TL;DR:

- EDD delves deeper than standard Customer Due Diligence (CDD), analyzing customers' financial behavior, transaction history, and connections to high-risk activities.

- It requires more comprehensive information, including corporate records, ownership details, and media checks.

- By evaluating the source of funds, monitoring transactions, and employing adverse media checks, EDD minimizes financial and regulatory risks, safeguarding institutions from fraud and money laundering.

- EDD supports adherence to AML regulations, protects the institution’s reputation, and builds customer trust by ensuring a secure and transparent onboarding process.

- Leveraging AI tools like Arya AI enhances risk profiling, fraud detection, and ongoing monitoring to tackle emerging threats like synthetic identities and deepfake.

Onboarding high-risk clients without proper due diligence can expose organizations to financial risks, including money laundering, fraud, and regulatory penalties. Implementing enhanced due diligence (EDD) can make all the difference and safeguard banks from potential legal and financial risks.

Identifying potential fraud or suspicious activities linked to high-risk entities is challenging with traditional verification methods. This is where Enhanced Due Diligence (EDD) comes into play, providing a deeper, more thorough assessment.

This guide will explore the role of EDD in today’s banking sector and offer insights into best practices for implementing robust due diligence in the AI era.

What is Enhanced Due Diligence (EDD)?

Enhanced Due Diligence (EDD) is a risk assessment tactic that financial institutions use to identify and mitigate high-risk activities. It’s an extension of Customer Due Diligence (CDD) but goes deeper to ensure institutions thoroughly assess clients with a higher risk.

EDD delves into the customer's financial behavior, transaction history, and potential connections to high-risk activities. This process becomes more critical when dealing with high-net-worth clients, politically exposed persons (PEPs), or clients who operate in regions with a history of financial crime.

Generally, enhanced due diligence is conducted on:

- Politically exposed person (PEP): Banks must perform EDD when dealing with high net-worth individuals, non-resident customers, or those who may be subject to economic sanctions. For example, a bank dealing with a foreign ambassador would examine the individual’s financial history, source of wealth, and potential ties to corruption or illicit funds.

- Clients from high-risk jurisdictions: A financial institution onboarding a client from a high-risk country would perform EDD by scrutinizing all relevant transactions, verifying the legitimacy of funds, and closely monitoring for money laundering activities like structuring.

- Customers whose country of origin lacks sufficient AML/CFT systems, have high levels of corruption, international sanctions, and those supporting terrorist activities.

- Customers running cash-intensive businesses where the company’s ownership structure is unusual, excessively complex, or opaque: Banks may conduct EDD in cases where the company has nominee shareholders or shares in bearer form or may conduct business relationships in unusual circumstances or unexplained geography.

EDD Requirements: Why is Enhanced Due Diligence needed?

According to FATF’s Recommendation 19, all FATF members must conduct EDD measures on “business relationships and transactions with natural and legal persons, and financial institutions.

Performing EDD empowers banks and other financial institutions to engage with legitimate clients. Additional benefits of enhanced due diligence include:

- Mitigating financial risks: Understanding the source of funds and transactional behaviors of high-risk clients minimizes the likelihood of engaging with illicit actors.

- Ensuring regulatory compliance: Anti-money laundering (AML) regulations require financial institutions to implement EDD as part of their compliance framework. Non-compliance can result in hefty fines, reputational damage, and criminal charges.

- Protecting reputation and trust: A bank’s reputation suffers even if it is indirectly linked to financial crimes. EDD helps protect institutions and preserves customer trust.

What is EDD in Banking?

Enhanced due diligence is a critical part of anti-money laundering (AML) practices for banks and financial institutions as banks have to assess clients based on their risk appetite.

Banks use EDD to examine high-risk customer’s financial transactions. Implementing EDD empowers banks to demonstrate to regulators that they have risk protection measures in place, are actively monitoring risks, and are capable of identifying suspicious activities.

What is the difference between CDD and EDD?

While Customer Due Diligence provides an initial layer of security, EDD dives deeper into the customer's financial dealings, associations, and sources of income.

