The importance of identity verification for banks and businesses cannot be overstated. Preserving their users’ and customers’ identities helps banks prevent fraud, reputational damage, financial losses, and legal penalties.

The growing concerns about identity fraud and its repercussions force financial institutions to strengthen and streamline their verification systems. While the identity verification market size is anticipated at $13.19 billion in 2024, it’s expected to grow at a 12.64 CAGR, reaching a whopping $23.49 billion by 2029.

The adoption of AI solutions and the stringent need to meet compliance and regulations form the core of the rising popularity and implementation of digital identity verification.

AI identity verification provides several benefits, like unparalleled accuracy and stronger security.

This blog provides a comprehensive guide to AI identity verification, including its benefits, challenges with traditional identity verification, and implementation and best practices for AI identity verification for a secure business.

What is AI Identity Verification?

Using Artificial Intelligence-based technologies to verify the identity of an individual is referred to as AI identity verification.

Automated identity verification is integral across several sectors, especially the financial sector, to reduce identity theft and fraud. It helps ensure secure, efficient, and streamlined identity verification for individuals.

Traditional identity verification processes involved using physical documents, security questions, PINs and passwords, and inputting access codes. However, AI streamlines these processes by eliminating human intervention and scanning documents, individuals’ faces, and patterns in no time.

From biometrics and document verification to facial recognition and fingerprint scanning, AI identity verification automates critical verification operations, boosting customer experience and curbing fraud risks.

How does Digital Identity Verification work?

Traditional identity verification processes heavily rely on physical documents, such as passports, government IDs, or driving licenses. The concerned authorities manually check these documents as scanned copies or in person with records or databases to verify the individual’s identity.

However, this manual check process is highly time-consuming, vulnerable to identity theft, and prone to errors.

On the other hand, digital identity verification uses sophisticated technologies like AI or ML to streamline and secure identity verification.

Here’s how digital identity verification typically works in four simple steps:

1. Data collection

This process includes collecting relevant user data, such as name, address, and date of birth, and biometric data, such as fingerprints, facial features, and iris scans. It can also include behavioral data, such as mouse movements and typing patterns.

The algorithm collects this data from sources like financial institutions, government databases, and social media profiles.

2. Pattern recognition

After gathering the data, AI algorithms trained on huge datasets of real and fake identities analyze the information to identify and compare patterns with already established patterns to detect anomalies and inconsistencies.

