The year 2021 has been a time of reinvention, and companies are finally reaping maximum benefits from their AI systems. The same is true for Insurers, who are using the full array of systems - Rule engines, Artificial Intelligence(AI)/Machine Learning(ML), Internet of Things (IoT), etc. to stay ahead of the curve. With the plethora of options available, choosing the right technology adoption strategy gets tricky.

Moreover, the insurance business, by nature, has its own complexity and hurdles. There are various comparisons and calculations required across the business lifecycle - underwriting, pricing, claims, audit, etc. Among these, claims is probably the most crucial and complex step. Insurers need the right system to augment and automate claims processes, manage decisions and provide guardrails in case of unintended outcomes.

Given the complexity of the business processes and the technology options available, some insurance companies consider AI adoption across all aspects of operations, some still prefer rule engines, while others play it safe using a combination of rule engines and AI.

So which solution should you choose? This blog provides a detailed comparison of AI versus Rules, and highlights the crucial points to consider before investing into any of these technologies.

Health Claims Processing: Rule Engines vs AI systems

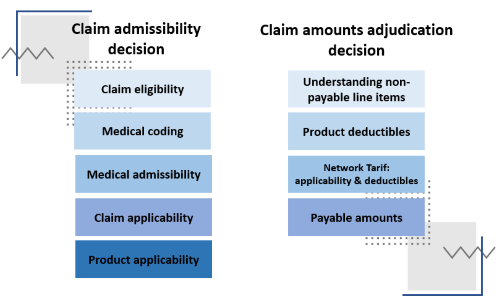

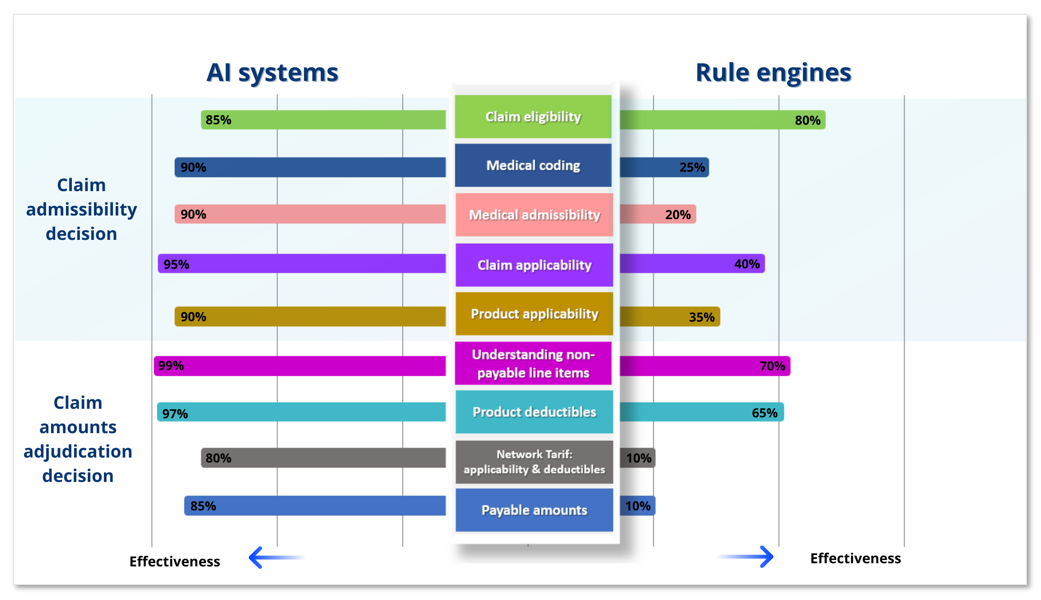

Health claims processing primarily has two decision functions - Claim Admissibility and Claim Adjudicated Amounts. Below is a quick comparison on how rule engines and AI systems function in both the scenarios:

-

Claim Admissibility: Claim Admissibility decides if the claim is payable, based on various decision parameters like claim eligibility, medical coding, product applicability, etc.