EDD requires documentation beyond what is gathered during CDD, such as corroborative documents, media reports, and detailed financial statements. As opposed to CDD, EDD might require information not only from the customer but from third-party entities as well. This may include:

- Banking information

- Information on relationships with other financial institutions

- Information about board members and beneficiaries

- Official corporate records from the company’s management

Common differences between customer due diligence and enhanced due diligence include:

Enhanced Due Diligence Checklist: Rundown of the EDD Process

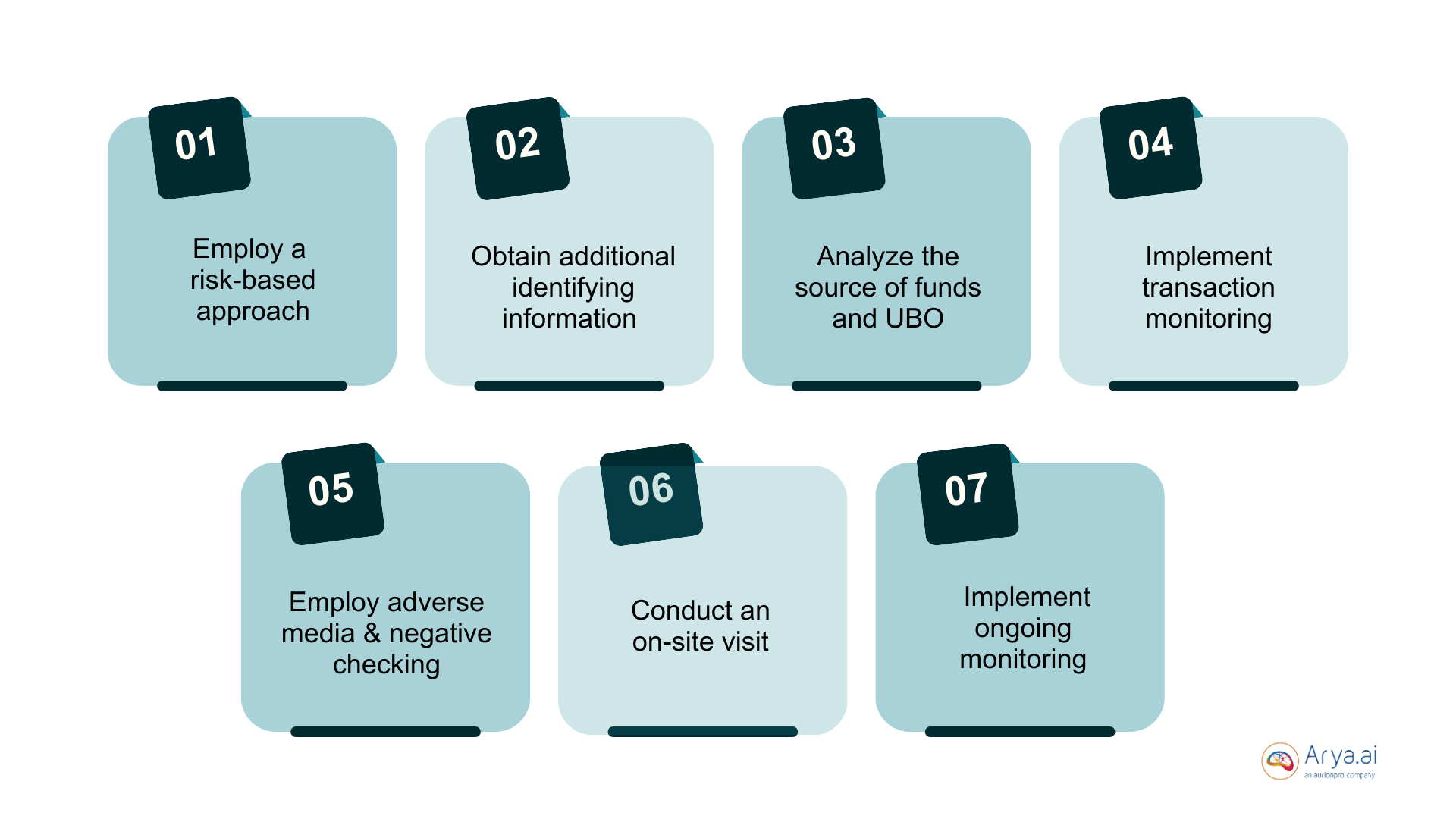

The EDD process generally involves several steps that institutions follow to ensure compliance with regulatory standards and mitigate potential risks.