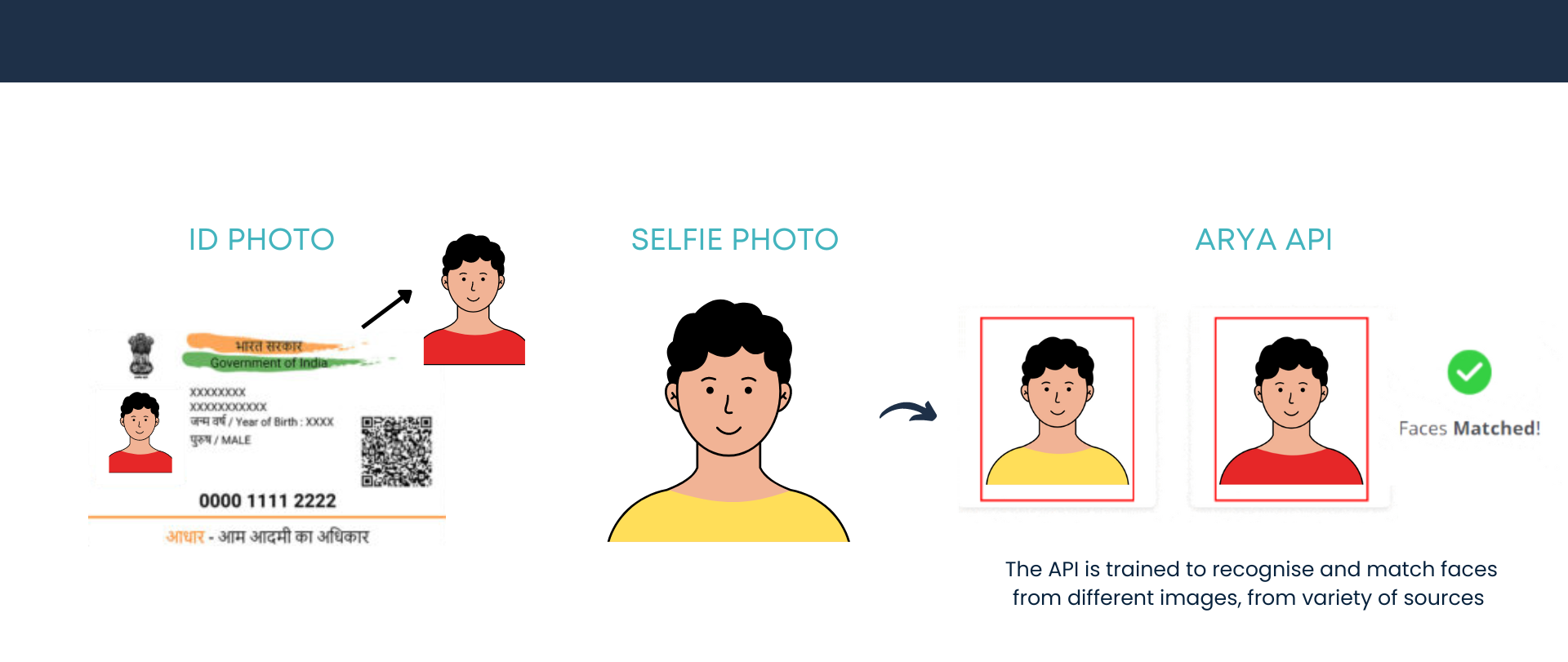

For instance, it may compare a user-provided photo with a live facial scan by analyzing features such as facial points and assigning a numerical score that reflects the match.

3. Decision-making

Based on the recognized pattern and assigned score, the AI systems then make a decision regarding whether the identity verification process is approved or denied.

This decision involves considering factors such as the consistency of the data across multiple sources, the accuracy of the data provided, and the results of the biometric verification process.

If the numerical score obtained is high, it confirms that the user is more likely who they claim to be. On the contrary, if this score is too low, the AI systems either deny access to the user or ask for additional identity proofs.

4. Additional checks

In some cases, additional verification checks are required to validate the user’s identity, which can include additional biometric verification, such as voice recognition or video chat.

These extra checks may also involve conducting manual reviews or cross-referencing the data provided with additional reliable databases.

Understanding the Impact of AI on Identity Theft

While AI can help detect and combat identity theft risks, it can also contribute to them. According to a survey conducted by Nationwide, 82% of the global population is worried about cybercriminals using AI to steal someone’s identity.

Fraudsters use sophisticated AI technology to exploit vast user data to perform breaches, steal money, and damage businesses and financial institutions’ reputations.

Here’s a breakdown of the negative impact of AI on identity theft:

- Cybercriminals use AI to automate several stages of identity theft attacks, such as scanning the internet for user’s personal information, creating synthetic user identities, and generating convincing and personalized phishing emails.

- Fraudsters can also use AI for data analysis, analyzing vast volumes of stolen data to identify patterns and loopholes in potential victims and tailor their attacks towards targeted individuals for a higher success rate.

- AI-generated deepfake images, audio, and videos are a major concern for banks, individuals, and businesses. These are created to impersonate an individual to manipulate identity verification and gain unauthorized access.

- Fraudsters can use social engineering tactics to create AI-powered virtual assistants and chatbots that mimic human behavior while interacting with genuine individuals online, tricking them into revealing sensitive information or performing actions that compromise security.

What Are the Common Methods of AI Identity Verification?

AI identity verification uses several sophisticated methods to verify an individual’s identity. Here are a few examples of these methods:

- Facial recognition: This method uses AI algorithms to analyze the user’s facial features and match them against the known faces in the database to verify user identities in the banking sector.

- Biometric verification: Beyond facial recognition, biometric authentication involves verifying biometric traits unique to specific individuals and difficult to forge. It includes methods such as fingerprint scanning, iris recognition, palm vein recognition, and voice recognition.

- Document verification: This method involves analyzing identity documents, such as passports, driving licenses, and government-issued IDs, to authenticate the user’s identity and authenticity.

- Behavioral biometrics: This method analyzes user behavior patterns and online behavior, such as navigation patterns, mouse movements, and typing speeds, to detect anomalies and fraudulent activities.

