Digital adoption has enabled the BFSI industry to transform processes and collect additional data. The next big phase we will see is AI-powered automated and intelligent processes. The use of AI and underwriting is given, and organizations have already explored or implemented certain models.

This blog takes a look at how deep learning as a technique can specifically help Life and Health Insurance and how it is differentiated as compared to other AI approaches for the same underwriting problem. We will also be looking at some of the use cases where deep learning can be implemented across the underwriting workflow.

As mentioned earlier, the demand to use AI is given, but the journey to deploy AI is industry specific. For example, certain industries like retail or marketing do not require much risk controls or diligence on usage of data, or even explainability. Hence, they look for more plug and play, easy to use solutions. Whereas, if you pick up the same scenario for industries like insurance, considering use cases of underwriting, claims, audit, etc., the requirements change drastically. So, there is a huge sensitivity regarding the data in BFSI - how and where it is being used.

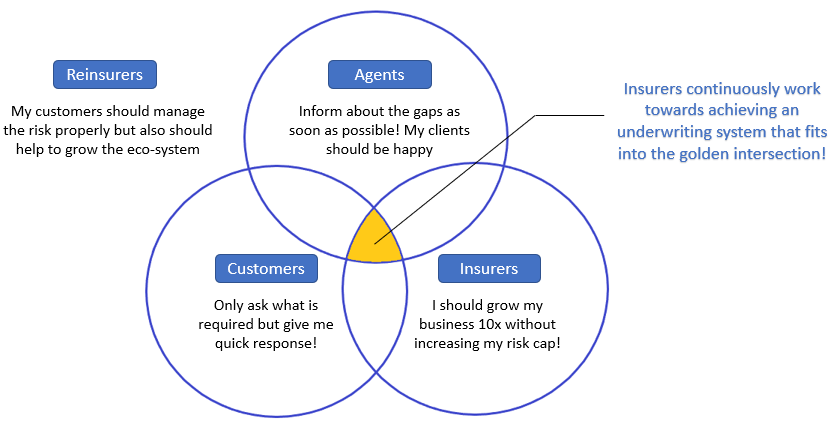

Now, let's come to the underwriting as one of the problems. underwriting is a combination of what you call it as a wish list matching of all three key critical functions - Insurer, Agent and the Customer.

