Know Your Customer (KYC) is a crucial process in the insurance and financial industry, allowing institutions to verify their customers' identities.

The Insurance Regulatory and Development Authority of India (IRDAI) has issued a new regulation mandating the use of Central KYC Registry (CKYC) for General Insurers. The circular states that all General Insurers are required to obtain and maintain CKYC compliant records of their customers. This is a significant and welcome step towards improving financial transparency and compliance.

As regulatory compliance requirements continue to evolve, KYC has become an essential part of the institutions' operations. However, it can be a complex and time-consuming process, requiring them to collect and verify data for multitudes of customers.

To address this challenge, Arya APIs developed our CKYC module that simplifies and streamlines the KYC process for our customers. Our CKYC API automates the verification process, eases the complete process of interaction with the central KYC repository for document retrieval using any ID information; for both individuals and legal entities.

Few people know the idea of CKYC number, which is a unique 14 digit number generated by CERSAI for each KYC record maintained in their repository. With the use of this repository, any institution can complete their customer’s KYC without having to ask them to provide the necessary documents.

Some of the important features of the Arya API’s CKYC Module:

- Automatic tagging of documents received from repository

- Combined with Aadhaar Masking

- Handling of any changes or tech updates for integration with Cersai

- Data privacy

- Seamless integration

Since implementing the CKYC API, we have received overwhelmingly positive feedback from our customers.

- Faster Onboarding: Our customers have reported that they can now onboard new clients in a fraction of the time that it took before. With our API, all KYC-related data is collected in a single place, making the process more efficient and reducing the risk of errors.

- Improved Compliance: KYC regulations can be complex and ever-changing. Our CKYC API ensures that our customers are always up-to-date.This has helped our customers achieve better compliance with regulatory requirements, reducing the risk of penalties and reputational damage.

- Better Customer Experience: With our API, end customers no longer have to go through a lengthy and cumbersome KYC process. This leads to a better customer experience, resulting in increased customer satisfaction and loyalty.

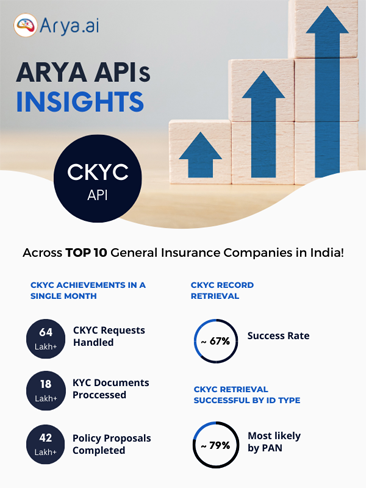

Success Statistics

We're proud of the positive impact our CKYC API has had on our customers. Here are a few statistics that illustrates its success:

With Arya’s CKYC API we have enabled our customers to onboard more clients quickly, achieve better compliance, and provide a better customer experience. We're proud of the positive impact our CKYC API has had on our customers, and we will continue to innovate and improve our products to meet their evolving needs.

If you're interested in learning more about our CKYC API or how it can help your business, please visit our platform and explore the API today!