Commercial banks have been juggling between knowing their customers and keeping them on a tightrope that breaks too often. The demand from regulatory bodies to be a secure place for clients enforces rules that are certainly good for society and the banks but are tiring to accomplish in themselves. In 2017, a Thomson Reuters survey revealed a $48mn expense for client onboarding. However, banks revealed that this is a deflated number with an actual number of $70mn. While it is true that banks do not create such rules, they do bear the brunt of customers ultimately ending in 6 out of 10 of them leaving the process midway. Such bumpy roads to client onboarding have moved the focus of research and innovation into converting this into a frictionless process. A result of this is the evolution of AI and fintech in the banking space, which will be explored in this post, along with their impact and future.

How does a commercial bank onboard customers?

The problem with onboarding lies within the steps that commercial banks take today. To understand the gaps in them, first, it is better to explore the steps a bank takes from lead to account creation.

- Regional manager contact: The first step is to establish contact between regional managers (which will be abbreviated as RM from hereon) and the client on a personal level. In most cases, this is done through a phone call. However, some clients prefer emails or in-person contact by visiting the managers physically in their branch. The main aim is to establish trust, identify client expectations, resolve queries, and apprise you of all the lucrative bank offers to the client.

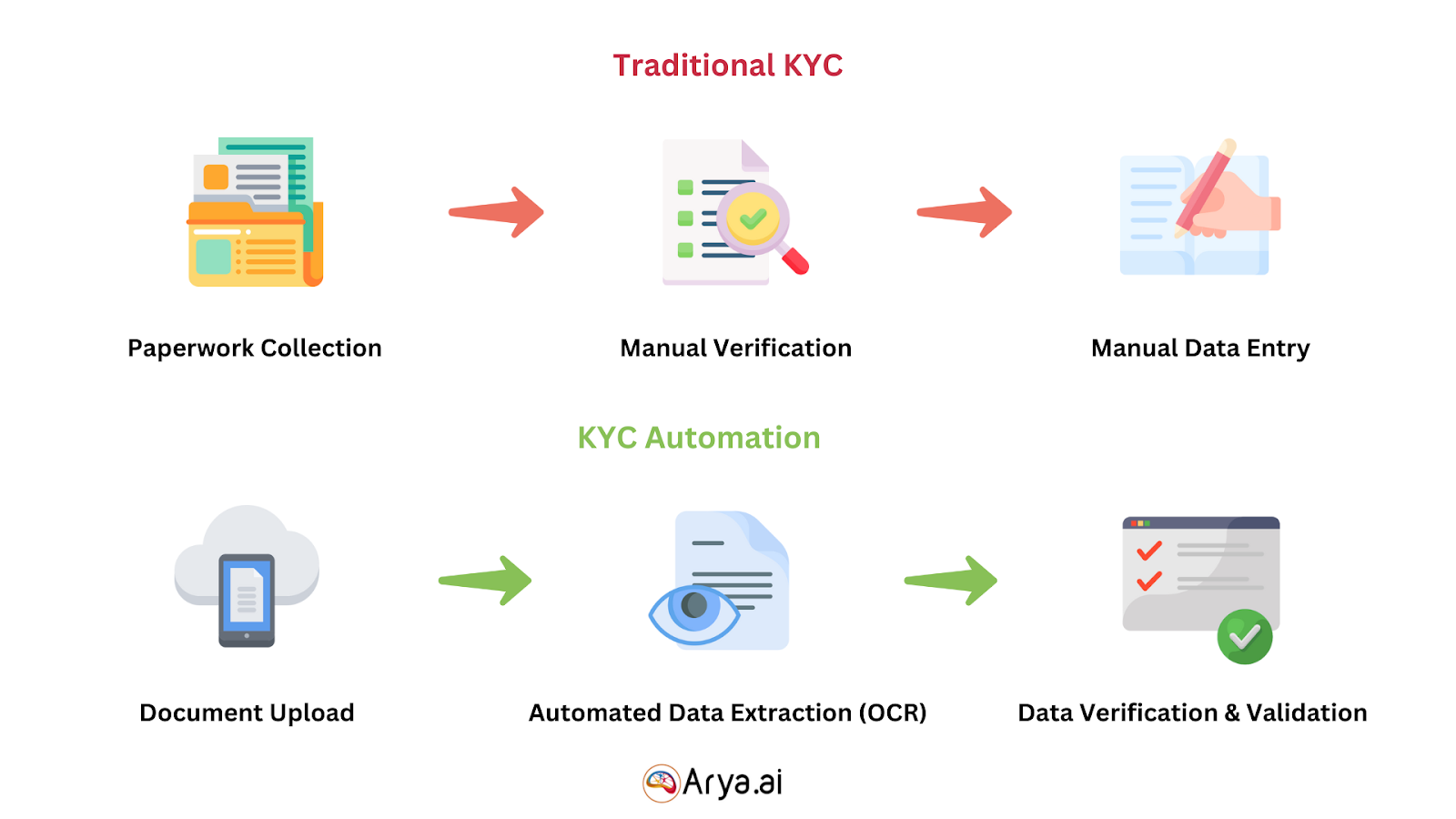

- KYC: The next step starts when the client has agreed to onboard and is ready to open the bank account. Here, the client asks for the necessary documents to ascertain their details (such as an address, company details, income details, etc.), which will help banks better understand their customers (hence KYC). This step can be achieved either digitally or by submitting physical copies of documents to the RM. Automated KYC streamlines customer onboarding in banks, ensuring efficient, secure, and compliant verification processes.

- Verification: The next stage is to verify the documents and their authenticity with Intelligent Document Processing. This is also termed “due diligence” or “background verification”. This step helps the banks plan the path that is most preferable for each client within their capacity.

- Calculating risk: Banks also have to go through processes that define the financial stability of the client and any possible risk associated with him. For instance, a missed loan payment is a sign of weak financials. Banks have to make informed decisions based on the risk associated with the client. If the client is too risky, they might even deny the onboarding.

- Legalities: Once the bank has verified the documents from their side, they send them to their legal team for approval. The legal team takes care of the verifications as mandated by the law such as criminal cases against the client. Legal approval is mandatory for each client as it affects the bank's reputation if anything goes the wrong way in the future.

- Initiate account opening process: The approval of the legal team is a green light to initiate the account opening process. The RM is responsible for this process.

- Onboard complete: The final stage of client onboarding is to issue documents (such as checkbooks or onboarding manuals) and send them to the client to finish the process.

Sometimes, small sub-steps may be expected in some banks such as “verifying onboarding completion” from the client side in which the client has to log in and complete the process from their account. Overall, the major processes remain the same though.

