Financial crimes and scams are ever-evolving, costing banks, businesses, and financial organizations a fortune and major reputational damage.

While banks and financial institutions are prey to several types of cybercrimes, such as identity theft, forgery, deepfake scams, and tax evasion, that affect these institutions in several ways, money laundering is one of the most common and problematic of them.

According to the U.S. Department of the Treasury, approximately $300 million is money laundered annually, representing around 15%-38% of global money laundering activity.

To prevent the risks of money laundering and its consequences, banks are required to comply with specific compliance guidelines and regulations, such as Anti-Money Laundering (AML) and Know Your Customer (KYC).

In this article, we'll explore the AML policy and the effective, step-by-step process for implementing and abiding by it to protect your business and financial institutions' revenue and reputation. Let's go!

What Is an Anti-Money Laundering (AML) Policy?

An Anti-Money Laundering (AML) policy is a combination of measures and a set of rules to identify and prevent money laundering risks and related offences.

AML is an international web of laws, procedures, and regulations that helps uncover and find money disguised as legitimate income. Well-framed AML policies are designed to establish structured guidelines and regulations for a company's systems to combat terrorist financing (TF) and money laundering risks.

Besides, an AML policy also helps banks and financial institutions comply with regulatory frameworks, such as Prevention of Money Laundering Act, 2002 (PMLA), making it easier to combat money laundering risks.

An effective AML policy determines AML tolerances, risk appetite, forbidden actions, unacceptable customer types, employee rights, employee responsibilities, qualifications, etc., and clearly states the company's commitment to combating money laundering.

The AML policy should be communicated to all the company's and entity's employees, and it should be approved and regularly reviewed by senior management for seamless implementation.

