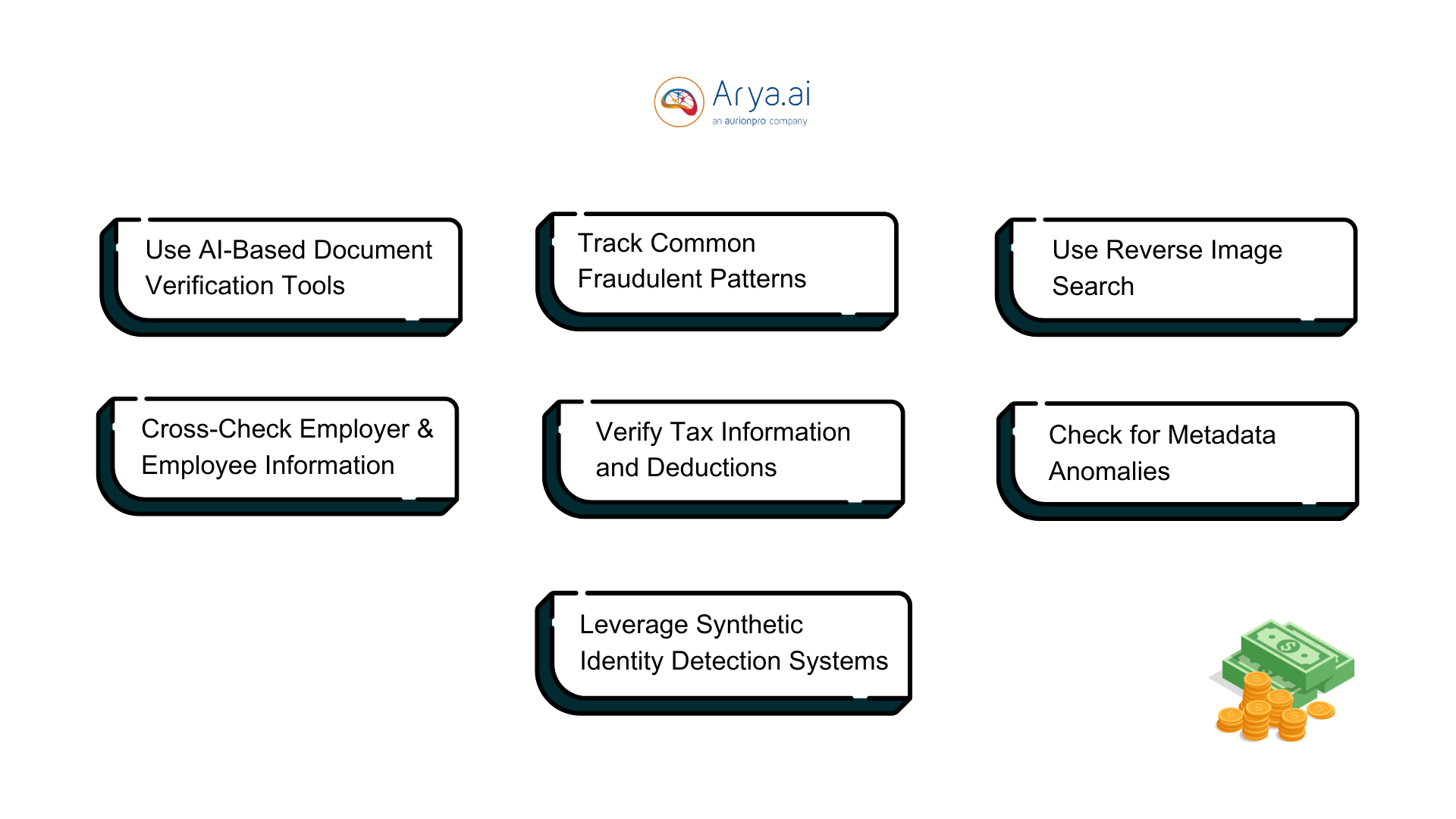

Methods You Can Adopt to Detect Fake Paystubs

Here are some methods to detect fake pay slips:

1. Use AI-Based Document Verification Tools

AI-powered tools, particularly those utilizing machine learning and image recognition, can analyze pay stubs for inconsistencies. These tools can detect anomalies in font types, spacing, and logo placement and even identify patterns commonly used by fraudsters.

