Embracing the ‘API Economy’ has moved from being a buzz phrase to a key mandate in digital transformation. APIs are enabling organizations to rapidly develop and deploy myriad combinations to suit specific workflows without creating the need for re-creating softwares or replacing existing infrastructure.

The generic nature of APIs further allows businesses to use them across various use cases and industries. The API economy allows organizations to create new business opportunities, reimagine workflows, forge relationships with partners and customers and create new pathways for innovation and growth.

Arya.ai launched Arya APIs platform containing a library of 28+ ready to use AI APIs, to handle diverse workflows in banking/financial services like customer onboarding, document handling, transaction processing or customer information updation.

Easily accessible as DIY building blocks, our APIs can also be structured together to create distinct processes and systems. For example, when it comes to customer on-boarding, we can consider the following 7 APIs:

Now that having an API strategy has become pertinent, let us look at how Arya APIs can be used to automate the customer on-boarding process with some specific examples.

API-led customer on-boarding strategies:

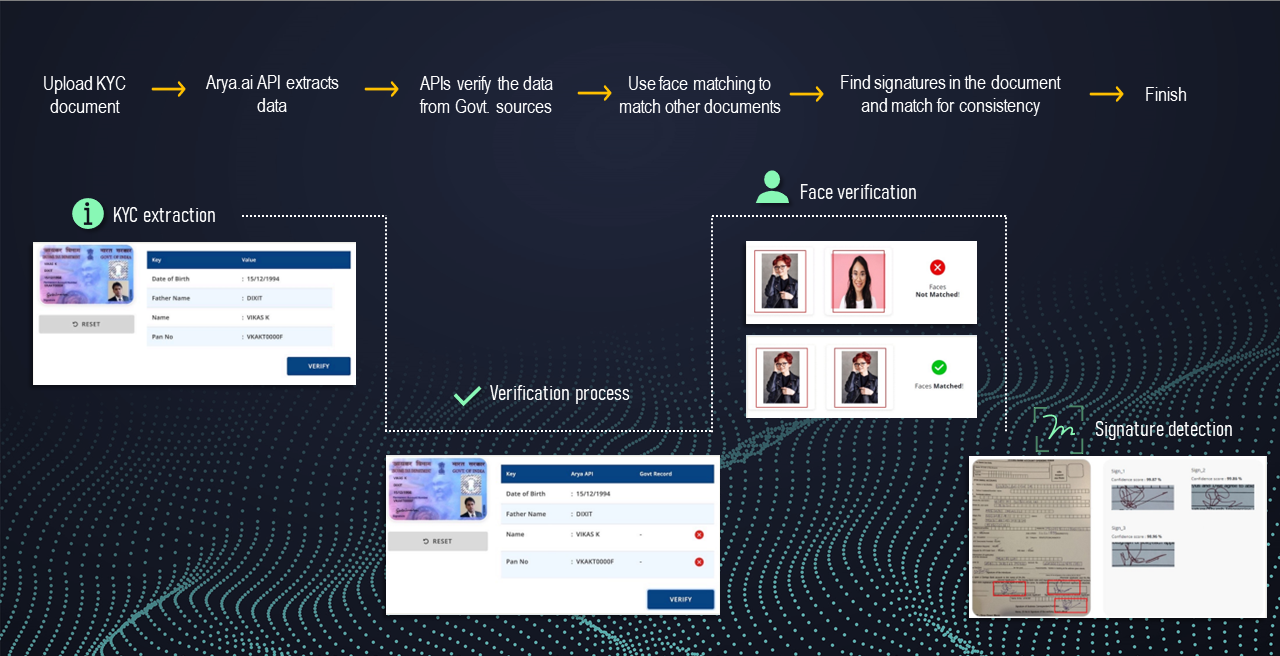

Strategy 1: Collect and Validate documents

In Financial services and banking, customers are required to submit various documents and KYC as a part of on-boarding process. Manually collecting, matching and verifying these documents against government sources can prove to be a tedious and time consuming process, which is also prone to errors.

The above mentioned APIs can be combined to create an on-boarding process as follows:

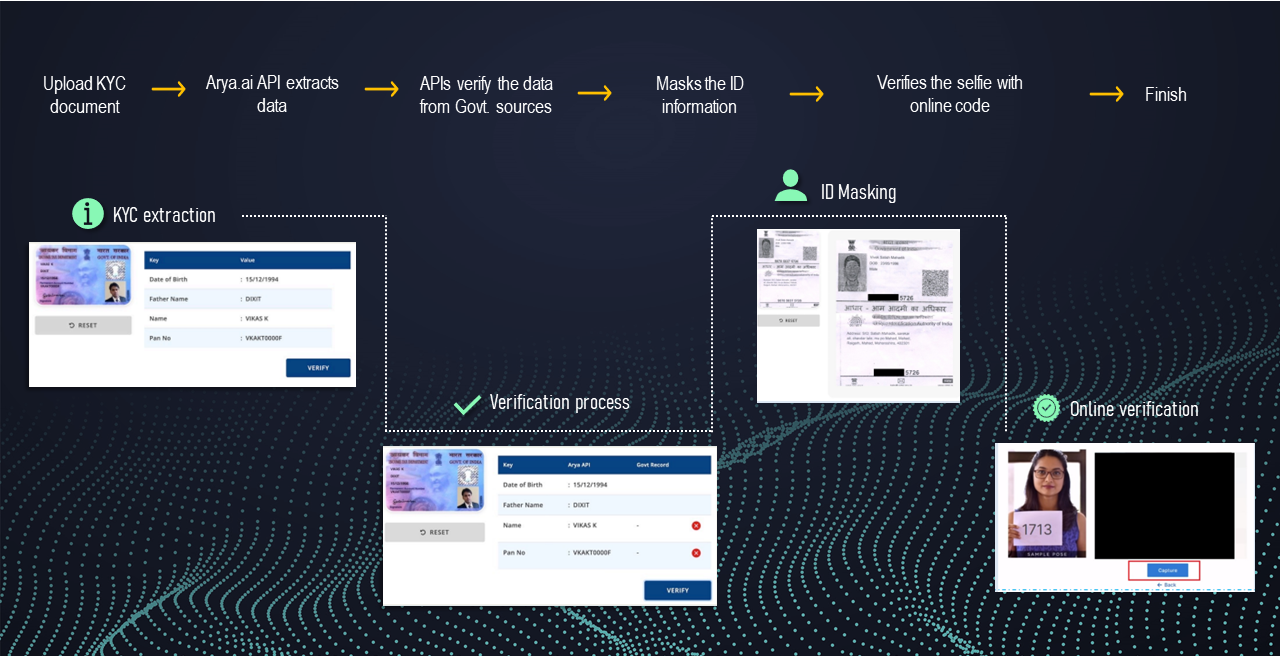

Strategy 2: Instant information validation

In some cases, while organizations ask for document copies for record keeping purposes, in compliance with regulations, sensitive customer information (eg. Aadhar number) should be masked from the document to avoid misuse or identity theft.

This can be resolved by integrating the ID masking API in the process. Collection, verification and masking of sensitive data can all be integrated in a single API-driven process.

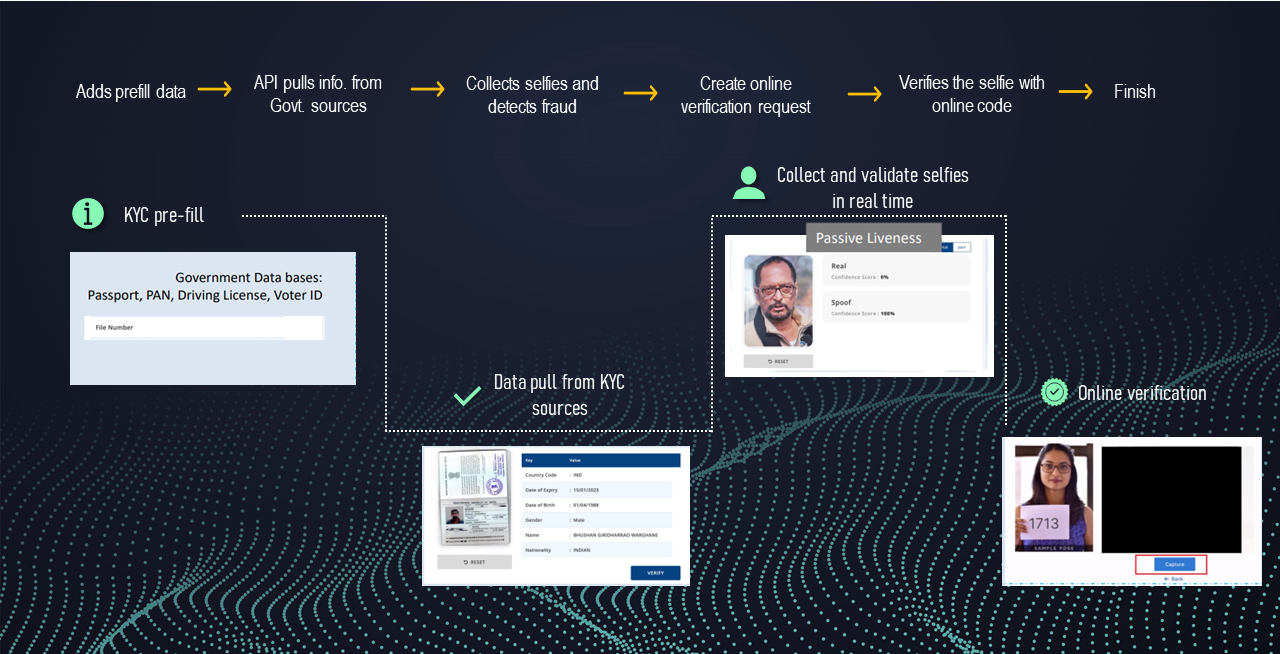

Strategy 3: Accelerate data validation and mitigate fraud

The insurance industry, preventing fraud is pivotal to successful customer verification. Insurers look for solutions providing accurate Digital identity verification, along with the best customer experience.

Along with the above mentioned APIs, insurers can also integrate Face Liveness Detection API in the onboarding process to mitigate fraud.

Try them yourself

These workflows show simple ways to get started with Arya AI APIs. Depending on the use case of the specific financial services institution or enterprise, APIs can be selected and combined. If you believe the APIs need to be customized - let's discuss further!

Arya API Platform offers a wide range of APIs; all APIs offered are ready to use, require no customizations, and are trained to work efficiently on generic data.

Interested to know more? Get a custom demo to see for yourself.

You can also learn to develop a customer acquisition application through our tutorial.