KYC or Know-Your-Customer has been a pivotal part of any customer onboarding process, especially when the stakes are high for the entity.

Be it operating a mobile wallet to signing up for online services, KYC has been always there. And with the onset of the pandemic, need for KYC increased even more as operations went remote.

With this ever growing regulation of KYC, it also started to be a pain point for Customers as well as Corporates to manage the whole process which was largely paper based until recent times.

Even as a customer, it became painfully monotonous to have to submit the same documents everytime to different entities. All of these led to the creation of CKYC - Centralised KYC.

What is CKYC?

CKYC stands for Centralised KYC.

Central Registry of Securitisation Asset Reconstruction and Security Interest (CERSAI) is one of the few organisations who creates, maintains and updates the Centralised KYC Registry.

CKYC acts as a centralised repository for all individuals / corporate entities who have completed the KYC process at least once.

Essentially, the whole KYC process which was earlier managed at a Financial Institution level, now gets managed centrally by a common entity and access is given to the institutions on a need basis

Some of the obvious benefits of having this centralised registry are

- No need for redundant document submissions for users

- Financial institutions need not maintain these records internally

- Direct access to the repository as and when required

- Complete information can be retrieved with a simple look up using any ID

- All records of a single individual/entity are unified with a 14 digit unique CKYC number

- Contains user’s photo, signature specimen, POI and POA documents

How to access CKYC records?

CKYC records are available to any Financial institution governed by RBI, IRDAI or any other such regulatory authority.

As per privacy regulations, all communications with the CKYC repository are encrypted. Each Financial institution is associated by a unique ‘FI Code’ and set of encryption keys.

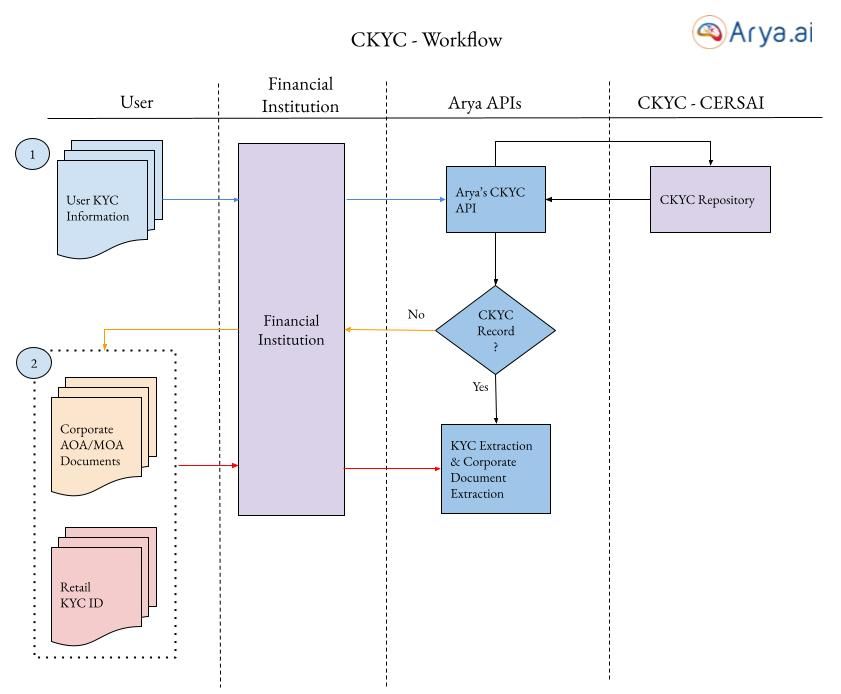

How does Arya’s CKYC module work?

