Financial institutions are increasingly turning to cutting-edge AI technologies to optimize their operations and enhance customer experiences. AI is reshaping customer onboarding, shifting from from traditional, error-prone manual steps to seamless digital processes.

Traditional onboarding involves face-to-face meetings, paper forms, and physical verification of documents, often leading to errors and time-consuming delays. During the COVID-19 pandemic, 63% of European customers have abandoned onboarding due to its complexity and time demands.

As consumers embrace a digital lifestyle, businesses can leverage AI to bring in new customers without in-person interactions. This blog shows how AI is revolutionizing digital onboarding, giving insights into the technologies driving this change and the benefits they bring to the BFSI sector.

What is Ai in Digital Onboarding for Financial Institutions?

Digital onboarding is the process of bringing new customers or clients into the financial institution’s system through online channels. This includes everything from the initial interaction with the customer, collecting and verifying their data, completing compliance checks, and setting up accounts - all done through online platforms or mobile applications.

Digital onboarding streamlines tasks such as data collection, identity verification, and compliance, making the entire process more efficient and user-friendly. For example, instead of visiting a branch and filling out multiple forms, a customer can upload their documents online, which are then automatically processed and verified by advanced algorithms.

The Role of AI in Digital Onboarding

With AI technologies, financial institutions can streamline the digital onboarding process, enhance security, and provide a superior customer experience. The following are some of the AI technologies that makes digital onboarding faster, accurate and secure:

AI-Powered Data Analysis and Verification

Data analysis has always been a strongpoint for AI. It helps financial institutions to efficiently process and verify large volumes of data, minimizing manual intervention and reducing the likelihood of errors.

- Intelligent Document Processing (IDP): Modern AI systems employ Intelligent Document Processing (IDP) to extract and validate data from various documents, including Government-issued IDs, address proofs, and bank statements. IDP uses Machine Learning (ML) models and Natural Language Processing (NLP) to interpret and extract relevant information from structured and unstructured data sources.

- Automated Data Validation: AI algorithms automatically validate the extracted data against predefined rules and external databases. For example, algorithms can cross-check addresses against postal services or verify IDs with government databases, reducing the risk of document fraud and compliance issues.

Deep Learning for Risk Assessment and Fraud Detection

By analyzing vast amounts of data, DL models can identify patterns and anomalies that may indicate fraudulent activity or potential risks.

- Real-Time Data Analysis: ML algorithms continuously analyze transaction data, behavioral patterns, and historical records to detect suspicious activities in real time. Platforms use ML techniques to monitor and analyze transactions to find potential fraud before it occurs.

- Predictive Analytics: Predictive models leverage historical data to forecast future risks. This helps financial institutions proactively manage potential threats.

- Anomaly Detection: Techniques like clustering and anomaly detection are employed to identify unusual patterns that deviate from normal behavior. These methods are crucial for detecting even the most advanced fraud schemes.

Natural Language Processing (NLP) for Chatbots and Virtual Assistants

In digital onboarding, NLP-powered chatbots and virtual assistants enhance customer interaction and support, providing a seamless and efficient onboarding experience.

- AI-Powered Chatbots: Chatbots with NLP capabilities can handle initial inquiries, guide customers through the onboarding process, and answer frequently asked questions. These chatbots, understand and respond to natural language inputs, giving personalized assistance 24/7.

- Virtual Assistants: In BFSI, virtual assistants can help customers complete onboarding tasks, provide information about products and services, and assist with troubleshooting.

Biometric Authentication and Security

AI-driven biometric technologies, such as facial recognition and fingerprint scanning, which are already available on smartphones, offer better security to the financial institution, while making digital onboarding convenient for the user.

- Facial Recognition: Face Verification systems use deep learning algorithms to analyze and match facial features with stored images. These systems provide a high level of accuracy and security, so only legitimate users can access accounts and complete onboarding processes.

- Fingerprint and Voice Recognition: Fingerprint and voice recognition technologies use unique biological traits for authentication by analyzing and matching fingerprints or voice patterns against stored templates. Audio deepfake detection tools helps recognize tampered voice, ensuring security and fraud prevention.

- Behavioral Biometrics: Behavioral biometrics analyze patterns in user behavior, such as typing speed, mouse movements, and navigation habits, to verify identity. AI systems use machine learning to create behavioral profiles, detecting anomalies that may indicate fraudulent activity.

