Organizations rely on data from invoices, cheques, and bank statements for important tasks such as fraud detection, data organization, regulatory compliance, credit risk analysis, and more.

Up until a few years ago, processing data from these documents was done manually. It was prone to errors and required the workforce to invest substantial time.

That is why organizations turned to adopting technologies like OCR. Now, AI-powered intelligent document processing solutions have taken it up a notch. Both have the potential to process data faster and more accurately, but which one should you invest in?

In this article, we’ll discuss both technologies and help you choose a solution that best meets your business needs and requirements.

What is OCR?

OCR can extract data from images, PDFs, or other scanned paper documents and convert and digitize this data into searchable, editable, and machine-readable data. In the context of OCR in banking enables institutions to extract data from sensitive documents such as bank statements and pay stubs.

It significantly streamlines data processing by reducing manual data entry effort and provides an efficient way to store data and documents digitally.

Applications of OCR

- Document Digitization for Easy Storage and Retrieval: OCR technology converts physical documents into digital formats, making them easier to store, access, and retrieve.

- Automating Data Entry from Forms, Invoices, and Handwritten Text: OCR can extract information from forms, invoices, and handwritten documents to automate data entry processes, reducing manual effort and intervention.

- Digitizing Historical Archives and Manuscripts for Preservation and Research: OCR technology can convert archival reports, contracts, manuscripts, newspapers, etc., into digital formats.

- Assisting Visually Impaired Individuals Through Text-to-Speech Conversion: Converting printed text into digital format, OCR enables screen readers and text-to-speech software to vocalize the content.

- Enhancing Security for Identity Verification: OCR can extract and verify information from identification documents such as passports, driver's licenses, and ID cards.

Limitations of Traditional OCR

- OCR systems heavily rely on rules and templates to recognize characters, which means they require a new rule for each individual iteration.

- They struggle with processing handwritten texts or signatures, making scope of use a serious bottleneck.

- OCR systems aren’t equipped with NLP, so they cannot understand the text’s context, limiting the use cases.

- Low-quality images, noise, poor resolution, and distortions significantly diminish OCR’s accuracy and effectiveness.

What is AI in Document Processing?

The core purpose of AI in the context of document processing is to use AI and ML algorithms to intelligently process data. Unlike OCR systems, Intelligent Document Processing makes it easier to understand the context of the information. For instance, bank statement analysis using AI-powered document processing can not only process the information but also provide a complete analysis of the statement.

OCR vs AI: What Are The Major Differences?

Here are some factors that distinguish OCR and AI from one another.

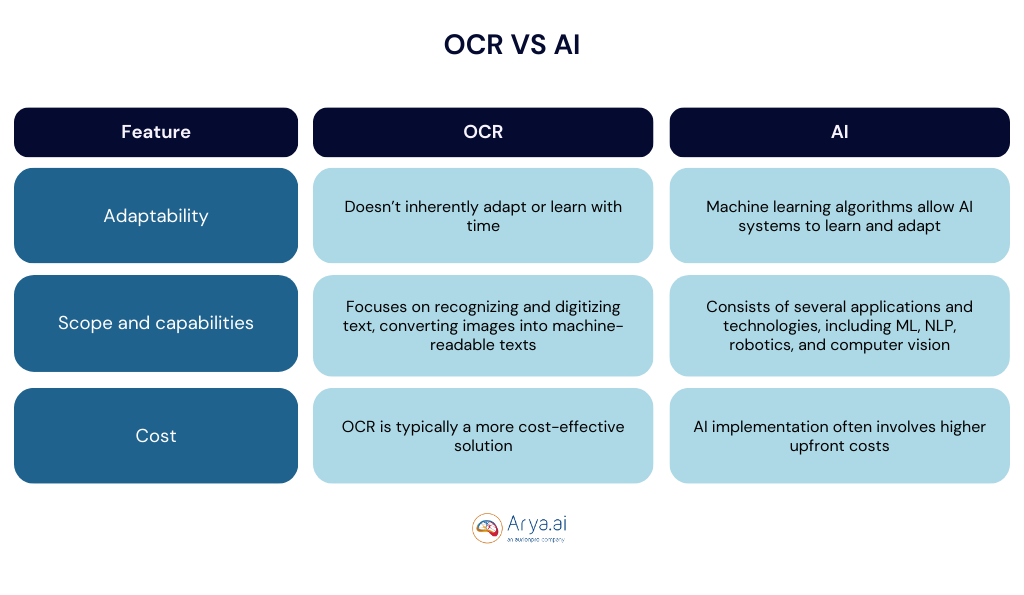

1. Adaptability

One of the major factors that differentiates AI from OCR is its adaptable and continuous nature of learning.

