The insurance industry today consists of over 7000 companies that collect more than $1 trillion in premiums every year. This massive industry provides more opportunities and bigger incentives to fraudsters committing illegal activities.

Insurance fraud is a high-alert concern that is rapidly growing across all countries worldwide. A recent study by the Coalition Against Insurance Fraud revealed that insurance fraud costs around $308.6 billion annually in the United States alone. It is no surprise that insurance companies and genuine customers have experienced heavy losses in recent years.

Tackling insurance fraud is challenging as scammers explore different methods to commit these frauds. Hence, you need to put in extra effort to understand the different types of insurance fraud and how they are committed.

In this post, we will share a list of insurance frauds and how you, as an insurance company, can mitigate the insurance fraud risks.

What Is Insurance Fraud?

Insurance fraud is a financial crime when an individual knowingly lies to an insurance company to obtain an illegitimate gain. This is done especially when individuals know they would not have received it if they had told the truth.

While insurance is considered a financial security to protect policyholders against financial burdens during hard times, some individuals attempt to take advantage of the opportunities and lie to receive the money from these policies. Besides policyholders, some insurance providers can commit insurance fraud by selling policies from fake companies, exploiting policies for extra commissions, skipping premium payments, and so on. Anyone can do insurance fraud - policyholders, medical providers, third-party claimants, and even insurance agents.

There are two categories of insurance fraud -

- Hard Fraud - This occurs when an individual purposely makes up for a loss to receive money from the insurance claim. Here, the insured property is intentionally destroyed to get the settlement money.

- Soft Fraud - This occurs when an individual is inflating or fabricating a legitimate claim or lying about certain information during the insurance application process.

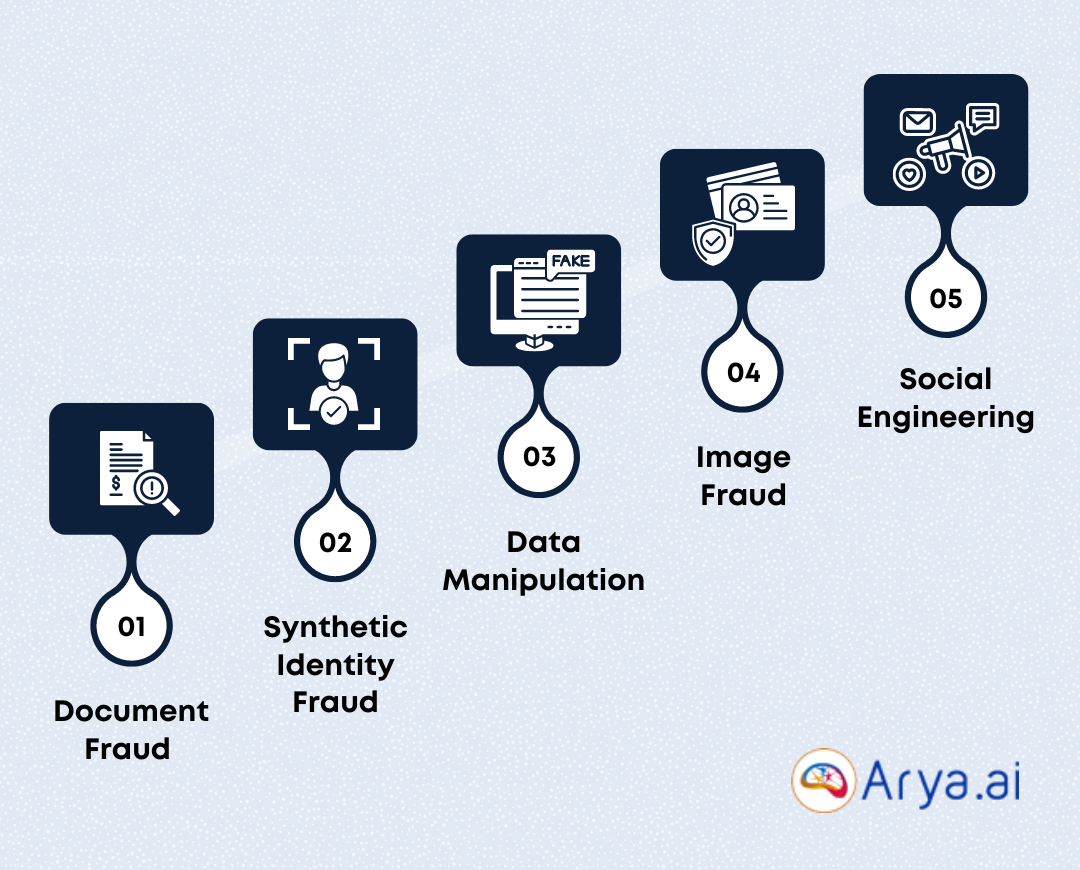

Let us understand some of the most common types of insurance fraud these scammers may attempt to commit.

Types of Insurance Fraud to Watch Out

Here are a few ways how fraudsters carry out the insurance fraud.

#1. Document Fraud

Document fraud is common in the insurance industry as fraudsters manipulate documents using AI technology to create fake documents for financial gain. Some of the popular techniques scammers use are -

- Document forgery

Scammers use AI-powered tools to create sophisticated forgeries of insurance documents like policy documents, claim forms, identification documents, and so on. These tools work on advanced generative AI algorithms to create realistic-looking documents that are difficult to distinguish from genuine ones.

