Key Highlights:

- Bank Statement Analysers automate data extraction and analysis from bank statements for actionable financial insights.

- They are essential for loan assessments, fraud detection, claims processing, and policy approvals, enhancing decision-making and reducing manual intervention.

- Bank Statement Analysers help spot inconsistencies and fraudulent activities while ensuring compliance with financial regulations like KYC and AML.

- To choose a reliable Bank Statement Analyser, consider factors such as accuracy, transaction categories, speed & efficiency, fraud detection, compliance support, and the option to add bespoke elements.

One of the critical tasks in finance, especially in banking and lending, is the analysis of bank statements—a process that can often be time-consuming, error-prone, and labor-intensive when done manually.

So, there is a greater need for data analysis and intelligent document processing.

Thankfully, a Bank Statement Analyser can simplify the process by automating the extraction and analysis of crucial financial data.

In this blog, we'll explore the top use cases of a Bank Statement Analyser and how it can automate the operations of financial institutions and businesses.

What is a Bank Statement Analyser?

A Bank Statement Analyser is designed to automate the extraction, organization, and analysis of data from bank statements. It scans these statements to provide insights into financial patterns, such as liabilities, recurring transactions, and monthly dues.

A Bank Statement Analyser takes the complexity out of reading financial documents and makes the information actionable.

