TL;DR:

- Structuring (or smurfing) involves breaking large sums of money into smaller transactions to avoid detection by financial institutions.

- It is a common tactic during the layering stage of money laundering, where illicit funds are disguised through a series of transactions to obscure their origin.

- Structuring involves one person making small deposits, while smurfing uses multiple individuals (smurfs) to spread the risk and make deposits.

- Financial institutions use Know Your Customer (KYC) procedures, Enhanced Due Diligence (EDD), and transaction monitoring systems to detect and prevent structuring activities.

Each year, trillions of dollars are siphoned off from the global economy with bribery, tax evasion, cyber theft, and money laundering.

The UN estimates that money laundering alone takes between $800 billion to $2 trillion from the global GDP. Structuring, is a common tactic in money laundering where large sums of money are broken into smaller transactions to avoid detection by authorities.

Where does Structuring fit in the Stages of Money Laundering?

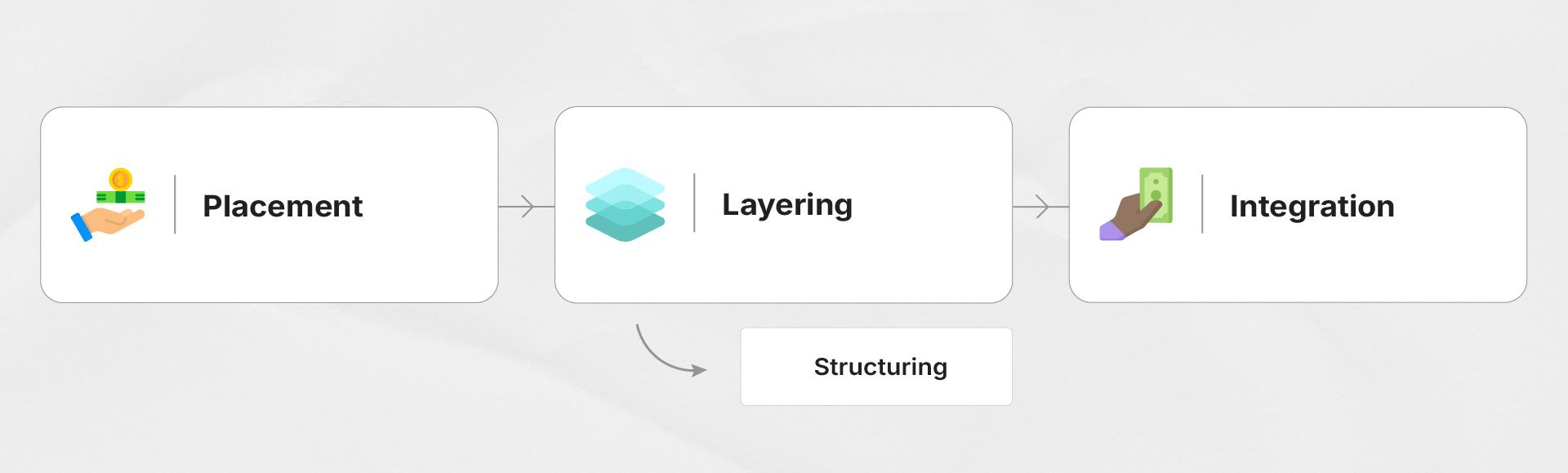

Money laundering is difficult to uncover, as it often operates across multiple countries with different regulations. So, to make it easier to identify, trace, and combat, money laundering is broken down into three distinct stages: placement, layering, and integration.

- In the placement stage, bad actors bring illicit funds into the financial system through cash deposits, smuggling, high-value purchases, or gambling activities.

- The layering stage is where they disguise the origins of that money through a series of elaborate transactions, shell companies, or non-traditional financial systems.

- Finally, in the integration stage, they reintroduce the “clean” money into the economy, appearing as if they were legally acquired through investments, purchases, or bank deposits.

Structuring (or smurfing) comes into play during the layering stage, where criminals divide large amounts of money into smaller, less detectable transactions.

What is Structuring in Money Laundering? And How Does It Work?

Money launderers use structuring to break down large sums of funds into smaller amounts and deposit these across various banks or accounts without raising suspicion.

The idea is to keep each transaction just under the reporting thresholds set by financial institutions, so these transactions fly under the radar.