- Signature Forgery

Scammers can use AI tools to mimic policyholders' signatures with high accuracy and utilize them to forge signatures on insurance documents, cheques, authorization forms, and so on. This makes it harder for insurance companies to detect fraudulent policies and claims documents.

- Text Generation

Scammers may use AI tools that rely on natural language processing (NLP) models to generate convincing content, such as creating fictitious stories, fabricating medical histories, and more for insurance applications, claims, and any other kind of correspondence for insurance documentation

#2. Synthetic Identity Fraud

Fraudsters create fictitious identities by combining real and fake information and applying for insurance policies. They utilize AI algorithms to synthesize various datasets to build new identities that seem genuine individuals. They build these identities so that they cannot be traced back to real individuals. The fraudsters then use AI tools to build a solid financial profile for these new identities. They open new bank accounts, apply for credit cards, take loans, and more. Establishing a credit history allows them to apply for insurance policies and later file for false claims without arousing any suspicion.

Read now- A Guide to AI Identity Verification

#3. Data Manipulation

Fraudsters can hack into your insurance systems and use AI algorithms to manipulate your data. They can alter information within your insurance systems to exploit insurance policies for financial gain without arousing any suspicion. This involves changing policyholder information and replacing it with synthetic identities, modifying the coverage limits, updating policy dates, or changing nominee information in the policies. Besides changing policy details, they may fabricate claims data for inflating claim amounts, submitting multiple claims, or simulating legitimate claims making it difficult for you to detect these activities.

#4. Image Fraud

Fraudsters can employ advanced AI-powered image editing software to manipulate images to support false policy documentation and claims to deceive insurance companies. By using deepfake technology, they can create realistic images and videos to produce false evidence and documentation. They might alter the images of damaged property, vehicles, or injuries to make them appear more severe than they actually are. This would help them increase the payout they receive from the insurance companies. Fraudsters today are also manipulating medical images like MRIs, X-rays, and CT scans to exaggerate injuries to claim more money for unnecessary procedures and treatments.

#5. Social Engineering

Fraudsters leverage AI-powered chatbots and virtual assistants to impersonate insurance agents or customer service representatives to engage with policyholders. They establish a good connection with the policyholders to encourage them to disclose personal details and gather sensitive information to gain unauthorized access to their insurance policy accounts. For instance, they may create fake insurance surveys that offer enticing incentives and ask participants to provide personal details, which are then used to log into their accounts or reset their passwords.

How Can AI Help in Insurance Fraud Detection?

AI can help detect insurance fraud by automating the claims process, monitoring customer behavior, and spotting unusual activities that may be strong fraud indicators.

FRISS surveyed over 400 global insurance professionals to assess their knowledge about innovative solutions and emerging risks within the current insurance landscape. Over 53% of respondents admitted that investing in anti-fraud technology helped them improve their investigator efficiency and stay ahead of various fraud schemes.

AI can analyze large volumes of data to find trends and detect fraud in real-time. It utilizes advanced algorithms and machine learning technologies to identify suspicious activities associated with insurance fraud.

Here is how it works -

- Thorough Data Analysis - Machine learning algorithms can analyze extensive data sets to identify patterns and anomalies in historical data. They can then be trained to spot this pattern in future data and flag potential instances of fraud.

- Real-time Monitoring - AI systems can regularly monitor transactions and claim processing processes to identify fraudulent activities. For example, irregular claim patterns, discrepancies in policy information, unusual customer behavior, and more. Once it detects a potential fraud activity, it can immediately send alerts to notify you to take immediate action.

- Predictive Analytics - AI can study historical data to predict future fraud trends. This helps you identify high-risk individuals that are more likely to commit fraud. You can then adjust the insurance premium amounts or refuse coverage altogether. Thus, taking proactive steps will certainly help you predict and prevent fraud before it actually happens.

AI in insurance fraud detection helps proactively detect fraud rather than tackling it after it is done. It is transforming the landscape of insurance fraud detection by providing insurers with powerful tools to analyze data, identify patterns, identify fake verifications, and uncover fraudulent activities more efficiently than ever before. By leveraging AI technologies such as anomaly detection, predictive modeling, NLP, image recognition, network analysis, and real-time monitoring, insurance companies can stay one step ahead of fraudsters and protect their bottom line.

Fight Frauds with Arya AI

At Arya AI, we're committed to revolutionizing the fight against fraud with our cutting-edge AI-powered solutions. Our comprehensive suite of APIs is designed to tackle various types of insurance fraud, ensuring that businesses can safeguard their operations and protect their customers' assets with confidence.

Our Financial APIs verifies the financial credibility of claimants, ensuring legitimate claims and minimizing the risk of fraudulent payouts. Identity Verification APIs validate the identities of policyholders and claimants, identity theft and unauthorized access to insurance benefits. As deepfakes become a growing concern in fraudulent claims, our Deepfake Detection API employs advanced AI algorithms to detect manipulated or synthetic media.

Arya AI provides many other features to help you build robust systems for your insurance company. Connect with our team to learn how our tool can help you combat insurance fraud.

Conclusion

Insurance fraud continues to cause huge losses to insurance companies and customers worldwide. By investing in anti-fraud technologies, you can recognize fraudulent activities and safeguard your business. AI-powered fraud detection tools can verify your policyholders, streamline the claims process, and tackle fraud-related risks without any hassles.