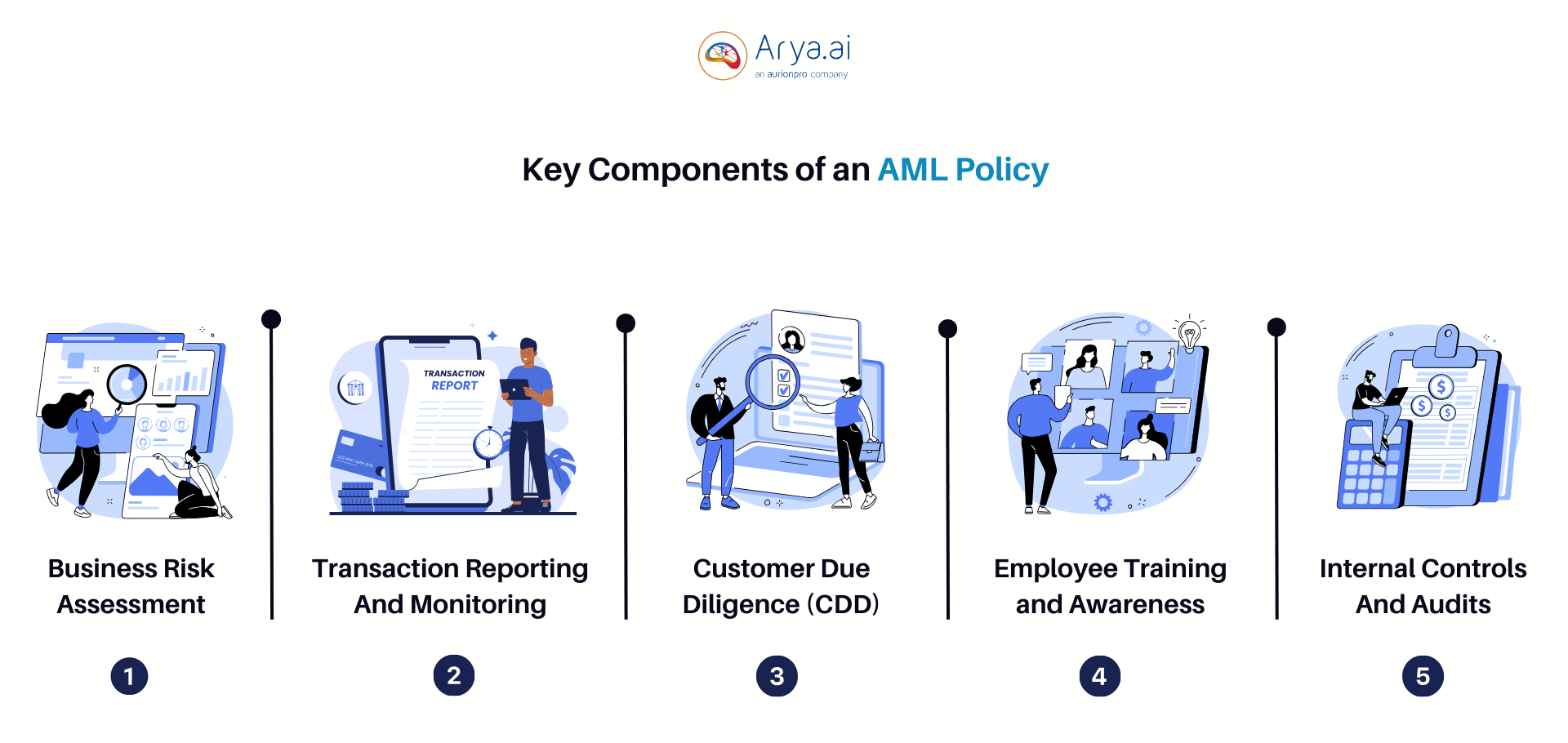

What Are The Key Elements/Components of an AML Policy?

Here are a few key components of an AML policy:

1. Business Risk Assessment

Identifying and evaluating business risks and exposures to financial crimes, such as money laundering, is critical. Hence, conducting an enterprise-wide risk assessment is paramount to evaluate specific risks an organization might face.

The organization or financial institution must define the risk identification, evaluation, and mitigation methodologies to conduct overall risk assessment.

- Risk identification involves identifying the risk's potential sources, such as customer profiles, types of products and services offered, geographical locations, and transaction types.

- Risk evaluation involves assessing the likeliness and potential impact of risks. For instance, assessing high-risk customers, potentially exposed persons (PEPs), or customers from countries with weak AML regulations.

- Risk mitigation involves developing strategies, such as enhancing higher-risk clients' due diligence or additional risk monitoring to mitigate money laundering risks.

The AML policy must consist of business risks' periodic review and their significance in driving the AML framework.

2. Ongoing Transaction Reporting and Monitoring

Ongoing reporting and monitoring of transactions and business relationships is essential to detect suspicious activities indicating money laundering.

A company's or bank's AML policy must include systems and procedures that indicate the implementation of transactions and customer behavior monitoring, threshold monitoring and suspicious activity reports (SARs) to identify anomalies or suspicious activities.

Moreover, the company or the bank is also required to provide details about the ongoing reporting and monitoring program along with regular reviews to ensure their accuracy and relevancy.

3. Customer Due Diligence (CDD)

A company's AML policy must contain detailed information about the Customer Due Diligence (CDD) process, which helps ensure that the bank or organization knows its customers and their financial activities to mitigate risks of money laundering.

CDD includes customer identification, verification, KYC, and more processes, which should be covered in the AML policy.

- Customer Identification Program (CIP) involves verifying the customer's identity with details, such as their name, address, date of birth, identification documents and government-issued ids before establishing a business relationship.

- Know Your Customer (KYC) processes involve understanding the customer's business, the account's purpose, and the source of funds, which helps assess the customer's financial activity and profile consistency.

- Enhanced Due Diligence (EDD) consists of much more in-depth security for higher-risk customers, including obtaining additional information about the customer's business activities, frequent transaction monitoring, and scrutinizing funds more carefully.

4. Employee Training and Awareness

A company's employees, especially those with customer-facing roles, need to be aware of AML risks and recognize suspicious activities. Employee training must cover the basics of money laundering, importance of the AML compliance, specific procedures to follow, updates with the changing AML regulations, and specific role-based training levels.

The AML policy should contain all these details about employee training, including the necessary topics and sessions, the mode of training, and making it mandatory for all employees to attend.