- Multi-factor authentication: MFA combines multiple identity verification methods, like fingerprint scanning, along with a one-time password sent to the user’s registered device to enhance security and avoid unauthorized access by fraudsters.

- Continuous verification: Rather than verifying user identity only at the time of login, continuous verification systems monitor users’ behavior throughout their active sessions by analyzing keystrokes and other real-time behavior to ensure consistent user identity with no discrepancies.

Why is Automated Identity Verification Necessary?

Identity fraud is increasing at an alarming rate today. Out of the 5.7 million total identity fraud and theft reports the FTC received, 1.4 million were identity thefts. At this stage, having a foolproof, secure, streamlined, and frictionless identity verification is critical.

The manual identity verification system is time-consuming, labor-intensive, prone to errors, and also doesn’t ensure satisfied customer experience.

Moreover, with the increasing volume of the customer dataset, traditional identity verification has become highly inefficient and insecure. Physically handling this data and sensitive documents leads to several risks, such as theft, loss, or forgery.

Integrating AI in identity verification not only streamlines data handling but also ensures compliance, simplifies customer onboarding and experience, improves accuracy, and ensures better security.

Need help choosing the right Identity Verification Provider? Read now- https://blog.arya.ai/top-10-identity-verification-providers/

Challenges faced by businesses for Manual ID Verification

Manual identity verification systems make banks and businesses encounter several drawbacks and challenges that hinder their productivity and lead to compromised security.

Here are some common challenges businesses face in regard to manual identity verification:

- Manual identity verification is highly susceptible to human errors, such as inaccurate data entry, misinterpretation of documents, and inconsistencies in verification processes, increasing compliance and fraud risks.

- Traditional identity verification often involves manual checks and reviews, making it highly time-consuming and labor-intensive. This results in delayed customer onboarding and an unsatisfied customer experience.

- Manual ID verification requires high operational costs and human resources to review customer documents, verify critical information, and handle customer queries, which is especially challenging for banks handling a large customer base and verification data volume.

- Traditional ID verification limits scalability, making it difficult to handle large verification requests and data volume to meet the growing business demand and scale verification operations at a larger scale.

- Besides the above challenges, manual ID verification also leads to higher security risks, including identity theft, document forgery, and insider threats as well.

- A cumbersome and lengthy identity verification process negatively impacts customer experience, resulting in customer dissatisfaction and frustration in contrast to smoother and efficient automated identity verification that streamlines customer experience.

What are the key benefits of AI ID Verification?

AI brings numerous benefits to the identity verification processes for banks and businesses, including greater accuracy and enhanced security. Let’s take a look at these benefits in more detail.

1. Enhanced accuracy

AI identity verification reduces the chances of errors by efficiently analyzing a vast amount of data accurately and integrating biometric verification systems, such as facial recognition and iris scanning.

It also much more effectively detects anomalies and inconsistencies in identity documents to flag potential fraud.

2. Faster verification

AI enables real-time and quick identity verification, reducing waiting times and enabling quicker onboarding processes, which is especially beneficial for remote transactions and online services.

3. Highly cost-efficient

By minimizing the need for manual checks and human intervention, AI identity verification turns out to be highly cost-effective.

Moreover, these systems can efficiently handle large volumes of datasets, making it easier for them to scale at a growing rate and accommodate the growing number of users while maintaining operational costs.

4. Improved user experience

Users don’t have to upload documents or other data to pass through identity verification manually.

Due to frictionless biometric authentication, automated identity verification makes onboarding seamless and efficient for customers, improving their overall experience.

5. Regulatory compliance

AI helps banks and businesses meet compliance standards and regulations, such as AML and KYC verification, audit trail and reporting, and data privacy compliance, reducing manual errors and enhancing regulatory adherence.

6. Improved fraud detection

Automated identity verification systems can easily and effectively detect indicative patterns and suspicious behavior by analyzing points such as behavior patterns, biometric information, and historical transactional data.

In addition, advanced AI systems can update and adapt their models when incorporating new insights and data, making it easier to recognize and respond to emerging threats.

Best Practices for Implementing AI Identity Verification

Implementing AI identity verification correctly is key to preventing fraud and identity breaches. Here are the best practices for implementing AI identity verification.

