Banking fraud is a major issue that causes serious financial losses for banks, businesses, individuals, and other financial institutions. To protect your organization and customers from becoming victims, you need to understand the various types of bank fraud and how fraudsters implement those frauds.

In this post, we will discuss various types of banking fraud and what you, as a banking firm, can do to stop fraudsters. We will also discuss how a fraud detection tool can reduce the risks of these frauds.

What Is Banking Fraud?

Banking fraud is a type of financial fraud that uses illegal methods to misuse banking institutions or its services to commit fraudulent activities. It is primarily done to gain access to financial resources, property, or any other assets owned by the bank or its customers through fraudulent means.

Fraudsters are constantly devising new methods to exploit vulnerabilities in financial systems and defraud banks and their customers for personal gain.

According to the Global Banking Fraud Index report by Seon.io, the number of monthly bank fraud attacks has been on the rise since 2022. For every $1 of fraud, US financial services pays up to $4.23 in investigation, legal, and recovery expenses.

Let us now understand the various types of banking fraud you should keep an eye out on.

What Are the Different Types of Fraud in Banking?

Here are the top 14 most common types of banking frauds, ranging from minor scams to large ones.

1. Account Takeovers

As the name suggests, fraudsters take ownership of the victim's online banking accounts using stolen credentials in account takeovers or ATO frauds. They gain unauthorized access to the bank account through phishing attacks, data breaches, or by purchasing the credentials on the dark web and then committing bank account fraud.

Fraudsters may transfer funds to another account, withdraw money, make fraudulent payments, or request credit cards in the victim's name. Once done, they might change the login credentials to lock the real account owner out of the account.

For example, fraudsters take over a bank account to transfer funds to their own accounts or buy expensive items for reselling. Thus making the entire process foolproof and hard to trace.

Did you know about 22% of U.S. adults become victims of ATOs every year, with average losses amounting to $ 12,000? ATO fraud is indeed on the rise.

2. Card Skimming

Fraudsters use card skimming to steal credit or debit card information from victims to conduct fraudulent transactions. They install a specialized skimming device on the ATMs, card swiping machines, or any other payment terminals to read the information present on the magnetic strips on the cards. The device scans the card to capture the details and stores the information locally. The data is then transferred to computer systems for fraudulent activities. Further, they install a tiny camera near the keyboard to capture the card PIN.

A survey by FICO revealed that over 161K cards were compromised due to skimming activity last year. This number is nearly five times higher than the figures in 2021.

3. Credit Card Fraud

Fraudsters steal the physical credit card or its information to use it for their financial gain. They may even use stolen information or fake documents to apply for new credit cards in the victim's name to fund their purchases. They take advantage of the hefty credit card limit allotted to the victims and make fraudulent transactions. As the funds available on credit cards are borrowed from the bank and must be paid back with interest, the victims fall prey to the never-ending cycle of debts and payments.

Another card-related fraud that scammers widely carry is contactless card payment fraud. This is done by hijacking an NFC-enabled transaction during a payment transfer or by covertly reading the chip itself. As contactless payments do not require PIN authentication, fraudsters with such cards can make several purchases until a PIN is needed.

4. Cheque Fraud

Cheque fraud involves using forged or counterfeit cheques for unauthorized financial gain. It is usually done to withdraw funds from accounts either by depositing them into an account without proper authorization or altering the payment amount on the same. Fraudsters even use forged cheques to make deposits into bank accounts.

Some of the most common occurrences of cheque fraud include -

- Cheques kiting - Fraudsters write cheques from accounts that do not have sufficient funds and then deposit the amount into the account to cover the missing funds before the cheque is processed.

- Altered cheques - Fraudsters usually alter the amount on the cheque.

- Cheque theft - Fraudsters steal the victim's filled-in cheques and use them as if it is their own.

- Cheque forgery - Fraudsters create a fake cheque using the victim's account information.

- Cheque counterfeiting - Fraudsters create a fake cheque that appears to be legitimate to steal money. Ensuring the authenticity of signatures is important. Leveraging AI technology like Signature Detection can be helpful in such cases.