5. Internal Controls and Audits

An internal controls and audits system is necessary to ensure the effectiveness of the AML policy and identify and fix any weaknesses or gaps.

For instance, these internal controls might include segregation of employee duties, regular reviews of customer accounts, and approval hierarchies for large transactions—ensuring these processes work efficiently.

These regular audits, by either the internal or external teams, assess the effectiveness of monitoring systems, the adequacy of AML frameworks, and the overall compliance with AML regulations, which helps ensure that the AML policies are followed and implemented correctly.

Thus, through translation monitoring, customer due diligence, and identifying and reporting suspicious activities, AML policies and programs can help prevent and combat financial offenses, such as terrorist financing and money laundering.

Why are AML Policies Important?

An AML policy plays a key role for businesses and banks in putting forth measures and systems that identify and prevent unauthorized transactions. Fraudsters and cybercriminals are always on the lookout for new ways to gain illegitimate funds—ultimately hurting the institution’s revenue, economy, and financial integrity.

This also makes it difficult for banks and financial enterprises to stay in business. Besides, mitigating and addressing the damages caused by money laundering risks requires extra time and money, interfering with normal business operations and efficiency.

The primary purpose of AML policies is to detect and report suspicious and illegal activities that try to obtain illegal funds; and ultimately protect business operations and economy while maintaining trust and financial reputation. Here are a few more reasons that make AML policies important for companies and financial institutions:

- It helps detect and prevent criminal activities, such as finance terrorism, money trafficking, and corruption—thereby allowing companies to gain a competitive edge by preventing imbalance in the economy.

- It helps maintain a company's financial systems' integrity and save money, thereby preserving trust and stability.

- It helps organizations comply with AML laws and regulations, which, if not done, can result in legal penalties, sanctions, hefty fines, and reputational damages.

- It helps enhance and build customer trust, assuring them that the company or bank is committed to ethical practices and security measures, such as AML.

Steps To Implement An Effective AML Policy

Reliable AML policies and their implementation are essential for banks and financial institutions that are at higher risk of money laundering.

Here is a step-by-step guide to implementing AML policies for banks and financial institutions-

1. Understand the AML/CFT Regulatory Requirements

Researching and understanding the AML laws and regulations applicable to banks, businesses, and financial institutions based on the industry is critical before imposing these regulatory frameworks onto existing systems.

These regulations may include local, national, or international laws, such as the EU Anti-Money Laundering Directives, the USA PATRIOT Act, and the Financial Action Task Force (FATF) recommendations.

Engaging with compliance and legal experts to interpret the regulatory requirements and understand the industry's best practices to enhance the AML policy helps ensure that it aligns with all the necessary legal requirements.

2. Conduct Business Risk Assessment

Banks and businesses need to conduct thorough business risk assessments and assess specific money laundering risks associated with the business's products, geographic locations, services, customer types, and transaction channels.

Once the risks are identified, the risk assessment process also involves evaluating the risks and categorizing them based on the risk levels, such as low, medium, or high, depending on their likelihood and potential impact.

This assessment makes it easier for companies to identify ML/FT risk exposure and develop strategies that help prevent and mitigate these risks.

3. Draft An AML Policy Statement

The next step is creating and drafting a tailor-made AML policy that considers the business's size and nature.

The AML policy must be easy to understand, practical to implement, clear and concise, and should include the following:

- The importance of the policy and its implementation

- Money laundering and terrorist financing definitions

- Commitment to the company's KYC procedures

- Commitment to the company's regular audits and review practices

- Employee AML training procedures and importance

- Company's values and cultures with respect to financial crime prevention

A tailored and clear AML policy makes its implementation even more seamless and easier for banks and other businesses.

4. Appoint An AML Compliance And Money Laundering Reporting Officer (MLRO)

Defining designated roles and responsibilities and appointing a senior staff as a Money Laundering Reporting Officer (MLRO) and AML Compliance Officer (AMLCO), responsible for overseeing the AML programs and controls, ensuring ongoing compliance, and reporting suspicious activity reports (SARs) is essential for banks and businesses.