Why do commercial banks struggle with client onboarding?

There are hardly any instances where a client opens a bank account without necessity. Even if they do, they are pushed by marketing calls that glorify their offers with higher returns over time. In both cases, the client expects a faster process due to higher expectations and get started with the returns quickly. However, it is just the opposite case. On average, banks take around 30 days to complete the onboarding process. Collectively, it is just not about the time alone. Multiple reasons contribute to the delayed onboarding although it is true that some are more to blame than others.

1. KYC challenges

Banks perform KYC (Know Your Customer) to make sure that the client is genuine and there are no risks attached to him. It is mandated by law and if not done correctly, fines are imposed in every country with additional government resources deployed till processes are improved. Since banks are a medium of handling and transacting money, a bad client can take down the reputation of the bank by performing illegal activities such as money laundering. This is why banks have a separate sub-section called AML (anti-money laundering) where they access the AML risk with the client.

KYC is divided into three sub-steps:

- Onboarding process initiation

- Application processing

- Setting up account

i) Onboarding process initiation

The KYC process starts as soon as the client is willing to open a bank account. This entire step depends on the RM which becomes the point of contact for other teams and the client. As for the client, the RM asks for certain documents that will be then forwarded to other teams. This process is challenging in a couple of ways:

- RM cannot always predict the document lists. Due to this, they have to contact the client multiple times.

- Due to multiple contacts, duplicate data is accumulated which makes data management harder for the team.

- Since onboarding is done as a manual job conventionally, uploading all the documents on the portal one by one for each client consumes a lot of time.

But this is just the start, the main KYC issues arise when application processing is initiated.

ii) Application processing

When application processing starts, the due diligence takes place with respect to the client and the bank itself. The bank has to assess its compatibility with the client and categorize him into categories as per business needs. This process comes with its own challenges:

- Risk assessment: Assessing risk on a client’s profile is a task that requires multiple processes. Risks come as credit risk, profile risk, legal risk, etc. Having a combined risk profile is harder when it comes to manual work. Sometimes, application processing is delayed as a lot of data is missing and the client is requested to provide the data. This communication can happen over 10 times per client!

- Large document processing: There are a lot of documents that come for application processing from various departments expanding to various domains. Processing all of them is a challenging task.

- Lack of digital mediums: Having manual processes comes with the challenge of uploading everything to a digital medium. This is true for important documents such as IDs and photographs as well. While it might not seem like a challenge for a single client, it does when the same process is repeated hundreds of times in a month.

- Repeat from scratch: If a client is reached out for some document or any other processing, it can initiate the complete process from the start due to dependency issues. For instance, a certain ID has certain legal conclusions attached to it. When a new ID is submitted, it is again sent to the legal team for analysis tallying to 2x of original time.