The machine learning algorithms allow AI systems to learn and adapt over time, improving their performance and decision-making capabilities and making them more accurate.

On the other hand, OCR doesn’t inherently adapt or learn with time—it can only be enhanced and made better through machine learning. It stores different fonts and texts as templates to leverage pattern recognition to compare and match text images word-by-word, but it doesn’t particularly learn and adapt to new data like AI.

2. Scope and capabilities

Another significant difference between AI and OCR is their use of scope and capabilities.

OCR specifically focuses on recognizing and digitizing text and characters, with the inherent function of converting images into machine-readable digital text. This limits the scope of OCR to just text recognition tasks.

Whereas, AI consists of several applications and technologies, including ML, NLP, robotics, and computer vision, as it includes algorithms that can learn, adapt, reason, and make decisions based on data. This extends its capabilities to perform a wide range of tasks, such as image recognition, speech recognition, data analysis, pattern recognition, and decision-making.

This also makes AI highly versatile and capable of handling complex, incomplete, and unstructured data compared to OCR.

3. Cost

AI implementation often involves higher upfront costs because it requires investing in sophisticated technologies and algorithms, data training, and computational power.

OCR, on the other hand, is typically a more cost-effective solution, especially in terms of implementation and document digitization.

However, it’s also crucial to note that the wider applications and use cases of AI makes it worth the investment and ideal for banks and organizations.

AI-powered OCR Systems: Solution To Ending The OCR vs AI Dilemma

While OCR and AI comes with its own sets of pros and cons, when combined together do wonders in enhancing business operations.

The solution to closing the OCR vs AI dilemma is leveraging AI-integrated OCR systems. Here’s how it can help financial organizations:

- Enhanced accuracy: Traditional OCR systems struggle with accuracy, especially when dealing with varying fonts, low-quality handwritten documents, or distorted texts, leading to inaccurate pattern recognition. By leveraging machine learning and neural networks, AI significantly boosts OCR’s accuracy by learning and adapting to different text formats and fonts and better understanding the context.

- Improved data insights and decision-making: AI-powered OCR systems can efficiently interpret and analyze the extracted data to draw deeper insights, enabling better decision-making.

- Improved contextual understanding: AI enables better contextual understanding than traditional OCR, which is useful in situations that require making educated guesses about blurred or unclear characters and words.

- Increased deployment and applications: With AI integration, the OCR system’s capabilities increase beyond text recognition, making it more versatile to perform applications like analyzing document structure, categorizing content, and even automating tasks, such as invoice processing and identity verification.

- Automated error correction: By leveraging Natural Language Processing (NLP), AI can automate error correction by identifying and correcting errors in recognized texts by OCR systems, improving the reliability of digitized documents.

Conclusion

While OCR individually serves specific purposes of text recognition, when integrated with AI, it brings a wider range of capabilities and applications.

AI-powered OCR systems allow banks and financial institutions to perform complex tasks beyond text recognition, such as advanced data analysis, automation, and decision-making.

If you’re looking for AI-driven solutions to automate and streamline your banking operations, choose Arya AI and its extensive range of Apps.

Leveraging our Apps, such as document fraud detection, invoice extraction, bank statement extraction, and face verification, can improve your workflow's accuracy and help you make better decisions. These APIs not only help ensure accurate data extraction but also keep your organization safe against fraud and help you make better decisions while eliminating manual labor.

So, transform your banking operations and leverage our Apps with seamless integration and a 99.99% success rate. Contact us today to learn more.