Companies and banks must also establish an AML team, depending on the size of the organization. The AML team should be responsible for supporting the AMLCO and MLRO and include key members from the compliance, legal, finance, and operations teams.

By clearing defining and documenting key responsibilities of the staff and employees, banks and businesses can ensure accountability towards mitigating and preventing money laundering risks.

5. Develop Customer Due Diligence (CDD) Processes

Customer Due Diligence (CDD) procedures involve verifying the identity of new customers, collecting and verifying their identity documents, and assessing the criminal risks they present—which is all included in the Customer Identification Program (CIP).

CDD also includes meeting and implementing Know Your Customer (KYC) requirements to understand their business, transaction behavior, and source of funds.

It's also important to set up procedures for ongoing monitoring of customer behavior and transactions to help detect deviations from expected behavior and determine the extent of CDD measures needed to implement them on the customer based on their business type, transaction pattern, and more.

Accordingly, banks and businesses can then determine whether a customer requires customer due diligence, simplified due diligence, or enhanced due diligence, which involves defining additional measures for higher-risk customers.

6. Perform Client Identity Verification

Besides CDD, banks and financial institutions must also define and set up comprehensive measures to verify the identity of their customers efficiently and accurately upon registering a new service or opening a new account.

Here are the critical identity verification checks that need to be implemented:

- The types of documents and information a customer needs to provide during customer verification depend on their background, business type, and risk level.

- Stating the means through which the customer data would be verified, including manual, biometrics, AI identity verification, etc.

- Stating the customer verification checks time limit and waiting period terms, including transaction restrictions for unverified accounts.

- Stating the measures required during situations where the customer cannot be verified, such as blocking customers, restricting account opening, and limiting transactions.

Depending on the customer type, defining such statements and measures for customer verification makes the process much more accurate, efficient, and secure.

7. Implement Reporting And Ongoing Monitoring

Performing transaction and ongoing behavior monitoring are essential elements and factors of a successful AML policy implementation.

Developing or investing in automated systems that help facilitate real-time transaction monitoring and flagging suspicious activities, such as unusually large transactions or deviations in transactional behavior is key to ensure accurate ongoing monitoring.

At the same time, businesses must ensure relevant systems are in place to identify and report transactions that surpass regulatory thresholds and establish clear policies and procedures to report suspicious activities to relevant authorities.

8. Establish Documentation And Record-keeping Protocols

Maintaining records and documentation of AML policies helps banks and businesses keep track of all AML-related records and documents required during the auditing process.

Companies must define how long these records and documents must be kept while ensuring compliance with legal requirements (typically 5-7 years) and which types of records should be retained, such as transaction records, customer identification documents, SARs, or AML training records.

Moreover, it's also crucial to ensure the safety and security of these stored records from unauthorized access, keeping compliance with data protection regulations.

9. Develop Internal Audits And Financial Performance Review Procedures

Conducting internal compliance audits helps banks and businesses monitor and keep track of the company's compliance with the AML policies and update them based on the bank's risks and regulatory requirements.

These internal audits and reviews can include approval of hierarchies, regular transaction reviews, and dual control processes.

Scheduling regular internal and external audits can help banks refine and improve the effectiveness of their AML policy, find areas of weakness, and make changes and recommendations that help mitigate fraud and money laundering risks better.

Conclusion

Money laundering is a serious threat to businesses and financial firms. It involves targeting vulnerable customers and company loopholes to conduct unauthorized transactions, engage in terrorist financing, and exploit a company's financial assets.

Besides having a deep understanding of the regulatory requirements and implementing a step-by-step process and best practices to develop a robust AML policy, banks can ensure compliance with laws and regulations, mitigate financial money laundering risks, and maintain their reputation and financial integrity.

Ensuring compliance with AML starts with ensuring KYC and robust customer identification systems. Arya AI empowers businesses to combat money laundering with a suite of advanced tools, including robust APIs for seamless transaction monitoring, AI-driven document fraud detection, and comprehensive KYC and identity verification solutions.

If you're striving to improve your AML policies, you can check out our robust Apps at Arya AI, which, when integrated seamlessly within our existing systems, can help you fight financial frauds effectively!

Contact us to learn more.