- Cheque washing - Fraudsters use some special chemicals to erase the ink on the cheque and write new information.

5. Phishing

Phishing, also known as fraudulent emailing, occurs when a fraudster uses emails to trick victims into sharing their personal and bank information. The email communication is designed to appear to be sent from the bank itself. These emails contain a fishy link that captures information, such as login credentials, OTPs, credit card numbers, and more.

For example, fraudsters send emails to individuals asking them to renew or upgrade their credit cards via a special link. Once the victims click the link, they are asked to enter the credit card number, expiry date, and CVV number. The fraudsters save these details in their systems and commit fraud upon submission.

6. Money Transfer Fraud

Scammers use money transfer fraud (also known as funds transfer fraud (FTF) or wire transfer fraud) to intercept and redirect legitimate money transfers to their bank accounts. Sometimes, the fraudsters steal banking credentials from the victims and log in to their accounts to wire money to themselves. Besides acquiring funds, they use wire fraud for money laundering, tax evasion, bribery, etc.

For example, fraudsters leverage emotional ways to convince naive people to donate money via wire transfers. They run fraudulent charitable organizations that exploit people's empathy and trigger their emotions for their financial gain.

7. Fraudulent Loan Applications

Fraudulent loan applications are another form of banking fraud that scammers use to secure money from financial institutions. They submit incomplete personal information or false documents about their income, assets, fake bank statements and more to support their loan application. Analysing these fake bank statements would be crucial to prevent these applications. The frauds includes mortgage fraud, payday fraud, personal loan fraud, loan stacking, and other loan scams. The sole intention of loan fraud is to obtain a greater amount of money and default it once the loan is disbursed.

8. OTP Fraud

One-time passwords (OTPs) enable two-factor authentication and secure online transactions. However, fraudsters have tricked many individuals into revealing their OTPs and stealing hefty amounts from their bank accounts. Besides OTPs, fraudsters can take other confidential account details like login credentials, user IDs, or card numbers and personal details like date of birth or address. All these details are gathered by fraudsters via a phone call.

Fraudsters claim to be executives from the bank or any other financial institution and request the victims to share their confidential information over the phone. This type of bank fraud is also known as vishing or phone call scam.

For example, fraudsters call up individuals with an exciting bank offer or a prize and ask the victims to share bank details and OTPs to confirm the offer. Once the victims share the information, they send demand drafts for money transfers.

9. Impersonation

Impersonation fraud occurs when fraudsters impersonate someone from the bank or the police to trick the victims into sharing their confidential information. It involves convincing the victims that the person is a trustworthy source and fabricating situations that require urgent financial actions.

Sometimes, scammers impersonate their victims to gain access to their bank accounts and conduct unauthorized transfers. For example, they steal victim's identities to open bank accounts in their names without their consent. These accounts are used to carry out illegal activities like taking out loans, transferring stolen funds, money laundering, and more.

Advanced tools like Deepfake Detection API can help identify these sophisticated forgeries, offering an extra layer of security against impersonation.

Read more- How Deepfake Detection can help prevent identity fraud

10. Spoofing

Spoofing or fake website scams is another tactic that fraudsters use for performing fraud. They create a fake website that mimics the brand name, logo, graphics, and more of the actual bank website to make it look like a genuine website. They trick victims into believing they are interacting with a trustworthy website and providing confidential information like bank account credentials, credit card information, etc.

Spoofed bank websites are quite identical to legitimate websites. For example, fraudsters build a new bank website that appears to be legitimate. However upon having a closer look, it might reveal some inaccuracies in the logo, brand name spelling, and so on.

11. Smishing

Smishing is a phishing tactic that fraudsters use to send fake text messages to trick individuals into sharing sensitive bank information or clicking on malicious links to illegitimate websites. It combines two words 'SMS' and 'Phishing'.

Fraudsters use a short message service (SMS) medium to send text messages to individuals to update their bank accounts, request new credit cards, or simply sign up for a new bank scheme to gain hefty returns. With the help of SMS scams, fraudsters send phishing links to victims asking them to confirm their details.

For example, sending text messages to tell victims that their bank account is frozen and they need to log in using the link mentioned in the SMS to unfreeze their accounts.