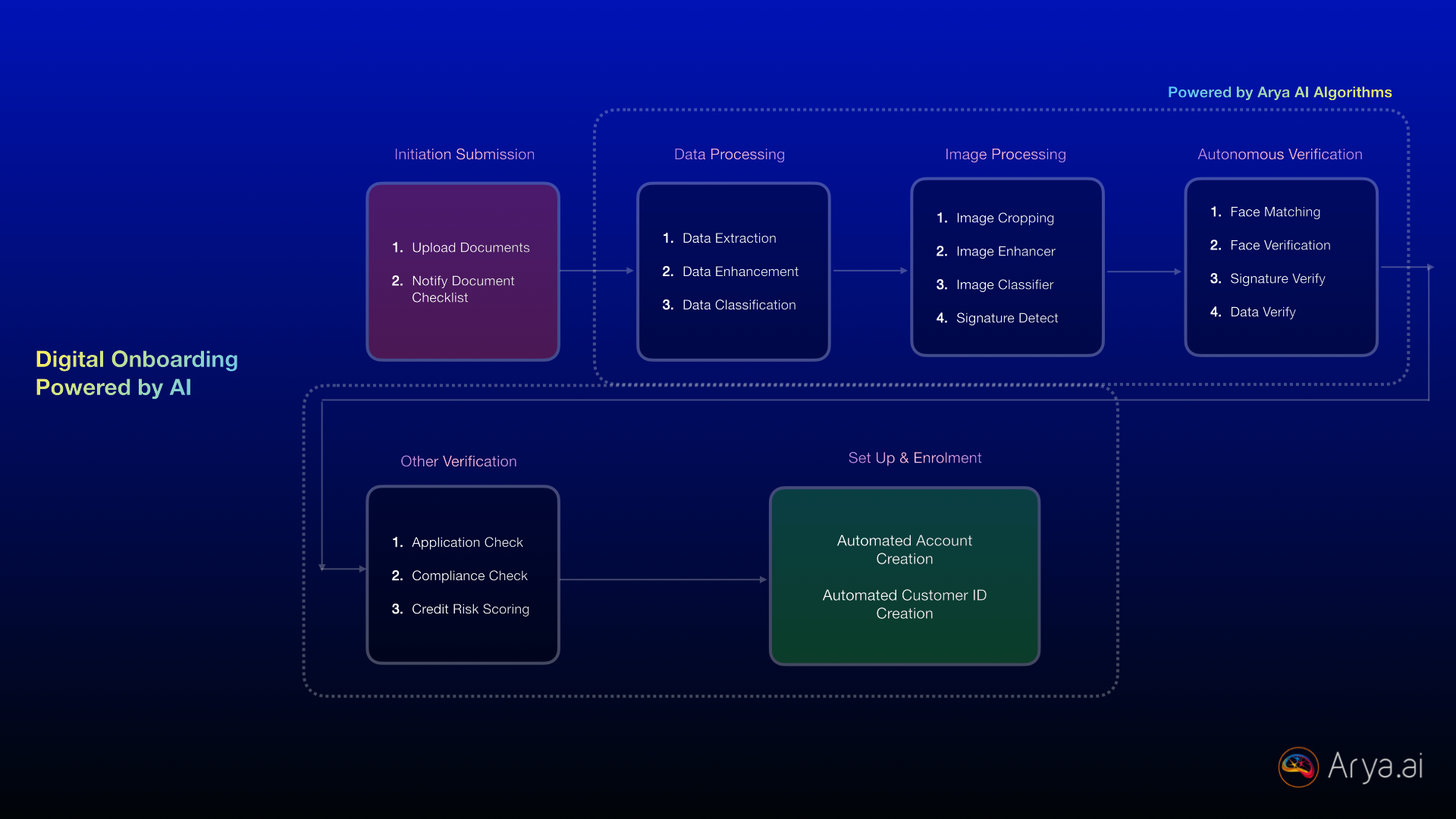

Digital Onboarding Process Powered by AI

Step 1- Initiation Submission

- Upload Documents: The onboarding process begins with customers uploading their identification documents. AI algorithms, particularly those powered by deep learning, can handle various formats, including images and PDFs, so that all necessary information is captured accurately.

- Notify Document Checklist: Once the documents are uploaded, the workflow automation system provides customers with a checklist to reduce the chances of missing information.