For instance, in the U.S., any cash deposit over $10,000 triggers a Currency Transaction Report (CTR), which is a report that banks must file to the government to track large cash transactions. But by keeping each deposit below this threshold, criminals can avoid detection.

Similarly, in Europe, the threshold is set at €10,000. In the UAE, the limit is AED 55,000, while in India, RBI mandates banks to flag cash transactions above INR 50,000.

Fraudsters keep the deposits under these limits to dodge regulatory scrutiny. This tactic also includes other financial instruments like money orders, cashier’s checks, and even cryptocurrency.

Examples of Structuring in Money Laundering You Should Know

Cash Structuring (or structuring) is one of the oldest tricks in the book for laundering money. Let’s say a business owner receives $200,000 in cash from illegal activities. If they were to deposit it all at once into a bank account, it would instantly raise suspicion, especially if their business can’t generate that kind of revenue.

Instead, they break it down into smaller deposits of $9,500 each, just below the $10,000 threshold in the U.S. By spreading these deposits across different bank branches or on different days, they evade the requirement for a CTR.

Smurfing vs. Structuring: Are They the Same?

The main difference between structuring and smurfing is in the number of people involved. Instead of one person splitting up deposits, smurfing involves multiple individuals, a.k.a "smurfs," who each make small deposits on behalf of a central organizer.

It’s a way of spreading the risk by using many hands to move money through the system, making the money trail harder to trace. Both techniques aim to circumvent anti-money laundering (AML) measures and keep the money launderers’ activities out of sight.

However, banks and AML agencies view these techniques differently. Structuring is often simpler to track, involving just one person. Smurfing, on the other hand, is more complex as it uses many individuals to carry out seemingly straightforward deposits.

Also, structuring is usually used to avoid triggering a CTR and may not involve concealing the illegal source of the fund. However, the goal of smurfing is to both avoid detection and hide the nature and source of the fund.

Is Structuring in Banking Illegal? — Suspicious Activity Reporting and Legal Consequences

Yes, structuring is illegal, and financial institutions must report it if they suspect it’s happening. When a bank notices any patterns of structured deposits, they must file a Suspicious Activity Report (SAR). These SARs are sent directly to the regulators who investigate possible money laundering.

Typically, banks are required to file a SAR within 30 days of detecting suspicious activity. But if they need more time to gather evidence, they can get an extension up to 60 days. The bank does not need to prove that a crime took place—just that there’s reasonable suspicion.

The individual/s involved won’t be notified that a SAR has been filed. Financial institutions are legally obligated to keep such reports confidential to avoid tipping off potential criminals.

When banks submit a SAR, they must include the identity of the person(s), the methods used, the exact time and location, and why they believe it’s suspicious.

Structuring Patterns

Certain patterns almost always trigger a SAR. For example, if a business claims one type of activity but the deposits don’t match that profile, or if multiple high-value bank transfers don't fit the account’s usual behavior, it raises concerns. Other warning signs include multiple complex transactions split across several accounts over a short interval.

Regulators treat these activities seriously because they are often linked to tax evasion, drug trafficking, or other crimes. The penalties for getting caught are severe — fines, asset forfeiture, and even imprisonment.

How Financial Institutions Detect and Prevent Structuring in Money Laundering

While filing Currency Transaction Reports (CTR) and Suspicious Activity Reports (SAR) are essential, banks have several strategies to detect and prevent structuring or smurfing.

The first step is, of course, Know Your Customer (KYC) procedures to verify customer identities to understand the financial behavior of each client. For high-risk profiles, they go deeper using Enhanced Due Diligence (EDD), which checks transaction histories to catch any suspicious activities early on.

Transaction monitoring systems are crucial to flagging multiple deposits that are just under the reporting thresholds. These systems alert banks when they see patterns that look like structuring.

How to Avoid Structuring Risks: Tips for Businesses

To reduce structuring risks, always keep financial practices transparent. Conduct regular audits and maintain a solid internal reporting system. These checks help spot irregular patterns early on.

Arya AI helps financial institutions leverage AI for smart onboarding. We also offer AI APIs to automate KYC data extraction, bank statement analysis, and fraud detection, minimizing compliance risks and improving transaction transparency.

Explore how Arya can enhance your anti-money laundering efforts and streamline compliance with AI-powered solutions.