12. Malicious Software and Fake Apps

Like website spoofing, fraudsters build fake apps that are exact replicas of legitimate banking apps to dupe bank customers. Most often, these apps contain malware, viruses, or other malicious software that captures sensitive bank information and offers unauthorized access to the victims' net banking accounts. This malware or fake app can also support fraudsters in transferring money from the victim's bank accounts to theirs.

13. Prime Bank Fraud

Prime bank fraud is a kind of fraudulent investment scheme where fraudsters create fictitious banks to lure investors into investing in their financial offerings. They offer exorbitantly higher return rates in their investment programs in a short time. They fabricate various documents like fake bank statements, fraudulent financial records, forged signatures, and others to convince the legitimacy of their ventures.

14. Employee Initiated Fraud

As the name suggests, employee-initiated fraud means that bank employees misuse their access to sensitive customer information and banking systems for their personal gain. This involves manipulation of bank resources, embezzlement, forgery, bribery, data theft, and so on.

According to the Association of Certified Fraud Examiners (ACFE), businesses lose around 5% of their revenue to internal fraud every year. The employees who committed these frauds (26%) are usually the ones having financial difficulties.

For example, a fraudulent bank employee may carry out unauthorized transactions like money laundering by gaining access to a dormant bank account.

What Are the Ways to Detect Financial Fraud?

Now that you are aware of the various types of banking and financial fraud, let us explore some of the best ways to detect them.

1. Conduct Data Analysis

Data analysis helps you detect fraud by identifying trends in your data that signify fraudulent activities. For this, you need to collect and segment your structured and unstructured data to find the associations, anomalies, and patterns of fraudulent behaviors. By leveraging various statistical methods, advanced mathematical algorithms, and machine learning techniques, data analytics extracts valuable information from your data enabling you to identify fraud and make informed decisions.

2. Monitor Financial Transactions

Transaction monitoring is another way to detect potentially fraudulent activities and flag them for manual review. Utilize a specialized transaction monitoring tool to analyze financial transactions in real time, identify suspicious activities, and alert the relevant team for further investigation. Monitor the bank accounts for unusual transaction patterns. Unexpected spikes in the transaction volume like withdrawals or transfers could be an indicator that the account is used by fraudsters for stealing money. By detecting fraudulent activities early on, you can prevent it from becoming a more significant issue and protect your organization and customers from being a victim of fraud.

3. Analyze Financial Statements

Financial statements are also the best indicators of fraudulent activities. Review and analyze financial statements regularly to identify unusual fluctuations and discrepancies in financial performance. Leverage a bank statement analyser tool that offers features, such as trend analysis, ratio analysis, and comparative analysis to identify patterns in financial statements and identify any inconsistencies. You can also conduct independent audits on high-risk customers by hiring a third-party auditor to look for any evidence of fraud.

4. Ensure Compliance with Regulatory Terms

Ensuring compliance contributes to following a proactive approach for managing risks and preventing frauds. By adhering to the laws, rules, regulations, and other ethical practices, you can create a legal and compliant environment. This helps in minimizing the risk of legal consequences, financial losses, and reputational damage due to fraudulent activities. For example, compliance to data protection and privacy laws ensure responsible handling of customer data and reduces the risk of unauthorized data access.

5. Educate Your Customers

Let your customers know about various types of banking frauds and how it would impact them. Encourage them to create strong passwords and enable two-factor authentication on their banking accounts. Ask them to keep an eye out on their emails and the links shared in the emails. Tell them that your bank would not ask for any confidential banking information over phone calls or messages at any point of time.

Challenges in Banking Fraud Detection

It is no brainer that banking fraud is on the rise. It poses a huge risk to the overall banking industry. Here are the top three challenges that most banking organizations face during fraud detection.

Volume of Fraud

Monitoring millions of transactions every day to identify fraud attempts is practically impossible. Besides, fraudsters are developing new methods to exploit banking system vulnerabilities by bypassing existing security measures. Hence, banks need to improve their security features and fraud detection mechanisms time and again to stay one step ahead of fraudsters at all times.