Step 2- Data Processing

- Data Extraction: Using Intelligent Document Processing (IDP) technologies, AI extracts data from the uploaded documents. IDP leverages machine learning and natural language processing (NLP) to convert scanned images and handwritten text into structured, machine-readable data, eliminating manual data entry errors. Various Document Workflow Automation systems, are improving data extraction efficiency and easing document processing.

- Data Enhancement: The extracted data undergoes enhancement, where ML algorithms clean and standardize the information. This step ensures that the data is accurate and formatted correctly, ready for further processing. Advanced GenAI models can detect and correct anomalies in the data, enhancing its quality.

- Data Classification: AI systems, using supervised learning techniques, classify the data into relevant categories, such as personal information, financial details, and address verification. Document classification is employed to identify and categorize various types of documents, ensuring specific data and fraud prevention.

Step 3- Image Processing

- Image Cropping: AI tools, using Convolutional Neural Networks (CNNs), automatically crop images to focus on the relevant portions, such as the customer's face or specific document sections.

- Image Enhancer: The images are then enhanced using AI algorithms designed for image processing, improving clarity and readability. This is particularly useful for low-quality scans or images taken in poor lighting conditions. Techniques like super-resolution can be applied to increase the resolution of images.

- Image Classifier: AI classifiers, using deep learning, categorize images based on their content, such as identifying different types of documents (passport, driver's license, etc.). So, each document gets processed according to its specific requirements.

- Signature Detect: The system uses AI to detect and extract signatures from documents, which are crucial for verifying the authenticity of the documents and the identity of the customer. This involves specialized algorithms for signature recognition and verification.

Step 4- Autonomous Verification

- Face Matching: AI-powered face verification and recognition technology, based on Deep Neural Networks, matches the customer's face in the uploaded images with the photograph on their identification documents.

- Face Verification: In addition to face matching, the system performs a detailed face verification to ensure the image is not tampered with and matches the database records, providing an added layer of security. This involves the use of Liveness Detection algorithms to prevent spoofing.

- Signature Verify: The extracted signatures are compared with those on file using AI models trained for signature detection & verification. This helps in preventing fraud and ensuring that the documents are genuine.

- Data Verify: AI systems cross-check the extracted and processed data with external databases and regulatory watchlists to verify its accuracy and compliance with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. This involves real-time data analysis using AI algorithms for enhanced accuracy.

Step 5- Risk Verification

- Application Check: The customer's application is reviewed by AI algorithms to ensure that all information is complete and correct. This step minimizes the risk of errors that can delay the onboarding process. AI models trained on large datasets can identify common issues and flag them for correction.

- Compliance Check: AI systems perform comprehensive compliance checks, ensuring that the customer meets all regulatory requirements. This includes Know your customer elements, where AI verifies that customer identities and documentation comply with industry standards and AML regulations. KYC Automation streamlines the verification process and helps identify and flag suspicious activities.

- Credit Risk Scoring: Risk assessment models use Predictive AI to evaluate the customer's creditworthiness by analyzing their financial history and other relevant data. ML algorithms analyze patterns and trends in the data to provide accurate risk scores. This helps the bank or financial institution in making informed decisions about onboarding the customer.

Step 6- Set Up & Enrollment

- Automated Account Creation: Once all verifications are complete, AI systems automatically create the customer's account. This step includes setting up login credentials, linking financial products, and initializing services. Robotic Process Automation (RPA) can be used to automate repetitive tasks involved in account setup.

- Automated Customer ID Creation: A unique customer ID is generated and assigned to the customer, which will be used for all future interactions and transactions.