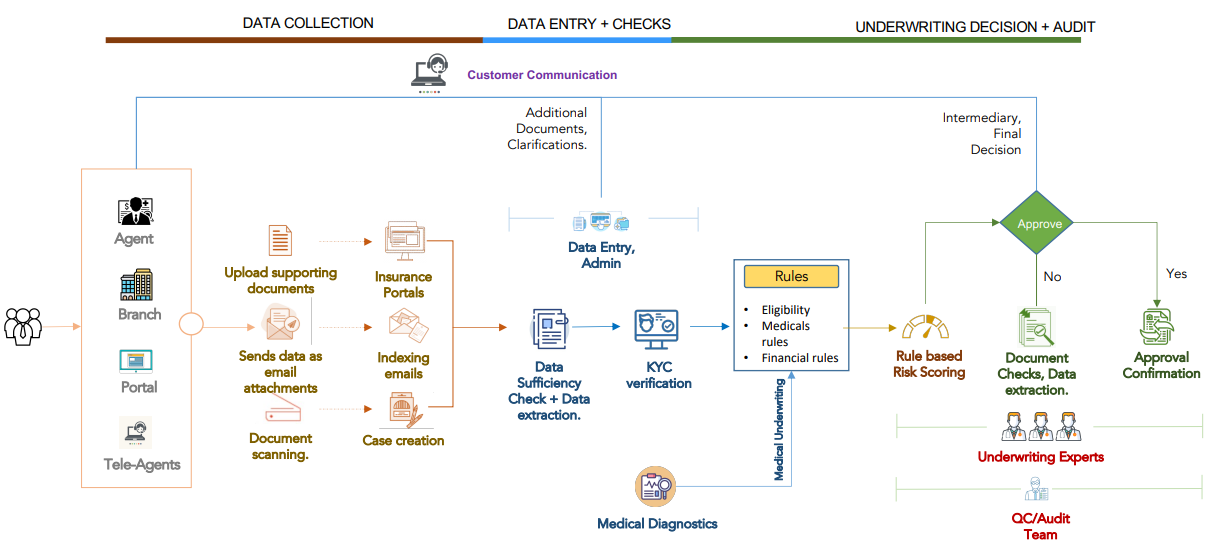

Underwriting today

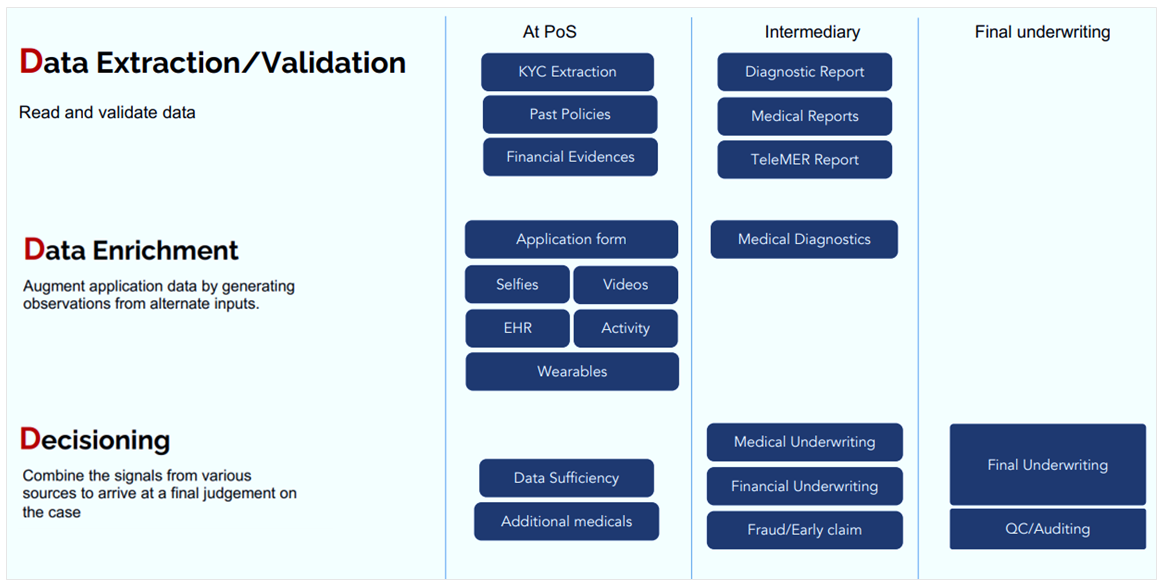

Currently, the underwriting process involves multiple tasks that involve data extraction, data enrichment and finally decisioning:

While insurers focus primarily on balancing between scale and risk, customers focus on speed and customer onboarding experience, agents focus on conversion, and reinsurers look at it from another angle.

- If there is too much focus on insurance objectives, there is less automation, and lengthy underwriting processes, since insurers may look at asking a lot of information

- If the focus is primarily around customers, then speed could be delivered, but it might have negative impacts in the book (Claims loss ratios, early claims and so on)

So the needs and wishes of all three - Insurer, Agent and Customer need to be aligned properly. This can only be possible when you use technology, because simply using the workforce is not an answer - for reasons like speed, costs, scalability, lack of technical expertise, etc. If the process is cost and time intensive, technology will have to be leveraged as much as possible, so that all of this can be achieved at an optimal rate.

Artificial Intelligence: What are the options today?

Although AI is, potentially at least, the answer for most of the problems that industry is facing, the question remains - what is defined as an ‘AI event’, because there are multiple methods that can be termed AI - one is rule based systems, which are simple ‘if and then’ rules built by an industry expert, which are the most commonly used processes. Then there are statistical models, a bit more complex than rules, but are handcrafted. And then there are the classic machine learning, deep learning and autonomous reinforcement learning methods.

Using advanced ML can help achieve better performances, higher accuracies and lower maintenance, on account of greater automation, real-time processing, and continuous learning.

Advanced ML using deep learning is based on neural network architectures. Neural networks are inspired from biological learning architectures, which have neurons. These neurons communicate to create synapses and reduce error rates in understanding a problem. So in most of the cases, these neurons can help learn patterns autonomously from the data; which in turn means that rules don't have to be written explicitly by humans, instead; the system can write the rules automatically.

Deep learning in underwriting - Use cases:

Let's look at the different use cases that can be identified or segmented for underwriting using deep learning. The use cases for AI in underwriting can be segmented into three Ds - one is data extraction and validation, second is data enrichment and third is decisioning.