2. Cross-Check Employer and Employee Information

One of the simplest ways to verify a pay stub is by cross-referencing its information. Institutions can also contact the employer directly or verify the data through tax records. Inconsistent or outdated company information is a major red flag for fraudulent pay stubs.

3. Verify Tax Information and Deductions

Paystubs must show accurate tax information, including federal, state, and local deductions. Fraudulent pay stubs often feature incorrect or missing tax data. Automated tools can compare these deductions with known industry standards or use publicly available information for specific income brackets to flag paystubs with discrepancies.

4. Check for Metadata Anomalies

Checking the document's metadata can provide important clues as to whether the paystub has been submitted digitally. Metadata can reveal when the document was created or last modified. Inconsistencies could indicate tampering.

5. Use Reverse Image Search

A reverse image search can be performed to determine whether these elements are commonly found on legitimate documents or are frequently used in fraudulent templates. This can help identify fake pay stubs created with generic templates or downloaded images from the web.

6. Leverage Synthetic Identity Detection Systems

With the rise of synthetic identity fraud, financial institutions must employ systems that detect and prevent such fraud. These systems can analyze data combinations from different sources to identify potentially fraudulent activity, like paystubs linked to synthetic identities.

7. Track Common Fraudulent Patterns

Knowing the most commonly used fraudulent schemes can help institutions quickly recognize fake paystubs. For instance, many fraudsters use commonly available paystub generators or templates that are easily identifiable through digital fingerprinting methods.

How to Automate Paystub Detection Using AI-Powered Apps?

Here's how AI-based tools can streamline the detection of fake paystubs:

1. Image Recognition and Optical Character Recognition (OCR)

AI-powered applications often use image recognition and OCR technology to analyze pay stubs and extract text from scanned images or PDFs. OCR algorithms can extract details such as employer names, pay amounts, tax deductions, and dates.

- Example: Apps like Arya AI use OCR for document verification and automation, offering high accuracy in identifying discrepancies in financial documents.

2. Machine Learning Models for Anomaly Detection

Machine learning algorithms can be trained to detect patterns in legitimate pay stubs and flag deviations from these patterns. AI can identify inconsistencies that suggest a document may be fraudulent.

- Example: Darktrace, an AI-driven security platform, uses unsupervised machine learning to spot deviations in document metadata and other transaction details, which could indicate the presence of a fake pay stub.

3. Metadata Analysis

AI can analyze metadata within digital documents to verify whether the document's creation date, modification history, or author information aligns with the listed pay period. AI algorithms can also check for inconsistencies in the metadata, such as file creation times that don't match the stated pay date.

- Example: AI tools from companies like Vervent specialize in financial document verification by analyzing metadata to spot inconsistencies and signs of manipulation

4. Cross-Referencing Employer Information

AI tools can automate the verification of employer data by cross-referencing the employer's contact details, business address, and other information against trusted external databases or company directories. If the data doesn't match or seems inconsistent with the employer's information, the AI system flags it for further investigation.

- Example: Solutions from companies like IDology use AI-driven verification systems to cross-check employer details against public and private databases.

5. Natural Language Processing (NLP) for Document Parsing

NLP algorithms can be used to parse the content of paystubs, automatically categorizing and extracting key details such as gross income, net income, and deductions. AI models then assess these figures in relation to industry standards or the user's role in detecting inflated figures.

- Example: Trulioo utilizes AI and NLP for document parsing and verification, focusing on income verification in financial applications.

Conclusion

The threat of fake pay stubs is growing as fraudsters become more sophisticated in their methods. For financial institutions, accurately detecting and preventing fraudulent documents is a matter of protecting assets, ensuring regulatory compliance, and maintaining customer trust. AI-powered tools and machine learning algorithms offer a robust solution by automating the process of pay stub verification, significantly reducing human error and speeding up the detection process.

By integrating these technologies, financial institutions can protect themselves from financial losses, maintain compliance with regulations, and preserve their reputation in a highly competitive market. As fraud tactics evolve, so must the solutions, and AI offers the most reliable and efficient way to stay ahead of potential threats.