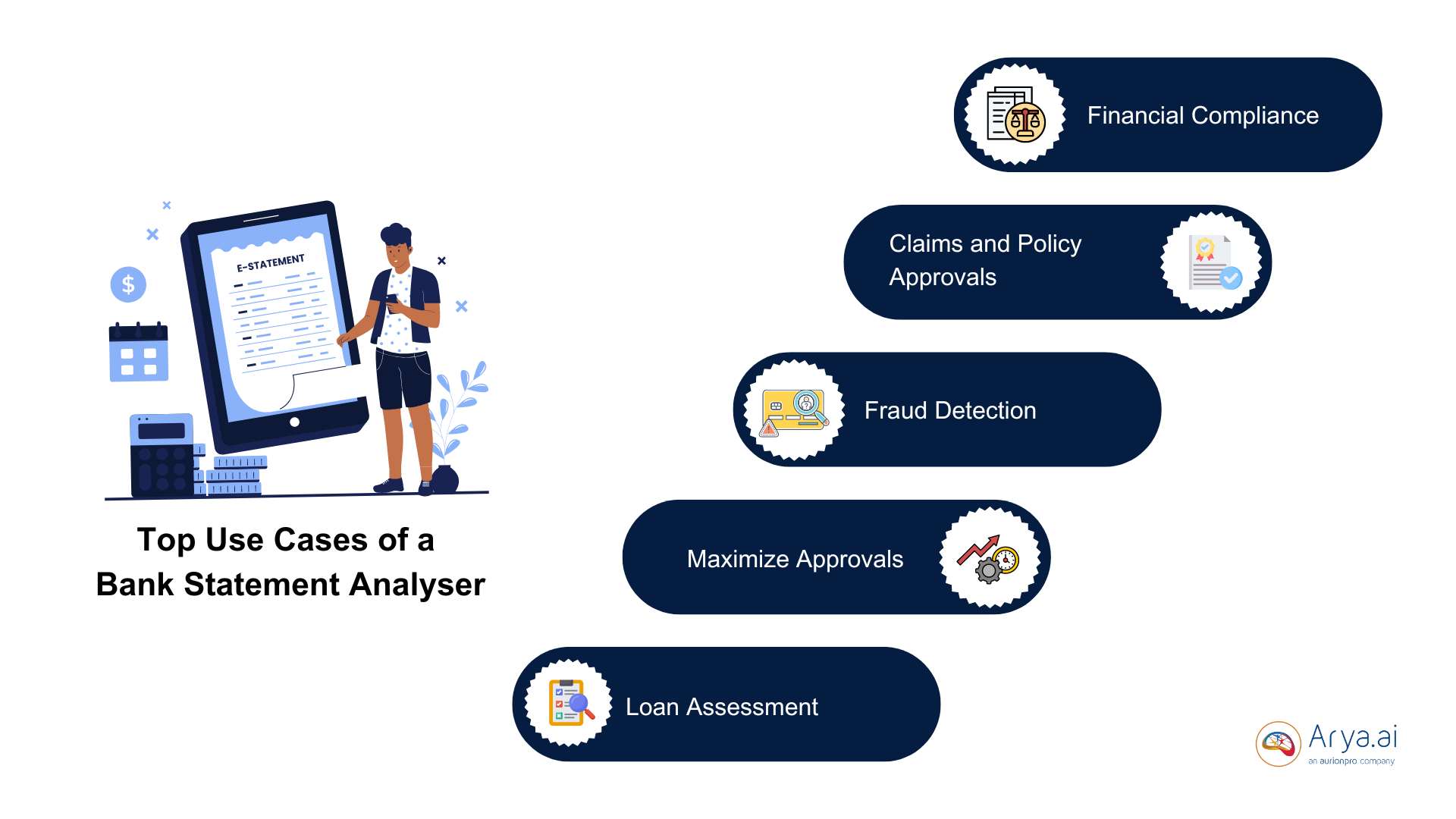

Top Use Cases of a Bank Statement Analyser

Here are the top applications where this tool enhances efficiency and accuracy across industries-

1. Loan Assessment

Evaluating an applicant's repayment ability is crucial for loan officers. A Bank Statement Analyser provides a comprehensive view of an applicant's income, expenses, and financial behavior over time. It also shows the available and existing balance, deposits made, withdrawals made, penalties due, and much more.

Loan committees can use these tools to verify applicants' financial stability. Banks can better estimate the risk of lending money by analyzing historical financial data. This speeds up the evaluation process and reduces manual errors.

2. Maximize Approvals

A bank statement analyser helps maximize loan approvals without compromising risk management. This data-driven insight allows lenders to make more accurate and quicker decisions, identifying applicants who meet lending criteria while filtering out those with potential red flags.

With improved accuracy in credit assessments, institutions can confidently approve more loans, leading to higher approval rates and a streamlined lending process.

3. Claims and Policy Approvals

A Bank Statement Analyser can validate a policyholder's financial status, ensuring accurate premium payments and eligibility for specific claims.

By analyzing a customer's bank statement, insurers can confirm the consistency of income, assess payment histories, and detect any discrepancies or fraudulent transactions. This helps streamline claims processing and policy approvals, ensuring that customers meet financial requirements while reducing the risk of insurance fraud.

4. Fraud Detection

A Bank Statement Analyser flags transactions that don't fit the usual pattern. Using this tool, any red flags like large cash withdrawals and deposits, overdraft crossing limits, negative balances, cross-verification and bounced checks may be quickly identified.

Detecting inconsistencies, altered transactions, changes in spending patterns, or fake bank statements early helps prevent larger issues. Continuous monitoring means identifying fraudulent activities promptly. These tools leverage algorithms trained to spot anomalies that might go unnoticed manually.

Financial Compliance

Compliance with regulations such as KYC and AML is crucial for organizations. Analyzers ensure all transactions adhere to regulatory standards, minimizing the risk of non-compliance.

These tools can flag potential compliance issues early by scrutinizing transactions. This proactive approach helps avoid costly penalties and legal issues.

What should you look for in a Bank Statement Analyser?

While evaluating a Bank Statement Analyser, focus on these key features:

- Accuracy: The analyser should reliably extract data from various bank statement formats (PDF, Excel, images, etc.), ensuring that information is captured correctly and comprehensively.

- Transaction Categorization: It should automatically categorize transactions into distinct categories, such as income, expenses, and recurring payments, making it easier to analyze financial patterns.

- Speed and Efficiency: The tool should handle large volumes of statements swiftly, providing timely insights without significant delays, which is crucial for high-volume environments.

- Fraud Detection: Look for features that help identify inconsistencies, fraudulent activities, or altered statements. Effective fraud detection enhances security and trust.

- Compliance Support: The analyser should comply with regulatory requirements, including KYC (Know Your Customer) and AML (Anti-Money Laundering) standards, ensuring it meets legal and industry guidelines.

- Customizable Insights: It should offer customizable reporting and data visualization options, allowing users to generate tailored insights that fit their specific analytical and business needs

Arya AI's Bank Statement Analyser

Arya's Bank Statement Analyser effectively reads transactions from almost any bank statement and converts that raw data into a comprehensive analytical downloadable report in PDF format. Whether showcasing significant trends, rule violations, or rare anomalies, our analytical tool gives all the metrics important to support the provided bank statement.

Arya AI's solution integrates smoothly with existing systems, enabling a streamlined workflow and enhancing overall productivity.

Contact us to learn more.