Customer Onboarding

Implementing extensive security protocols like multiple authentication steps, regular KYC updates, biometric, lengthy onboarding process, and more can frustrate genuine customers. This leads to poor customer experiences and may even cost you your customers.

Technology Investments

Today, fraudsters are adopting new technology and mediums to commit frauds. For instance, phishing, hacking, malware, and so on. Every fraud attempt is different from the previous one, thereby making it difficult to catch it in its nascent stages. Relying on older tech infrastructure is futile for tackling the new threats. This releases a pressure on baking institutions to invest in these novel technologies and constantly update their technology stack for improved fraud detection.

How Can AI Help Detect Financial Fraud?

Artificial intelligence and machine learning are pivotal in helping banks combat fraudulent activities. Around 88% of banking executives believe that reducing fraud is the best way to tackle banking fraud and believe that AI and machine learning offer the best framework.

AI and machine learning help detect bank fraud in multiple ways. They identify patterns and trends in financial data by utilizing advanced techniques like anomaly detection, trend analysis, comparative analysis, and so on. This data analysis helps in quicker fraud detection and management. It also enables you to speed up your manual processes with automation. For example, instead of relying on manual customer verification processes, you can leverage advanced tools for document analysis, biometric verification, and other types of identity verification.

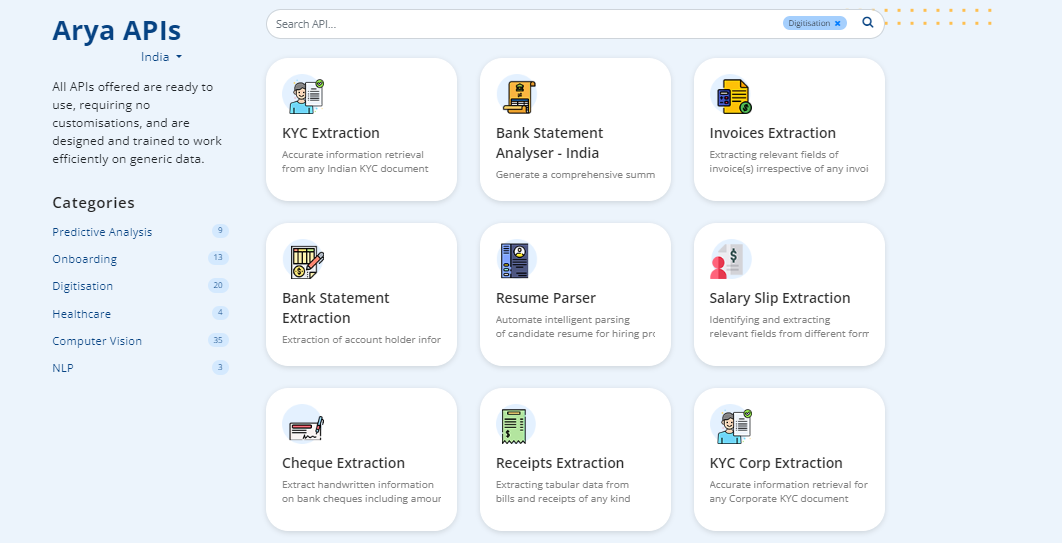

Arya APIs stands at the forefront, offering a comprehensive suite of advanced tools designed to empower businesses in their fight against financial fraud. Alongside essential tools like the Bank Statement Analyser, Signature Detection, and Cheque Extraction, which ensure the integrity of financial transactions, Arya AI extends its capabilities to encompass Identity Verification. These APIs provide robust authentication processes, enabling businesses to verify the identities of their customers securely.

By harnessing the power of these innovative tools, businesses can not only prevent fraudulent activities but also foster trust and confidence among their customers. You can give our APIs a try for free on our platform.

Conclusion

Banking frauds are constantly evolving. Hence, it is important to be vigilant and take precautions to protect your bank and customers. AI and machine learning-powered tools can help you tackle fraud more flexibly. They can automate the fraud detection process by helping you identify and reduce the risk of fraud early on. Connect with our team for a free demo to explore how our APIs can help secure your banking solutions.