Data Extraction, Validation and Enrichment

Currently most of the observation generation from the data is within the hands of the underwriters. Now, if that can be done using AI, it can actually produce a lot of observations which can be used to to underwrite more in an automated manner or in a more streamlined manner.

For example, application forms could be one of the critical areas. So, let's say you have 20 questionnaires that you are asking as part of the application. Now, during the course of underwriting, an underwriter will call the customer and ask multiple additional questions. Instead, having an AI predict what questions to ask at the point of source, will reduce the load on the underwriter, and collect alternate data which helps in improving the application quality.

Along with the application form, alternate datasets like selfies, EHR records, videos, activity data, etc. can also be collected. All this additional data provides in-depth insights on the customer, which can help underwriting systems become precise.

Decisioning

Decisioning means advanced predictions by AI, an example of which can be data sufficiency checks. When a customer is completing the application form, if an AI can predict/discern whether all data has been received or no, then the gaps can be predicted right at the source (instead of through a follow up question by an underwriter), and this information can be collected by the agents or provided by the customers directly.

Strategizing AI: Holistic view & scope mapping in Life & Health insurance

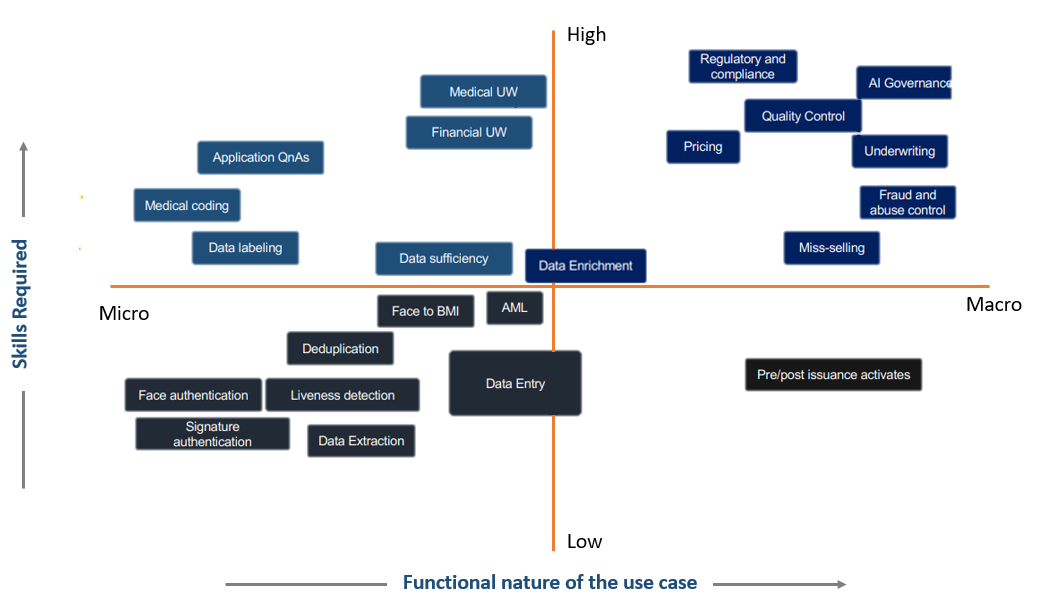

Before we figure out what kind of rollout methodology to use, we need to understand what is the background of the problems. For example, Medical underwriting, Data collection, Application QnA’s, data extraction, etc. - each of these use cases have different pre context and different impact value across different metrics, and are approached differently.

We cannot have the same AI approach to solve all these use cases, so the approaches need to vary according to the context of the use case. This can be done by categorizing them, which can be as simple as a high-skill or low-skill use case. For example, Medical underwriting is a high-skill use case, since one needs to have medical knowledge for interpreting data. Whereas, simple data extraction and checking data sufficiency can be low-skill use cases.

Another type of categorization can be micro or macro use cases. Micro use case can be a simple, one step process - an API should be sufficient. A multi-step process, which requires multiple AI functionalities or steps to achieve the end goal will be considered as a macro use case. Mapping them in a quadrant is a useful visualization:

When enterprises start using advanced ML, they can see a drastic improvement in automation rates, compared to using rule-based or statistical models since the system is more confident because of continuous learning. As more and more data comes into the same AI ML model, system performance exceeds.

This blog is the first part from our series on 'Deep Learning in Life and Health Underwriting'. Keep watching this space for the next parts on strategizing Deep Learning roll out and establishing governance & auditability of AI.