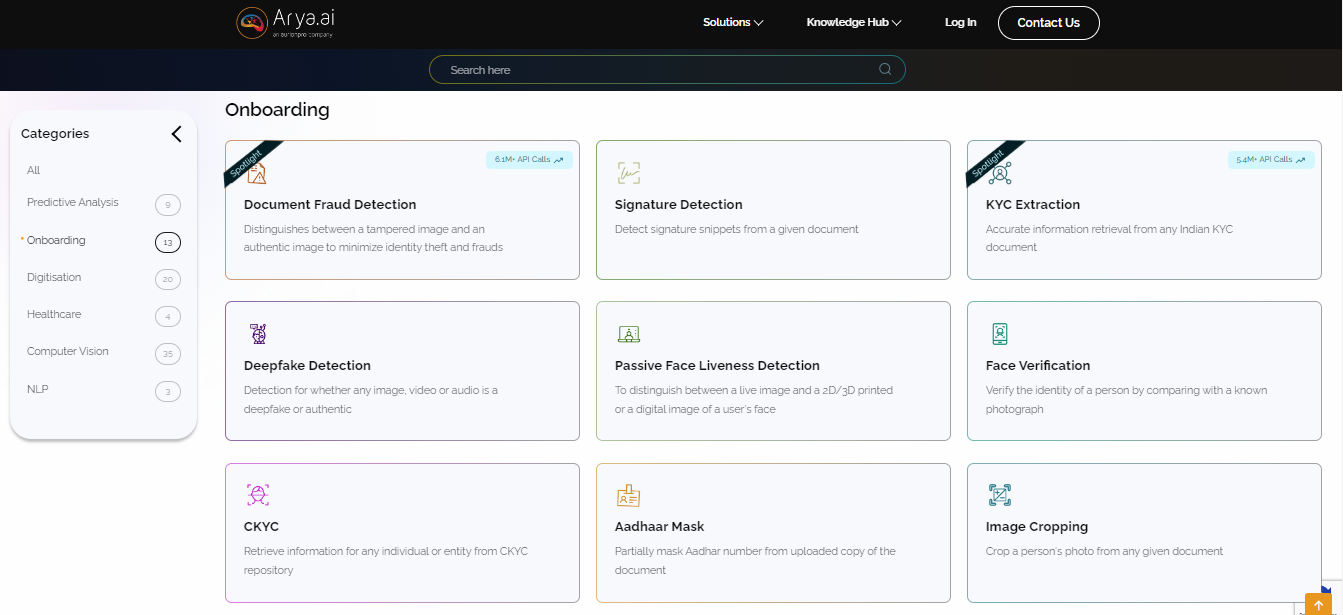

Arya AI's Cutting-Edge Onboarding Tools for the BFSI Sector

Arya AI is transforming digital onboarding in the BFSI sector with state-of-the-art AI-driven solutions designed to enhance accuracy, security, and efficiency.

With Arya AI’s advanced onboarding tools you can leverage AI to simplify and accelerate the process, ensuring a seamless experience for both institutions and customers. We offer various apps for all your digital onboarding needs, which can be used separately or clubbed together to create distinct processes tailored to your specific requirements.

- Document Fraud Detection and Signature Detection

Arya AI's Document Fraud Detection tool distinguishes between tampered and authentic images, significantly reducing identity theft and fraud risks. Complementing this, the Signature Detection tool accurately extracts and verifies signatures from documents, ensuring the integrity of the onboarding process.

- KYC Extraction and Deepfake Detection

KYC Extraction App retrieves accurate information from Indian KYC documents, while the CKYC tool integrates with central repositories for comprehensive data verification. Arya AI's Deepfake Detection identifies synthetic media, adding an additional layer of security against sophisticated fraud attempts.

- Advanced Facial Recognition and Virtual Verification

Arya AI enhances security through Passive Face Liveness Detection, which distinguishes between live images and digital or printed images, and Face Verification, which compares a person's face with a known photograph. These tools, combined with Virtual Verification for remote identity checks, streamline the onboarding process while maintaining high security standards.

- Specialized Tools for Comprehensive Data Handling

Arya AI's suite includes specialized tools like Aadhaar Mask, which partially masks Aadhaar numbers to protect privacy, and Image Cropping for automated photo extraction from documents. The Pan to GST tool retrieves GSTIN linked to a particular PAN, and the Passport Reader extracts information from passport MRZ codes, facilitating seamless and secure data handling.

By integrating these sophisticated AI tools, Arya AI enhances the accuracy and security of digital onboarding and significantly improves your customers’ experience, making the onboarding process faster and more reliable.

Conclusion

Digital onboarding has witnessed a significant boost in the BFSI sector. By integrating AI-powered solutions, your organization can offer a seamless, secure, and efficient onboarding experience that meets the evolving needs of your customers. From automated data collection and intelligent document processing to personalized customer engagement, AI is enhancing every step of the customer’s journey.

With a suite of advanced solutions for document verification, fraud detection, KYC compliance, and more, Arya AI’s onboarding tools empowers your business to mitigate risks, improve accuracy, and deliver exceptional customer experiences.

Financial institutions that embrace these technologies will stay ahead of regulatory demands and security threats while also building trust and loyalty among their customers. The future of digital onboarding is ever-changing, but with Arya AI’s innovative solutions, BFSI institutions are well-equipped to navigate this journey.