Once this is completed, the client’s data is copied to other digital assets for all the teams that work disjointly.

iii) Setting up account

Finally, once the application is processed, the account is set up for use. The major challenges have already been overcome till this point. The only problems a team faces in this section are propagating the data to all the teams and observing client activities in the cooldown period of a few weeks. This is sometimes hard because there are many clients and if advanced technologies like AI are not integrated, automatic alerts are not received, therefore consuming the time of a banker.

Overcoming KYC issues is the hardest of all the issues faced in client onboarding by the bank. While the process can be streamlined, it is hard to be eliminated until advanced technologies are incorporated.

2. Isolated departments

Banks work in a messy environment of multiple departments. However, since banks are sensitive organizations that deal with client’s money, all these departments are kept as isolated as possible. The main idea behind this is that even if one department is compromised from internal or external sources, the whole infrastructure can be saved from suffering. But this serves as a problem in client onboarding as well in the following ways:

- Mismanagement in data collection: If two departments are kept isolated, this means that they are collecting and handling data differently. That does not necessarily mean that they cannot share data. In a few cases, data can be requested from other teams with approvals. But this process takes a lot of time!

- Frequent contact to the client: In some cases, we may find teams contacting the client multiple times (as mentioned in the previous section) due to the mismanagement of data. Client may not always be available and this back-and-forth switching can go on for weeks as well.

- Propagation of data: Lastly, isolated departments also face the challenge of propagation of data when new data is collected. In such a case, it may happen that two departments start requesting the same data unknowingly causing an increase in duplicate data in the database. This makes it even harder and time-consuming to clean when algorithms are applied on it.

Isolated departments are a necessity but poor initiation of client onboarding process is one of the major issues commercial banks face that delays the onboarding process.

3. Poor data management

Technologies have advanced at a staggering pace but banks have not been able to adapt to it at the same rate. Banks work in a lot of dimensions such as technology, marketing, sales, finances, etc. and each of those dimensions either produces or consumes the data. Relying on their conventional setups which are at least a decade old, banks’ limited resources struggle to cope with them, especially in the current world where every user action is a data point. This creates a few challenges in this space:

- Hard to clean: The poor data management of banks makes it harder for teams to clean and fetch large data into meaningful outputs. For this, multiple additional processes are applied which consume time and delays the processes.

- Frequent contact to client: As it is true to other challenges, here too teams seek to contact the client directly even if they have the data because it serves as the shortest path that quickly provides the banks what they need.

- Hurts customer experience: Contacting a client multiple times and taking too much time to accomplish a task that in a client’s eyes is “just straightforward” always hurts the customer experience. Their expectation is always more majorly due to being unaware of the back-end processes.

By exploring these three major issues that are included in client onboarding, it is clear that the processes that work as a root cannot be eliminated. Ensuring KYC and isolating the departments has to be done to ensure banks are safe for everyone. However, the problem lies in the way things are handled across various teams in a bank the impact of which has to be shared by the economy and society.

The impact of delayed client onboarding

A delayed client onboarding process can result in the following issues:

- Financial losses: KYC and AML-related issues were billed to $3.3 billion across banks. The main reason was clients backing out of the process as banks were taking too much time. This is an astronomical number considering nobody gets any returns on it.

- Customer dissatisfaction: Taking time in onboarding or any other banking service leads to customer dissatisfaction, a metric that 72% of customers keep on priority. 50% of all the customers think about changing the bank once they have an unsatisfactory experience. This is the reason that the banks that prioritize customer satisfaction grow at almost 3.2x than others. When we talk about client onboarding, the value of time for the client increases even more because they are not part of the bank yet and want the process to be completed as soon as possible and start to use their bank account.

- Competitor’s advantage: Finally, once a bank that has initiated the onboarding process starts to take more than expected time, the client may get furious and apply for an account in other banks. If these banks initiate and complete the process earlier, the client drops the application and the bank loses a potential customer. A customer loss in the bank is attributed to a long-term loss of revenue as the relationship generally goes on for a while. All this could have been saved if the bank had initially completed the client onboarding process earlier.

All these sections talk about the problem of commercial banks and their impact on banks and clients in a wholesome picture. But if we look at these problems, a lot of us may think that KYC and AML are not so challenging. Once the banks have set up their processes smoothly, made some dramatic changes to the existing infrastructure, and most of all, started to use advanced technology in the system, the process time and hassle can be reduced to a negligible point. When we combine all these, we get a simplified solution using Arya.

How AI is revolutionizing client onboarding?