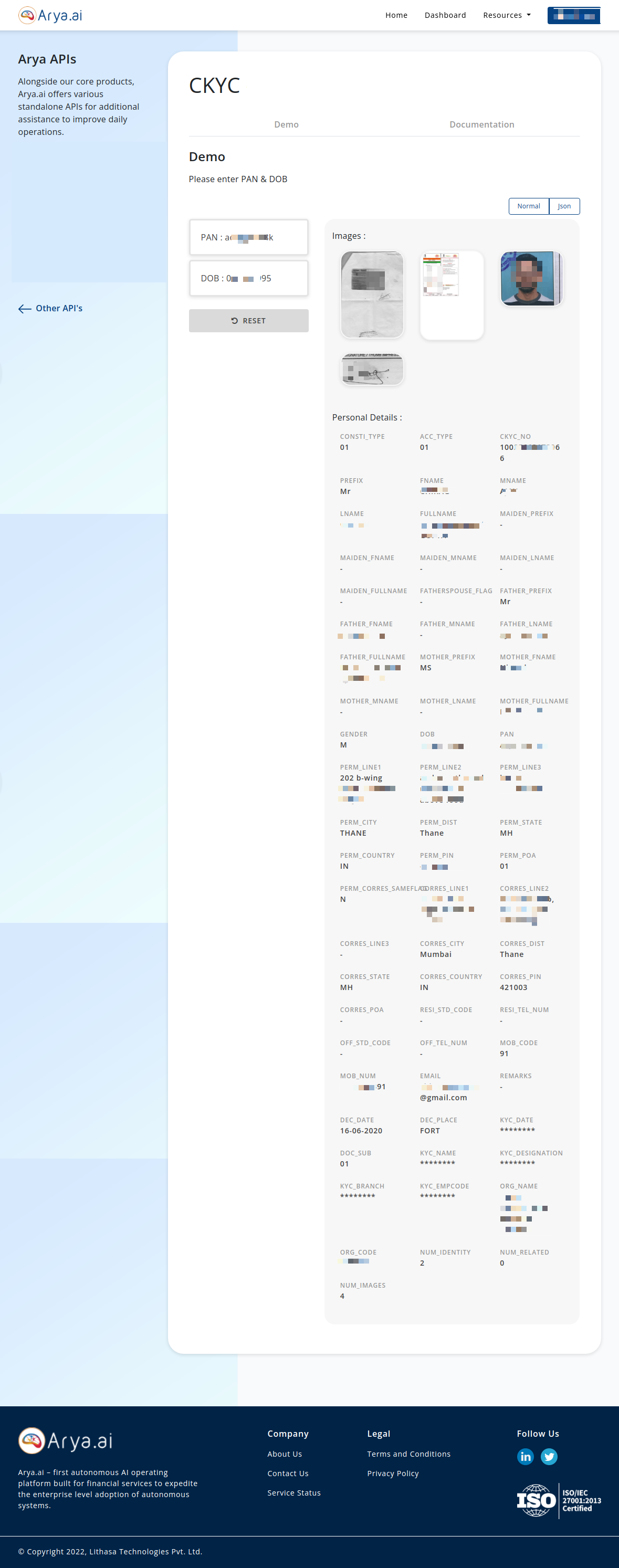

Arya’s CKYC module streamlines the complete process of interaction with the central KYC repository. We meticulously parse through the numerous parameters retrieved from the look up and filter and assess only those that will be of actual importance to our clients for the KYC process.

Additionally, we also classify and provide a tag for each of the images retrieved whether it is a photo of the customer, a signature specimen, or a particular ID copy such as PAN, Aadhaar etc.

Following are some of the basic parameters which are retrieved from the CKYC record after Arya’s CKYC module parses through the response to create a summarised version of the KYC record

- Full Name as per ID

- Father’s / Spouse’s Name

- Mother’s Name

- DOB

- Gender

- PAN

- Permanent Address

- Correspondence Address

- PoI, PoA submitted & its status (verified or not)

- Documents submitted

- Type of Documents submitted (e.g Certified copy, E-KYC etc.)

- KYC Date

Additionally for legal entity, following parameters are retrieved apart from the ones specified above which also apply for legal entities

- Constitution Type (Private limited company, Trust, LLP etc)

- Entity Name

- Place of Incorporation

- Date of commencement of business

- Country of incorporation

- TIN/GST Registration if available

- PAN

- Related person details - Details of various people related with the entity such as Partners, Directors, Promoters etc and their KYC information if available.

What information is needed for retrieval of any CKYC record?

For Individuals

- Date Of Birth (Mandatory)

and any ONE from below identification options

- PAN

- Last 4 Digits of Aadhaar number, Full name (as in Aadhaar), Gender

- Voter ID number

- Driving licence number

- Passport number

- CKYC number (unique 14 digit identifier)

For Corporates / Legal entities

- Date Of Incorporation (Mandatory)

and any ONE from below identification options

- PAN

- Certificate of Incorporation / Formation (CIN)

Possible Add on APIs for the scope of complete Onboarding

KYC Extraction - Can be done in two different scenarios

- For Extraction from documents retrieved from CKYC registry

- For customers whose record was not found on the CKYC registry

Arya’s KYC extraction module not only classifies the image into which Identification document it is, but also ascertains the quality of image data received.

Face Verification - Match the photo received from the CKYC registry against any other photo ID

Aadhaar Mask - Mask the first 8 digits of Aadhaar number as per UIDAI regulations

Does your organisation need CKYC?

Almost every organisation especially in the BFSI sector has been adapting to CKYC. And with Arya APIs, that transition is made much more easier.

With the rising popularity of the centralised KYC registry, and with Arya's streamlined CKYC API ready for integration, there should be no qualms about how your organisation can be a part of the stride.

Check out Arya's CKYC API now! Feel free to Book a Demo to discuss in detail about how this can be adapted for your organisation.