A rule engine in this instance will be restricted to decide within the scope of predefined rules and conditions. It will operate only on ‘Positive rules’, in which standard rules are specified to cover the standard reasons for accepting the claims, and on ‘Negative rules’ which cover the standard rules applicable for scenarios to reject a claim.

An AI engine, however, will produce an end-point decision. It will determine whether the given claim can be accepted, rejected or lacks enough data to reach a final decision. The AI engine will even go as far as informing which additional data needs to be arranged from the customer.

-

Claim Adjudicated Amounts: This step in the claims process entails arriving at accurate claim amounts for each line item, like product deductibles, payable amounts, understanding non-payable line items, etc. Rule engines will perform simple formulae-based calculations to match the line item and pay. Whereas an AI engine goes a step further, by determining line-wise payable and non-payable amounts.

These decision functions have various parameters that are considered, to determine the final decision on the claim application.

Lets dive into a further comparison across these decision parameters:

Claim Admissibility:

- Claim eligibility - For rule engines, simple rules can be applied to ensure eligibility of claims by sampling and applying match rules. Whereas, AI systems can correlate the relevant parameters to ensure that the claim is eligible.

- Medical coding - Rule engines prove to be ineffective, since rules can not be used to check the medical coding the contextuality. However, AI systems can highlight if there is an abnormal coding combination in the claim.

- Medical admissibility - Rule engines show a limited performance. Assuming the coding is done correctly, rules can be written on simple claims like day-care or standard cases and in conjunction with other rules to validate the medical admissibility. Going beyond this, AI can deduce nuance patterns in the claims to predict more complex medical admissibility decisions like a medical professional.

- Claim applicability - Rule engines only works for waiting period validation, given that the coding is right and has poor performance when it comes to PED validation, as claim diagnosis for and PED disclosed may not be in the same text. Good AI engine can understand the contextuality of the diagnosis instead of a simple match. Hence, it can be very effective in validation of waiting period, PED etc.

- Product applicability - Rule engines are ineffective in this case. When considering benefits stored text, rules can not work unless all product scenarios are codified which complicates the rules structure itself. AI can learn from patterns to interpret the benefit text or benefit line item and validates the applicability.

For Claim Adjudicated Amounts:

- Understanding non-payable line items - Upon good categorization of bill line items, simple rules can segment if the line item is payable or not. The rule engine is highly dependent on the effectiveness of categorization of line-items. On the other hand, with access to enough training data, an AI engine can predict the payability of a line item even without categorization.

- Product deductibles - Rule engines can work for simpler product deductibles like copay. However, they are highly dependent on efficiency of medical coding for applying the sub-limits and other deductibles. An AI engine can understand the contextual applicability of a product deductible basis on as-is text and also medical coding.

- Network Tarif: applicability & deductibles - Other than packages and fixed benefits, it is near impossible to write rules to apply tariffs on each bill line-item, rendering rule engines ineffective. Whereas AI systems can learn from past patterns to derive the network specific prices. With properly structured tariff tables, they can also apply the bill line-item specific tariffs efficiently.

- Payable amounts - When determining the payable amounts, rule engines work largely for package and fixed benefits. Most of the other claims are largely unique in nature, and need expertise to adjudicate for arriving at an acceptable line-wise amount. AI engine learns from historical claims data, determining how the dependent parameters impact the payability of a line item. With data, it can arrive at more granular adjudication accurate to the point and be consistent.

Rule engines will continue to be present for certain functions, but AI systems are better in the long run since they are more adaptable to constant improvements and enhancements. However, this does not have to be a either/or choice - a combined approach of rule-based systems and AI systems can provide most accurate results. Systems which augment with your current ecosystem can balance the shortcomings of one another. Which is the right method? There are several factors influencing this choice, but the best way to determine is to chart out your business needs.

While both systems have their advantages and disadvantages, it is imperative that companies have to amp up AI adoption, since these systems get better with time and an early start would prove to be a competitive advantage.