The manual, time-consuming KYC process is now revolutionized by incorporating artificial intelligence into the system along with digitalizing the complete end-to-end setup. It is true that digitalization has been a part of a bank’s onboarding system for a few years now. However, as much as 52% of banks struggle to maintain the digital overheads after implementing it in their infrastructure, as per Experian. This is true because even though the documents are digital, they still have to be evaluated by manual scrutiny, which is error-prone in many cases.Along with errors, document fraud undermines trust and security, posing significant risks to individuals and institutions.

Artificial intelligence has the ability to process all the digital data in the intended direction and make sure that minimal or no human intervention is required. The trained models can perform KYC extraction, face liveness detection, signature verification, document fraud detection and collect and clean the data fetched from multiple sources to generate a lucid profile for all team members. Moreover, AI can also be integrated as a chatbot for clients and bankers resolving queries using natural language processing rather than generating multiple tickets that floats from one team to another for days. The power of artificial intelligence brings down the client onboarding process to a maximum of 2 days where the first 30 minutes are taken by AI and the rest of the time is left for manual approvals. This is why 77% of bankers today believe that leveraging AI will differentiate winning banks from losing banks.

Improving client onboarding with Arya AI

One of the major areas where banks have not been able to cope is technology. While you may agree that banks have improved their UI and security factor at the first level (the application layer at the user level) significantly, the back end remains more or less the same. Why invest so much money when the user wouldn’t even notice it? Unfortunately, stale technological infrastructure has started to show its effect and eat up a lot of valuable time for the clients. Today, banks are at a stage where they are losing the race to new FinTech applications. They do not have time to dispatch resources and transform their infrastructure as compared to these new technologically advanced applications. However, what they can do is take help from companies like Arya that can integrate into the system and bring technologies like artificial intelligence within one day.

1. Document Fraud Detection

Utilizing advanced AI and deep learning technologies, Arya AI Document Fraud Detection meticulously analyzes and verifies documents, ensuring authenticity and integrity. This powerful tool helps businesses, financial institutions, and individuals safeguard against fraudulent activities by detecting anomalies and discrepancies in real-time.

This App can distinguish authentic documents from tampered ones, guaranteeing the trustworthiness of crucial information across various applications.

Read now- How lenders can leverage AI-powered document fraud detection systems?

2. Automated KYC Extraction

KYC is a process followed in various institutions, especially financial ones, to verify the identity of a client and affirm whether the client is genuine and reliable or not. One software that can eliminate the issues discussed above associated with delayed onboarding is Arya. With its simple-to-use KYC Extraction App, any type of ID card can be scanned and verified for KYC. The tool can be integrated into your system and fetch information with 95% accuracy.

What this integration does is reduce the time for KYC verification to a significantly lower number. The verification is real-time and based on an intelligent classification mechanism providing a boost to the efficiency of the bank’s systems and minimizing the wait time for the client.

3. Face verification using AI

Arya’s Face Verification AI model is one of the most efficient face verification software available. It is trained on a large data set providing a mechanism to ensure that the user you are seeing is the same as the user on the identification card. One of the best use cases for this feature in client onboarding is to promote KYC submission, initiation, and verification from an offline to a completely online process. With Arya’s integration, banks can make the account opening process online without worrying about someone impersonating in place of the user.

4. Signature detection

Detecting the accuracy of signatures is an important part of document verification. A false verification may lead to bank fraud not only once but till the time signature mismatch is identified. This process relies on manual verification as of now but manual identification is error-prone and may increase the risks for the banks. Arya AI Signature Detection works extensively on analysing any given image to localise and extract snippets of signature present at any location.

Arya is also capable of removing noise from the signature areas and making the signature clearer for identification through artificial intelligence.

Arya Apps are a perfect way to get ahead in the race of acquiring customers and enhancing their satisfaction without investing millions in the infrastructure. The company keeps evolving every day enhancing model accuracy and acquiring more and more training data for better results.

Conclusion

Client onboarding is a process that requires combined work from multiple teams that make sure the client is genuine, reliable, and of course, will bring business to the bank. However, as per the current scenario, it is the most painful process to get stuck in. It takes time, costs money, and brings dissatisfaction to the clients. The most identifiable issues are delays in KYC, verifying identity, and mismanaging data properly across various departments.

While it is true that banks have not been able to cope with advanced back-end technology, this does not mean they will be left behind forever. If they take the right steps in the correct direction, they can save years of work and other resources within minutes. This is where Arya AI plays a pivotal role in shaping the commercial bank’s client onboarding process. They bring their expertise in artificial intelligence that can perform KYC extraction, face validation, and signature detection just through an App call. It is fast, secure, efficient, and most importantly, accurate in its work. Commercial banks can make a significant jump and compete shoulder to shoulder with FinTech apps with third-party tools and its effect will be seen on society as a whole as no one would have to wait 40-120 days just for opening an account in any bank.