Step 1: Employ a risk-based approach

The EDD process starts with customer verification and determining if they may pose a higher risk based on their jurisdiction, customer type, spending habits, transaction size, and political exposure. Customers who appear high-risk will undergo further investigation.

Step 2: Obtain additional identifying information

As an extra layer of scrutiny, collect more information from high-risk customers such as:

For Businesses and other legal entities:

- Identity of board members and beneficiaries.

- Registration documents from the local Registrar of Companies.

- Official corporate records from the company’s management.

- Articles of incorporation, partnership agreements, and business certificates.

- Names and locations of customers and suppliers.

- Banking information and relationships with other financial institutions.

For Politically Exposed Persons (PEP):

- Title and details on the position the PEP holds or held in the past.

- If the PEP is a close associate or family member, their identity, title, role, and level of proximity to public office should be established.

Step 3: Analyze the source of funds and ultimate beneficial ownership (UBO)

Scrutinize the source of wealth of individuals, companies, and companies’ beneficial owners, and verify its legitimacy. As a next step, assess information on business relationships, understand ownership structures, and vet the details of high-value transactions.

If inconsistencies are found in the earnings, source of funds, and customer’s net worth, collect extra information on shares, salary, bonuses, investments, dividends, assets, property, and inheritance.

Step 4: Implement transaction monitoring

Evaluate all available customer transaction history such as the background, purpose, nature, and duration of the transaction. Vet all parties involved in the transaction.

Step 5: Employ adverse media and negative checking

Don’t just vet formal documents. Instead, review news articles, reports, and social media to understand your customer’s potential involvement in scandals, legal troubles, or unethical behavior.

Step 6: Conduct an on-site visit

The absence of a real address or the presence of an address that does not correspond with official documents is considered a high-risk indicator. Visit the business and conduct an on-site audit to ensure that the business exists at the stated address and operates as expected.

Step 7: Implement ongoing monitoring

Monitor and update customer information according to AML regulations on an ongoing basis.

Keep up with changes in sanctions lists to update customers’ risk profiles regularly and perform sanctions screening during the customer’s onboarding and transactions.

Conducting Due Diligence in the AI Era

Conducting due diligence is becoming trickier as fraudsters get smarter with AI tools.

Scammers have started using tactics like synthetic identity fraud that blends real and fake details to create a new, seemingly legitimate identity. It’s tough for banks and businesses to spot these because they look real enough to slip through traditional checks.

Deepfakes are another major issue—fraudsters use AI-generated images or voices to mimic people, making fake IDs or even impersonating someone during a verification call. Additionally, AI-driven phishing scams are getting harder to detect as they craft personalized, convincing messages.

Faced with these challenges, banks must leverage AI-based anti-fraud solutions that improve their due diligence processes to counter risks, detect scams, and protect against money laundering.

Smart Onboarding with Arya AI

Arya AI empowers financial institutions to make onboarding more resilient using AI and perform enhanced due diligence accurately. Its approach to smart onboarding streamlines the process and ensures that every aspect of EDD aligns with compliance standards.

Using the platform, financial institutions can make bespoke onboarding workflows or integrate AI APIs such as bank statement analyser, document fraud detection, corporate KYC, and global identity verification.

These tools help identify risks, detect fraudulent activities, and verify individuals and entities efficiently, allowing financial institutions to build trust and mitigate risks while maintaining operational efficiency and regulatory adherence.

Conclusion

Enhanced Due Diligence is indispensable for banks and financial institutions, especially as they navigate an increasingly digital and AI-driven landscape.

Robust EDD practices enable secure, transparent, and trustworthy banking experiences. By implementing EDD, banks can protect themselves from financial crime, ensure regulatory compliance, and preserve reputation, leading to higher customer trust and banking success.

Leveraging advanced tools like Arya AI for risk profiling, document verification, and continuous monitoring ensures banks can onboard customers and grow safely in the AI era.