- Implement multiple verification methods to enhance the identity verification process’s security and reduce the risk of fraud. These methods can include integrating facial recognition, biometric verification, fingerprint scanning, etc.

- Prioritize user data privacy and security by implementing encryption to protect sensitive data, implementing secure access control systems to restrict unauthorized access, and regularly monitoring and auditing the verification system for vulnerabilities.

- Choose the right AI identity verification system to ensure the AI algorithms’ reliability and accuracy. It’s crucial to choose a solution that trains and improves itself continuously and incorporates feedback mechanisms to reduce false negatives.

- Understand and keep up with the regulatory requirements, such as data protection regulations like GDPR and Anti-Money Laundering (AML), and Know Your Customer (KYC), to ensure compliance and avoid legal penalties.

- Provide user education and support throughout the verification process by providing clear instructions and extending assistance in case they face any issues. This helps build trust within the business or financial institution.

- Regularly monitor your AI identity verification system and its performance to stay up-to-date with new technologies and requirements and update it to adapt to emerging threats and growing requirements.

- Lastly, conduct a thorough assessment and testing of your system with a diverse range of use cases and scenarios to detect and identify potential weaknesses and issues and deploy accordingly.

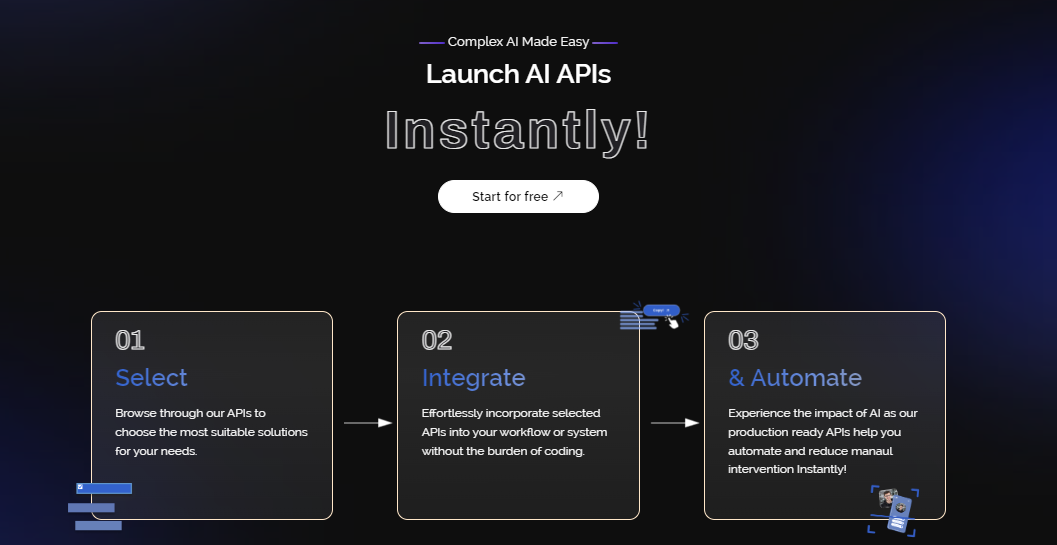

At Arya.ai, we provide an extensive range of APIs to streamline and automate identity verification and customer onboarding for your business or financial institution. These APIs together make the verification process secure, seamless, and convenient for both banks and their customers.

Some of these APIs are:

- Face verification recognizes and matches users’ faces from multiple sources, such as images or surveillance videos, to ensure accuracy.

- Deepfake detection is paramount in identity verification to differentiate user images from manipulative and fake digital images to ensure credibility and enable authorized access.

- Passive face liveness detection distinguishes a user’s face from 2D or 3D printed or digital images to prevent spoofing or presentation attacks.

- KYC extraction, which identifies KYC documents, such as Aadhar cards, Voter IDs, PAN cards, and driving licenses to extract the required information and submit as a part of KYC regulation.

Conclusion

With the increasing identity fraud and growing malicious attacks, AI identity verification plays a vital role in preventing unauthorized access and combatting fraud.

Besides enhancing security, automated identity verification also enables scalability, accuracy, regulatory compliance, and a better customer experience, allowing banks and businesses to gain a competitive advantage.

So, integrate AI in your identity verification and authentication system for a more sophisticated and secure approach to customer onboarding.